EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

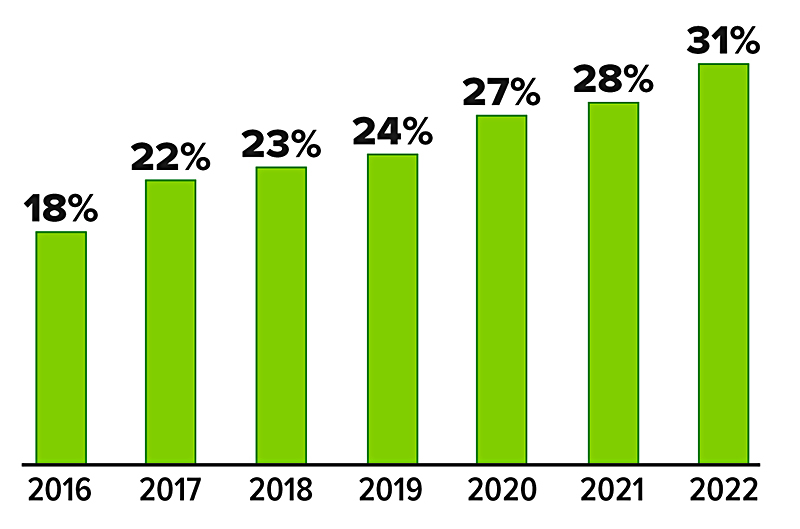

Empty Nesters Own Outsized Share of Big Homes

Empty-nest baby boomers owned twice as many large homes (with three bedrooms or more) as young families with kids in 2022. Careerwise, many boomers benefited financially from the 90s economic boom and/or bought their first homes when it was much more affordable. In recent years, boomers have had little reason to downsize, as many own their homes outright or have mortgages with lower rates than they could get for a replacement home. Millennials’ earnings were negatively impacted by the Great Recession, and they’ve had to spend more of their incomes on housing. Ten years ago, the older generation owned a smaller share of large homes than families that were raising children.

Sources: Redfin, 2023

Making the Most of Your Credit Card

A growing number of Americans are moving towards a “cashless” society. As a result, credit cards are being used more often than ever — especially by those with higher incomes.1

Credit cards are no longer viewed solely as a debt instrument for cash-strapped individuals. Instead, they are prized for a variety of benefits, such as earning rewards and travel perks, protecting purchases, building credit, and gaining additional insurance coverage.

Reap the rewards

Using a rewards credit card for everyday purchases can provide you with valuable perks. Some rewards cards will offer a percentage of cash back for every dollar spent on certain purchases (e.g., dining; travel) or the ability to apply rewards towards a statement credit. Others offer travel rewards that can be used to purchase airline miles and hotel accommodations. Certain rewards cards can even provide you with entrance into VIP airport lounges and early access to purchase tickets for concerts and sporting events. Many rewards cards offer additional sign-up bonuses, such as double cash back or bonus miles/points for new customers if you charge a certain amount on the card within a specified period of time.

The disadvantages of a rewards card are that it can often come with a higher interest rate or charge an annual fee. So if you tend to carry a balance on your card, you could end up paying more in interest than you would earn in rewards. In addition, it is important to read the fine print and fully understand the terms and conditions of the rewards offered. You’ll also want to periodically check in with your card issuer to see if any of the terms and/or conditions of the offer have changed.

Protect your purchases

One of the main advantages of using a credit card is that you have greater protection for your purchases than you would if you use cash or a debit card. If your credit card is lost or stolen, you generally are liable for no more than $50 in fraudulent/unauthorized charges. Credit cards also come with additional fraud protection in the form of fraud alerts that are sent immediately to you by email or text message when suspicious charges are detected.

Your credit card may also provide extended warranties and/or extra purchase protection for high-cost items bought with the card, such as a TV or laptop.

Build your credit

Using a credit card is an excellent way to build credit and improve your credit score. There are a variety of factors that go into determining your credit score, such as your payment history, outstanding debt, and how close your balances are to their account limits.

In order to use a credit card to build and/or improve your credit, you should be sure to consistently pay your full monthly balance on time and keep your balance below your credit limit.

Gain additional insurance coverage

Many credit cards provide you with additional insurance coverage for particular circumstances. For example, if you use your card to rent a car, you may be covered by auto rental insurance to protect you in case of damage or theft. If you use your card to purchase a trip, it may offer travel interruption insurance if your trip is canceled for a covered reason. Your credit card may even provide coverage for a lost or damaged cell phone if you purchased your cell phone or pay your cell phone bill with your card.

Share of payments made by credit card

Use your card wisely

The key to making the most of your credit card is to use your card wisely and avoid falling into common credit card traps. Here are three tips for using your credit card responsibly:

- Only charge what you can afford and pay the full balance due each month.

- Avoid missing payments by signing up for automatic payments and account alerts.

- Try to keep your balance well below your credit limit.

1) Federal Reserve, 2023

Do You Have Enough Life Insurance?

Your life insurance needs change as your life changes. When you are young, you may not have a need for life insurance. However, as you take on more responsibility and your family grows, your life insurance needs increase but then decrease after your children are grown.

You should periodically review your life insurance coverage to ensure that it adequately reflects your life situation. Here are several methods to consider in determining your life insurance needs.

Income rule

The most basic rule of thumb is the income rule, which states that your insurance need would be equal to six or eight times your gross annual income. For example, a person earning a gross annual income of $60,000 should have between $360,000 (6 x $60,000) and $480,000 (8 x $60,000) in life insurance coverage.

Income plus expenses

This rule considers your insurance need to be equal to five times your gross annual income plus the total of any mortgage, personal debt, final expenses, and special funding needs (e.g., college). For example, assume that your gross annual income is $60,000 and your total expenses are $160,000. Your insurance need would be equal to $460,000 ($60,000 x 5 + $160,000).

Income replacement calculation

The income replacement calculation is based on the theory that the family income earners should buy enough life insurance to replace the loss of income due to an untimely death. Under this approach, the amount of life insurance you should consider purchasing is based on the value of the income that you can expect to earn during your lifetime, taking into account such factors as inflation and anticipated salary increases, as well as the interest that the lump-sum life insurance proceeds will generate.

Family needs

With the family needs approach, you would purchase enough life insurance to allow your family to meet its various expenses in the event of your death. Under the family needs approach, you divide your family’s needs into three main categories:

- Immediate needs at death (cash needed for funeral and other expenses)

- Ongoing needs (income needed to maintain your family’s lifestyle)

- Special funding needs (college funding, bequests to charity and children, etc.)

Once you determine the total amount of your family’s needs, you should consider purchasing enough life insurance to cover that amount, taking into consideration the interest that the life insurance proceeds could earn over time.

Estate preservation and liquidity needs

This approach attempts to calculate the amount of life insurance needed upon your death to settle your estate. This method takes into consideration the amount of life insurance required to maintain the current value of your estate for your family, while potentially providing the cash needed to cover death expenses and taxes. Using this method, you should consider purchasing enough life insurance to cover potential estate taxes, along with funeral, accounting, and legal expenses associated with the administration of your estate. The life insurance may allow you to preserve the value of your estate at the level prior to your death and to help prevent an unwanted sale of assets to pay estate taxes and related expenses.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

Can You Put the Brakes on Rising Auto Insurance Premiums?

When your auto insurance policy renews, chances are that your premium will be going up, possibly by a lot. Rates vary by state and location, but nationwide, premiums increased more than 20% between May 2023 and May 2024.1

Higher vehicle prices and repair costs (including parts and labor), more accidents, a rising number of fraud cases and lawsuits, and severe weather events have affected the bottom line of insurers, leading to across-the-board rate hikes. That’s not good news for your wallet, but there are still steps you can take to help make your premium more affordable.

Review your coverage. A good time to review your auto policy is before it renews, but you can make coverage changes or shop for new insurance at any point. Auto insurance rates vary greatly from company to company, so shop around. While price is important, you’ll also want to select a financially sound company that offers great customer service. If you’re happy with your current insurer, call the company or your agent to explore additional ways to save money.

Try to avoid downgrading to the minimum coverage required by your state. That could leave you financially vulnerable if you have an accident. If your vehicle is leased or financed, you’ll likely be required to maintain a certain level of insurance.

Look into discounts. These vary by state and insurer but may include discounts for low annual mileage, insuring multiple vehicles or bundling policies with the same company, installing anti-theft or other safety devices, completing driver training courses, and having a safe driving record. Some insurers offer discounts for participating in a usage-based (telematics) program that uses driving statistics uploaded from an app or tracking device to adjust rates based on driving habits.

Raise your deductible. You may be able to save money by choosing the highest deductible you can afford. Your deductible is the dollar amount you agree to pay out of pocket if you have an accident that is your fault. According to the Insurance Information Institute, raising your deductible from $200 to $500 could save you 15% to 30% on collision and comprehensive coverages, while raising it to $1,000 could save you 40% or more.2

Get quotes when car shopping. Before deciding on a vehicle, find out how much it will cost to insure — certain makes and models will be more expensive. For example, premiums for electric vehicles may be substantially more than for gas-powered vehicles, in part because repair costs are higher. The vehicle’s value, age, safety record and features, and where it will be located may also affect your premium.

1) U.S. Bureau of Labor Statistics, 2024

2) Insurance Information Institute, 2024

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.