Investor demand for exchange-traded funds (ETFs) has increased rapidly over the last decade due to attractive features that set them apart from mutual funds. At the end of 2024, over $10 trillion was invested in more than 3,600 ETFs. This was equivalent to 36% of the assets invested in mutual funds, up from 21% in 2019 and just 12% in 2014.1

Fund meets stock

Like a mutual fund, an ETF is a portfolio of securities assembled by an investment company. Mutual fund shares are typically purchased from and sold back to the investment company and priced at the end of the trading day, with the price determined by the net asset value (NAV) of the underlying securities. By contrast, ETF shares can be traded throughout the day on stock exchanges, like individual stocks, and the price may be higher or lower than the NAV because of supply and demand. In volatile markets, ETF prices might quickly reflect changes in market sentiment, while NAVs — adjusted once a day — take longer to react, resulting in ETFs trading at a premium or a discount.

Indexes and diversification

Like mutual funds, ETFs may be passively managed, meaning they track an index of securities, or actively managed, guided by managers who assemble investments chosen to meet the fund’s objectives. Whereas active management is common among mutual funds, most ETFs are passively managed, which helps reduce administrative fees.

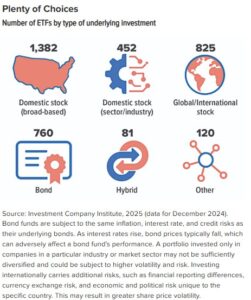

Investors can choose from a wide variety of indexes, ranging from broad-based stock or bond indexes to specific market sectors or indexes that emphasize certain factors. This makes ETFs a helpful tool to gain exposure to various market segments, investing styles, or strategies, potentially at a lower cost. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Tax efficiency

Investors who own mutual fund shares actually own shares in the underlying investments, so when investments are sold within the fund, there may be capital gains taxes if the fund is held outside of a tax-advantaged account. By contrast, an investor who owns ETF shares does not own the underlying investments and generally will be liable for capital gains taxes only when selling the ETF shares.

Trading, expenses, and risks

ETFs typically have lower expense ratios than mutual funds — a large part of their appeal. However, you may pay a brokerage commission when you buy or sell shares, so your overall costs could be higher, especially if you trade frequently. Whereas mutual fund assets can usually be exchanged within a fund family at the end of the trading day at no cost, moving assets between ETFs requires selling and buying assets separately, which may be subject to brokerage fees and market shifts between transactions.

Mutual funds typically have minimum investment amounts, but you can generally invest any dollar amount after the initial purchase, buying partial shares as necessary. By contrast, you can purchase a single share of an ETF if you wish, but you can typically only purchase whole shares.

The trading flexibility of ETFs may add to their appeal, but it could lead some investors to trade more often than might be appropriate for their situations. The principal value of ETFs and mutual funds fluctuates with market conditions. Shares, when sold, may be worth more or less than their original cost. The performance of an unmanaged index is not indicative of the performance of any specific security. Individuals cannot invest directly in any index.

Exchange-traded funds and mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Investment Company Institute, 2025