EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

Retirement Services

- About

- Why Use a TPA/What is a TPA?

- Professional Services

- Types of Plans

- ERISA Fidelity Bonds

- Team Retirement Services

- Download our e-brochure

About

EagleStone Retirement Services (“ERS”) offers complete retirement plan design, consultation and administration services to small- to medium-sized companies. We believe in delivering creative plan solutions to our clients and understand that ongoing communication with our clients is critical to a plan’s success.

The EagleStone Retirement Services team is comprised of a talented group of individuals that share over 100 years’ combined experience in serving clients nationwide. Jay Martin, EagleStone’s Chief Operating Officer, started in the Third-Party Administration (TPA) industry in 1990, and founded Martin Retirement Services, Inc., in 2000. In 2022, Martin Retirement Services joined forces with EagleStone Tax & Wealth Advisors to form EagleStone Retirement Services.

Our clients benefit from an integrated financial solution — a “one-firm” integrated approach to financial management, with retirement and benefits administration, tax preparation, accounting services, financial planning, and investment advisory services all under one roof.

Whether we are establishing new plans or improving the TPA experience for clients who have hired us after working with another firm, our goal is to fully customize the plan design for the groups we work with. When a plan is designed with the clients’ best interests in mind, the success rate for the retirement benefits will be optimized.

Why Use a TPA/What is a TPA?

The retirement plan industry is highly regulated by the Internal Revenue Service and Department of Labor and the requirements vary from plan to plan. Hiring an experienced Third Party Administrator will help you adhere to the legislative, regulatory, and legal changes, minimizing the chances of costly audits, fees, or plan disqualification.

We work with our clients to design plans that meet their specific needs, whether maximizing contributions, reducing tax liability, or increasing plan participation. You will have the opportunity to continually work with a one-on-one dedicated plan representative. We believe in developing lasting relationships with our clients delivered with a personal touch; we are available by phone or email to respond to your questions and needs.

As Plan Sponsor of a qualified retirement plan, you are ultimately responsible for meeting your fiduciary responsibilities. Let EagleStone Retirement Services be your guide for continual compliance.

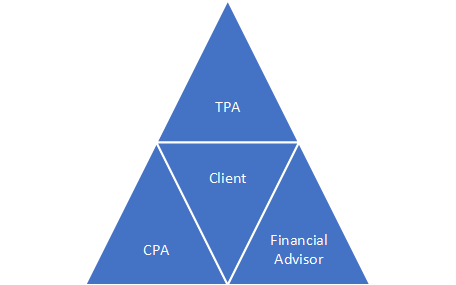

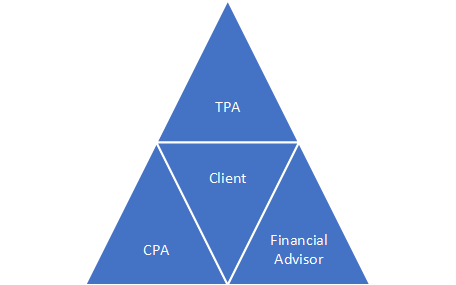

Your retirement plan success begins with your Team working in Tandem.

Professional Services

Offering a retirement plan to your employees benefits your business by attracting and retaining top talent, maximizing tax deductions, and allowing employees an opportunity to save for retirement.

EagleStone can help you achieve these goals, and we offer the following services:

- Consultation and Custom Plan Design for New and Existing Plans

Choosing the right plan design is critical. We will suggest plan designs that offer generous tax savings and meet our client’s objectives and goals. As your company’s needs and demographics change, your assigned Plan Consultant will monitor your plan and suggest modifications as needed.

- Actuarial Services for Defined Benefit and Cash Balance Plans

- Dedicated Plan Consultant

We believe in building “one-on-one” relationships with our clients. You will be assigned a Plan Consultant who will assist with the day-to-day operation of your plan and assist annually with the following administrative services:

-

⯁ Contribution calculations

⯁ Non-Discrimination Testing

⯁ Coordination with your CPA

⯁ Annual Valuation Report

⯁ 5500 Preparation and E-Filing on Behalf of the Plan Sponsor

⯁ Participant Distributions and Vesting

⯁ Hardship Distributions

⯁ Qualified Domestic Relations Order (QDRO)

⯁ Participant Loans

⯁ Employee Benefit Statements

⯁ Coordination with your Independent CPA for large plan audits

⯁ Assistance in all aspects of an Internal Revenue Service (IRS) or Department of Labor audit

- 3(21) Fiduciary Services

- Technical Expertise and Compliance Restoration

- Plan Document Maintenance, including Regulatory Amendments

Types of Plans

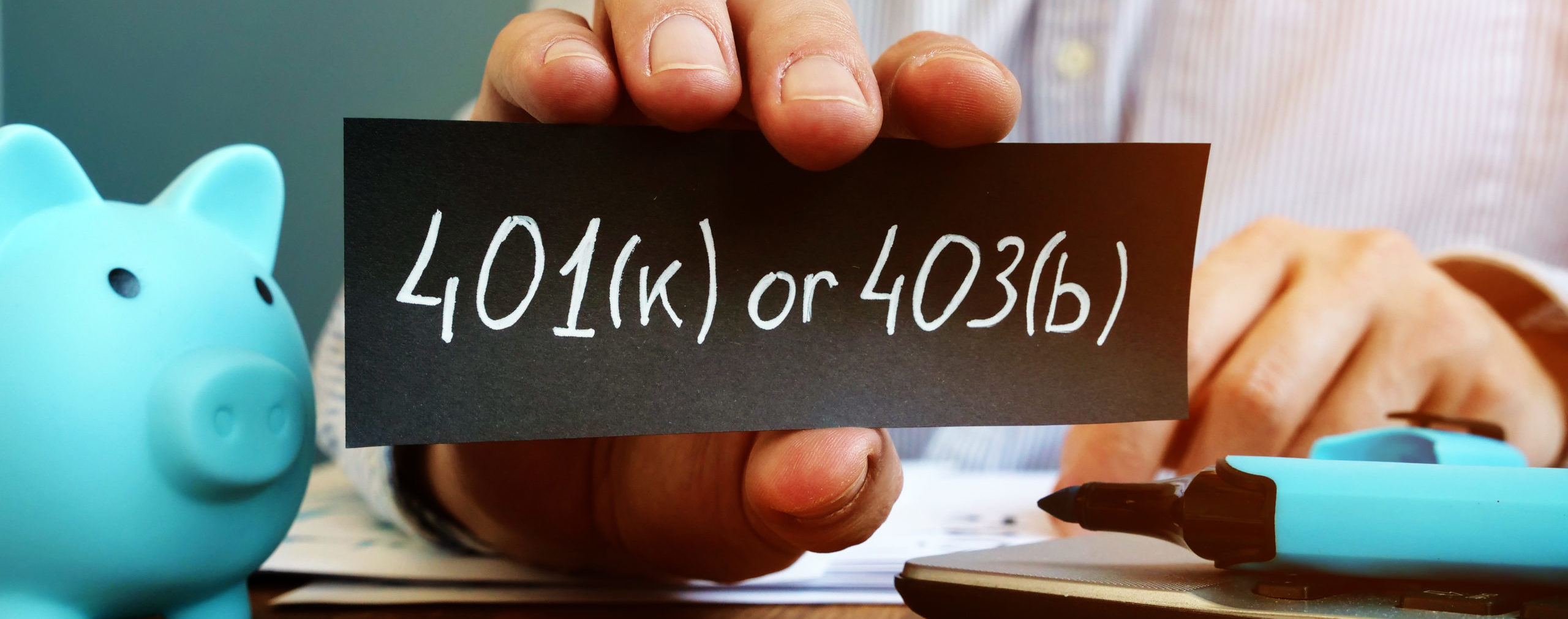

Employer-sponsored retirement plans are divided into two main categories: defined contribution and defined benefit. Both plan types offer various advantages to employers and employees. However, the features of each are distinct and quite different.

Defined Contribution Plans can be funded by both employers and employees. Depending on the plan type below, the assets are typically participant-directed with the guidance of a Financial Advisor.

Types of Defined Contribution Plans:

- 401(k) Plans, including Solo and Safe Harbor

- 403(b) Plans

- Profit Sharing Plans, including age-weighted and cross-tested

Defined Benefit Plans are solely funded by the Sponsoring Employer. These types of plans provide larger retirement benefits for owners and significant tax savings. Employers should expect to maintain and fund these plans for a minimum of 4-5 years.

Types of Defined Benefit Plans:

- Traditional Defined Benefit Plan – Employers provide a guaranteed retirement benefit to employees based on a set formula. Traditional Defined Benefit Plans define an employee’s benefit as a series of monthly payments for life to begin at retirement.

- Cash Balance Plan – A “hybrid” retirement plan with characteristics of both a Defined Benefit Plan and a Defined Contribution Plan. The Plan Sponsor is still responsible for managing the plan assets, but a Cash Balance Plan defines the participant benefit in terms of a stated account balance opposed to a monthly benefit.

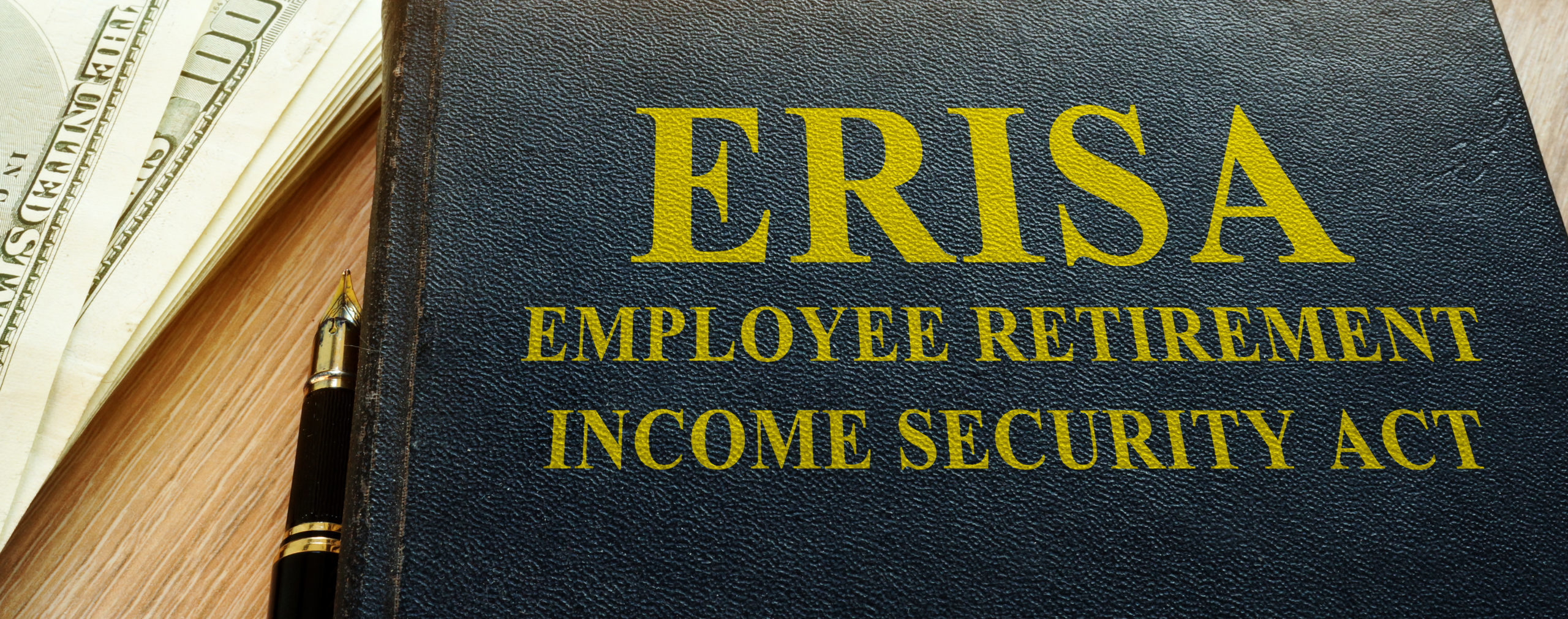

ERISA Fidelity Bonds

The Employee Retirement Income Security Act of 1974 (ERISA) requires all persons who handle assets of employee benefit plans to be bonded. This requirement protects plans against losses sustained due to acts of fraud or dishonesty by those persons whose positions require them to come in direct contact with or exercise discretion over plan assets. The bonding requirement applies to plans which cover employees other than the sole owner and his/her spouse. There are two types of insurance:

- Required: ERISA Fidelity Bonds insure a plan against losses due to fraud or dishonesty by any person handling plan funds, regardless of whether such person is a fiduciary.

- Optional: Fiduciary Liability Insurance is designed to protect both the business and its fiduciaries from claims of mismanagement and breach in fiduciary duty.

What coverage amount is required?

The specific plan name(s) must be named as the insured on the fidelity bond. The amount of the bond must be fixed at the beginning of each plan year in an amount that is not less than 10% of the plan’s qualifying assets, subject to a $1,000 minimum and $500,000 maximum. The bond must not require a deductible; otherwise, it will not satisfy ERISA requirements.

How do I apply for an ERISA bond?

You may wish to confirm with your insurance broker if your current corporate insurance policy provides ERISA bond coverage. The fee for the fidelity bond can be paid by the company or with plan assets.

EagleStone Retirement Services has also partnered with Colonial Surety Company. Please follow the direct link to their site or you may contact them directly at (888) 383-3313. Be sure to provide our referral code MD0131.

Team Retirement Services

- About

- Why Use a TPA/What is a TPA?

- Professional Services

- Types of Plans

- ERISA Fidelity Bonds

- Team Retirement Services

- Download our e-brochure

EagleStone Retirement Services (“ERS”) offers complete retirement plan design, consultation and administration services to small- to medium-sized companies. We believe in delivering creative plan solutions to our clients and understand that ongoing communication with our clients is critical to a plan’s success.

The EagleStone Retirement Services team is comprised of a talented group of individuals that share over 100 years’ combined experience in serving clients nationwide. Jay Martin, EagleStone’s Chief Operating Officer, started in the Third-Party Administration (TPA) industry in 1990, and founded Martin Retirement Services, Inc., in 2000. In 2022, Martin Retirement Services joined forces with EagleStone Tax & Wealth Advisors to form EagleStone Retirement Services.

Our clients benefit from an integrated financial solution — a “one-firm” integrated approach to financial management, with retirement and benefits administration, tax preparation, accounting services, financial planning, and investment advisory services all under one roof.

Whether we are establishing new plans or improving the TPA experience for clients who have hired us after working with another firm, our goal is to fully customize the plan design for the groups we work with. When a plan is designed with the clients’ best interests in mind, the success rate for the retirement benefits will be optimized.

The retirement plan industry is highly regulated by the Internal Revenue Service and Department of Labor and the requirements vary from plan to plan. Hiring an experienced Third Party Administrator will help you adhere to the legislative, regulatory, and legal changes, minimizing the chances of costly audits, fees, or plan disqualification.

We work with our clients to design plans that meet their specific needs, whether maximizing contributions, reducing tax liability, or increasing plan participation. You will have the opportunity to continually work with a one-on-one dedicated plan representative. We believe in developing lasting relationships with our clients delivered with a personal touch; we are available by phone or email to respond to your questions and needs.

As Plan Sponsor of a qualified retirement plan, you are ultimately responsible for meeting your fiduciary responsibilities. Let EagleStone Retirement Services be your guide for continual compliance.

Your retirement plan success begins with your Team working in Tandem.

Offering a retirement plan to your employees benefits your business by attracting and retaining top talent, maximizing tax deductions, and allowing employees an opportunity to save for retirement.

EagleStone can help you achieve these goals, and we offer the following services:

- Consultation and Custom Plan Design for New and Existing Plans

Choosing the right plan design is critical. We will suggest plan designs that offer generous tax savings and meet our client’s objectives and goals. As your company’s needs and demographics change, your assigned Plan Consultant will monitor your plan and suggest modifications as needed.

- Actuarial Services for Defined Benefit and Cash Balance Plans

- Dedicated Plan Consultant

We believe in building “one-on-one” relationships with our clients. You will be assigned a Plan Consultant who will assist with the day-to-day operation of your plan and assist annually with the following administrative services:

-

⯁ Contribution calculations

⯁ Non-Discrimination Testing

⯁ Coordination with your CPA

⯁ Annual Valuation Report

⯁ 5500 Preparation and E-Filing on Behalf of the Plan Sponsor

⯁ Participant Distributions and Vesting

⯁ Hardship Distributions

⯁ Qualified Domestic Relations Order (QDRO)

⯁ Participant Loans

⯁ Employee Benefit Statements

⯁ Coordination with your Independent CPA for large plan audits

⯁ Assistance in all aspects of an Internal Revenue Service (IRS) or Department of Labor audit

- 3(21) Fiduciary Services

- Technical Expertise and Compliance Restoration

- Plan Document Maintenance, including Regulatory Amendments

Employer-sponsored retirement plans are divided into two main categories: defined contribution and defined benefit. Both plan types offer various advantages to employers and employees. However, the features of each are distinct and quite different.

Defined Contribution Plans can be funded by both employers and employees. Depending on the plan type below, the assets are typically participant-directed with the guidance of a Financial Advisor.

Types of Defined Contribution Plans:

- 401(k) Plans, including Solo and Safe Harbor

- 403(b) Plans

- Profit Sharing Plans, including age-weighted and cross-tested

Defined Benefit Plans are solely funded by the Sponsoring Employer. These types of plans provide larger retirement benefits for owners and significant tax savings. Employers should expect to maintain and fund these plans for a minimum of 4-5 years.

Types of Defined Benefit Plans:

- Traditional Defined Benefit Plan – Employers provide a guaranteed retirement benefit to employees based on a set formula. Traditional Defined Benefit Plans define an employee’s benefit as a series of monthly payments for life to begin at retirement.

- Cash Balance Plan – A “hybrid” retirement plan with characteristics of both a Defined Benefit Plan and a Defined Contribution Plan. The Plan Sponsor is still responsible for managing the plan assets, but a Cash Balance Plan defines the participant benefit in terms of a stated account balance opposed to a monthly benefit.

The Employee Retirement Income Security Act of 1974 (ERISA) requires all persons who handle assets of employee benefit plans to be bonded. This requirement protects plans against losses sustained due to acts of fraud or dishonesty by those persons whose positions require them to come in direct contact with or exercise discretion over plan assets. The bonding requirement applies to plans which cover employees other than the sole owner and his/her spouse. There are two types of insurance:

- Required: ERISA Fidelity Bonds insure a plan against losses due to fraud or dishonesty by any person handling plan funds, regardless of whether such person is a fiduciary.

- Optional: Fiduciary Liability Insurance is designed to protect both the business and its fiduciaries from claims of mismanagement and breach in fiduciary duty.

What coverage amount is required?

The specific plan name(s) must be named as the insured on the fidelity bond. The amount of the bond must be fixed at the beginning of each plan year in an amount that is not less than 10% of the plan’s qualifying assets, subject to a $1,000 minimum and $500,000 maximum. The bond must not require a deductible; otherwise, it will not satisfy ERISA requirements.

How do I apply for an ERISA bond?

You may wish to confirm with your insurance broker if your current corporate insurance policy provides ERISA bond coverage. The fee for the fidelity bond can be paid by the company or with plan assets.

EagleStone Retirement Services has also partnered with Colonial Surety Company. Please follow the direct link to their site or you may contact them directly at (888) 383-3313. Be sure to provide our referral code MD0131.

Contact Us

Get in touch with one of our professionals to discuss your needs.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial planning, investment and wealth management services provided through EagleStone Wealth Advisors, Inc. Tax and accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, please visit FINRA’s BrokerCheck website. You can also download a copy of Emerson Equity’s Customer Relationship Summary to learn more about their role and services.

Download our Form CRS/ADV Part 3 (Customer Relationship Summary) by clicking here.

Download Form CRS Exhibit Document by clicking here.

Download Form ADV by clicking here.

Download Form ADV Part 2A by clicking here.

Download Form ADV Part 2B Here: Tarun Mehta, Olac Pallan, Kevin Moody & DJ Reeves

Click here to learn more about our Privacy Policy and Information Security Program.

Click here for additional disclosures

Investment products & services are only available to residents of DC, FL, IN, MD, NY, PA, SC, & VA.

Licensed to sell insurance and variable annuities in the following States: DC, DE, FL, MD, ME, MI, NC, NJ, NY, PA, SC, & VA.

Contact Us

Address:

1101 Wootton Parkway

Suite 400

Rockville, Maryland 20852

Phone:

301-924-2160

Fax:

202-204-6322

Email:

[email protected]