EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

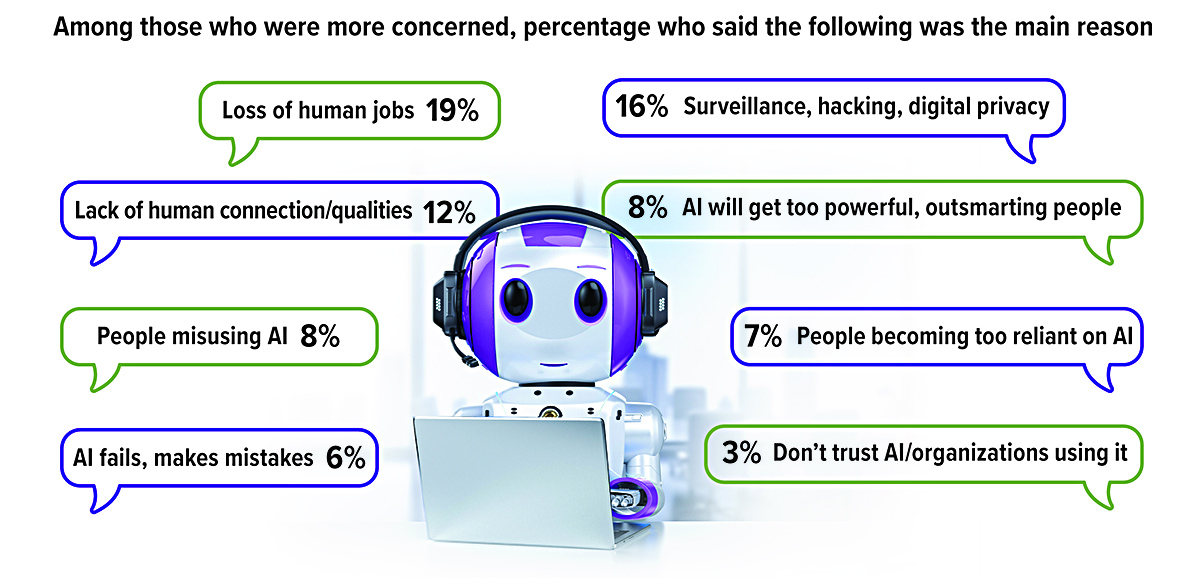

What Real People Think About Artificial Intelligence

When U.S. adults were asked about the expanding presence of artificial intelligence (AI) technology in daily life, 38% said they were more concerned than excited, while just 15% were more excited. Many people were still on the fence, as 46% felt equally concerned and excited about the life-changing potential of AI.

Source: Pew Research Center, 2022–2023

Four Key Objectives of a Sound Retirement Plan

A sound retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you’re retired, your income plan should strive to address four basic objectives: earn a reasonable rate of return, manage the risk of loss, maintain a source of sustainable and predictable income, and reduce the impact of taxes.

Earn a Reasonable Rate of Return

Your retirement savings portfolio will likely be used to provide at least a portion of your income throughout retirement. The overall goal is to maintain an amount that produces the necessary income each year. This requires accounting for the rising costs of goods and services (including health-care expenses); identifying your budgetary needs and wants; estimating how long you’ll expect retirement to last; and factoring in Social Security and other income sources. It also requires estimating a rate of return you’ll need to earn on your portfolio and then putting together an investment strategy to pursue that target rate.

If you have enough savings to meet your retirement needs, you’ll want to maintain that level of savings throughout your retirement years. That’s why it’s important to strive for a realistic rate of return on those savings. Of course, determining a reasonable rate of return depends on your individual circumstances and goals.

Manage Risk of Loss

If you have sufficient savings to meet your retirement needs and goals, you’ll want to protect those savings and reduce the risk of loss due to sudden market corrections and volatility. The goal is to reduce investment risk and preserve savings. A reduction in savings due to a market downturn could require you to sacrifice important retirement goals and reduce retirement income.

Prior to retirement, you have more time to recover from market losses. However, once retired, your time frame for recovery is much shorter. For example, if you had retirement savings of $500,000 and lost 25% due to market volatility, your savings would be reduced to $375,000. You would have to earn a rate of return of more than 33% in order to get back to $500,000. That could take plenty of time to achieve.

Maintain a Sustainable and Predictable Income

During our working years, most of us are used to receiving a steady income. However, once we retire, the income we got from work is no longer there, even though that’s what we’ve been accustomed to. So it’s important to create a sustainable, dependable, income stream in retirement to replace the income we received during our working years. While you may receive Social Security retirement benefits, it’s unlikely that you can maintain your desired lifestyle in retirement on just Social Security. In addition, defined-benefit pension plans are not as prevalent or available as they once may have been. Most employers don’t offer pension plans, placing the burden on us to find our own sources of retirement income.

Maintaining a sustainable income in retirement is important for many reasons. You’ll want sufficient income to meet your retirement expenses. It is also important that your income is not negatively impacted by downturns in the market. And you’ll want your income to last as long as you do.

Reduce the Impact of Taxes on Retirement Income

Taxes can cut into your retirement income if you don’t plan properly. Many of us think our tax rate will be lower in retirement compared to our working years, but that is often not the case. For instance, we may no longer have all of the tax deductions in retirement that we had while working. In addition, taxes may increase in the future, potentially taking a bigger chunk out of your retirement income. So it’s important to create a tax-efficient retirement.

Your retirement plan should be suited to your particular situation. However, these four objectives are often part of a sound retirement plan. A financial professional may be able to help you to earn a reasonable rate of return, manage risk of loss, create and maintain predictable retirement income, and reduce the impact of taxes on that income. There is no guarantee that working with a financial professional will improve investment results.

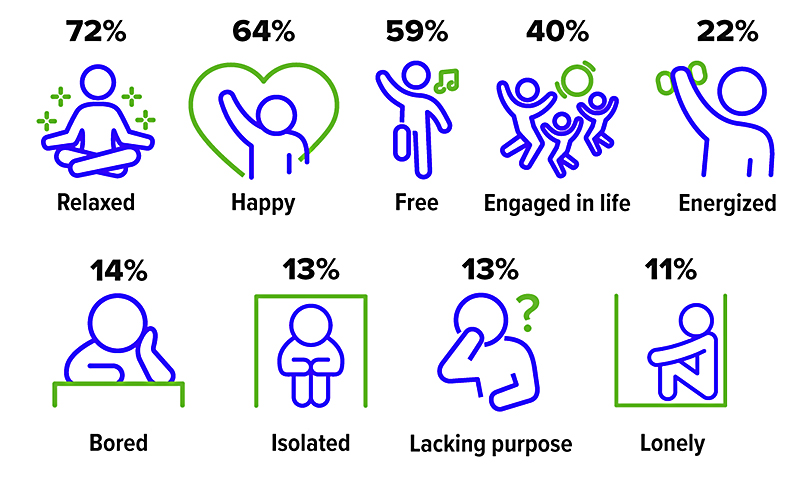

A Few Words About Retirement

In a recent survey, retirees ages 40 to 74 were asked to choose from a list of words and short phrases to describe their feelings about retirement. The good news is that most had positive feelings.

Source: AARP, 2022 (multiple responses allowed)

New Life for Your Old Insurance Policy

Life insurance can serve many valuable purposes. However, later in life — when your children have grown, you’ve retired, or you’ve paid off your mortgage — you may think you no longer need to keep your coverage, or perhaps your coverage has become too expensive. You might be tempted to abandon the policy or surrender your life insurance coverage, but there are other alternatives to consider.

Term vs. Perm

If you have term life insurance, you generally will receive nothing if you surrender the policy or let it lapse by not paying the premiums. However, depending on your age, your health status, and the time left in the term, you may be able to extend the coverage or convert the policy to a permanent policy. The rules for extension and conversion vary by policy and company.

On the other hand, if you own permanent life insurance, the policy may have a cash surrender value (CSV), which you can receive upon surrendering the insurance. If you surrender your cash value life insurance policy, any gain resulting from the surrender (generally, the excess of your CSV over the cumulative amount of premiums paid) will be subject to federal and possibly state income tax. Also, surrendering your policy prematurely may result in surrender charges, which can reduce your CSV.

Exchange the Old Policy

Another option is to exchange your existing permanent life insurance policy for either a new life insurance policy or another type of insurance product. Under the federal tax code, this is known as an IRC Section 1035 exchange.

The exchange must be made directly between the insurance company that issued the old policy and the company issuing the new policy or contract. The rules governing 1035 exchanges are complex, and you may incur surrender charges from your current life insurance policy. In addition, you may be subject to new sales, mortality, expense, and surrender charges for the new policy.

Here are some options for a 1035 exchange.

Lower the premium. If the premium cost of your current life insurance policy is an issue, you may be able to lower the premium by reducing the death benefit, which would not require an exchange. Or you can try to exchange your current policy for a policy with a lower premium cost. However, it’s possible that you may not qualify for a new policy because of your age, health problems, or other reasons.

Create an income stream. You may be able to exchange the CSV of a permanent life insurance policy for an immediate annuity, which can provide a stream of income for a specific period of time or for the rest of your life. Each annuity payment will be apportioned between taxable gain and nontaxable return of capital. You should be aware that by exchanging the CSV for an annuity, you will be giving up the death benefit, and annuity contracts generally have fees and expenses, limitations, exclusions, and termination provisions. Also, any annuity guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.

Provide for long-term care. Another option is to exchange your life insurance policy for a tax-qualified long-term care insurance (LTCI) policy. Any taxable gain in the CSV is deferred in the long-term care policy, and benefits paid from the tax-qualified LTCI policy are received tax-free. Keep in mind that if an LTCI policy does not accept lump-sum premium payments, you would have to make several partial exchanges from the CSV of your existing life insurance policy to the LTCI policy provider to cover the annual premium cost. A complete statement of coverage, including exclusions, exceptions, and limitations, is found only in the policy. Carriers have the discretion to raise their rates and remove their products from the marketplace.

Whatever option you choose, it may be wise to leverage any cash value in your unwanted life insurance policy to meet other financial needs.

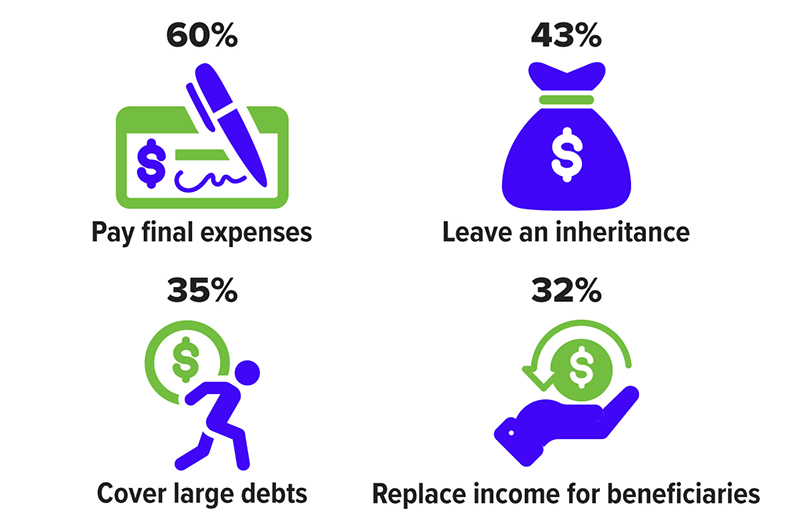

Why Buy Life Insurance?

Although life insurance has traditionally been viewed as a way to replace Income after the death of a wage earner, consumers are more likely to give other reasons for purchasing coverage.

Source: NerdWallet, 2022 (multiple responses allowed)

Time to Bulk Up Your Emergency Fund

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it. It is important to be prepared by having a financial safety net in place — not having one could prove to be financially devastating. But bulking up your emergency fund isn’t always easy, especially during times of economic uncertainty. According to a recent study, only 26% of people say they have more emergency savings than they did a year ago, and 39% say they have less.1

Generally, you’ll want to have at least three to six months’ worth of living expenses in a readily available emergency fund. Your living expenses include items such as your mortgage or rent, debt payments (e.g., credit card, car loan), groceries, and insurance costs. The actual amount, however, should be based on your particular circumstances. Consider factors like your job security, health, and income when deciding how much money you should save in your emergency fund.

When you reach your savings goal, try to keep adding to your emergency fund — the more money you have, the better off you’ll be in an emergency. In addition, review your emergency fund from time to time — either annually or when your personal or financial situation changes. Major milestones like a new baby or homeownership will likely require some adjustments to your savings goal.

If you are looking for ways to bulk up your emergency fund, consider the following ideas.

- If possible, authorize your employer to directly deposit funds from each of your paychecks into an account specifically designated for emergency savings.

- Make increasing your emergency fund a habit by modifying your budget to include it as part of your regular household expenses.

- Put aside some of the money that you would normally spend on discretionary items like entertainment, vacations, and hobbies toward your emergency fund instead.

- Move funds from cash accounts or liquid assets (e.g., those that are convertible to cash within a year, such as a short-term certificate of deposit) into your emergency fund.

- Add earnings from other investments, including stocks, bonds, or mutual funds to your emergency fund.

The FDIC insures bank CDs, which generally provide a fixed rate of return, up to $250,000 per depositor, per insured institution.

1) Bankrate, Annual Emergency Savings Report, January 2023

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.