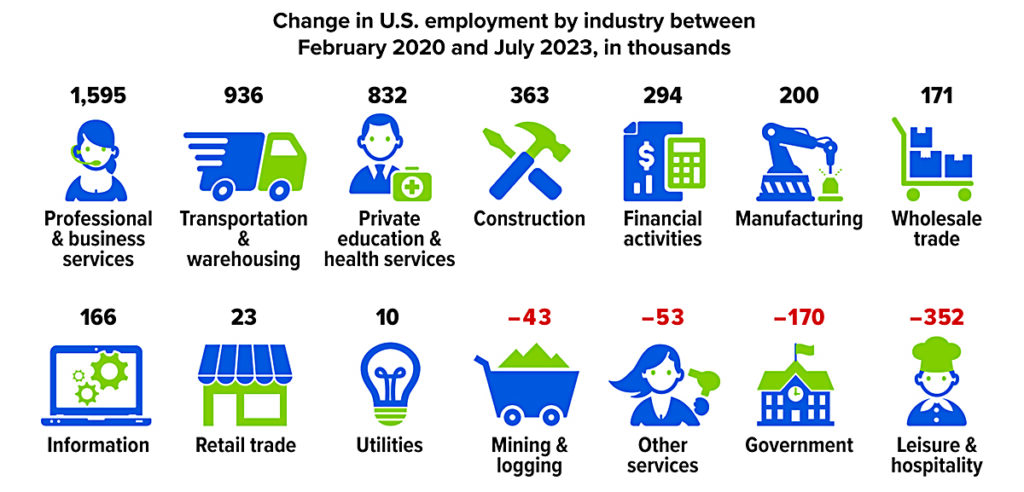

Uneven Jobs Recovery

The U.S. economy lost nearly 22 million jobs during the two-month pandemic recession of March–April 2020. The total job count returned to pre-pandemic levels in June 2022, and by July 2023, there were almost 4 million more Americans working than before the pandemic. But jobs shifted among industries. The biggest gains have been in professional & business services (which includes many remote workers) and transportation & warehousing, while the biggest losses have been in leisure & hospitality and government, largely in public education.

Source: U.S. Bureau of Labor Statistics, 2023

HDHP/HSA Pairing May Help Control Medical Costs

If your employer offers health insurance benefits, one of your options may be a high-deductible health plan (HDHP) with eligibility for a health savings account (HSA). These plans offer potential savings by encouraging you to make cost-effective choices in your medical spending. If you do not have employer-sponsored health coverage, you can choose from a variety of individual HDHPs, including plans through state or federal health insurance exchanges.

Lower Premiums, Higher Deductibles

Premiums for HDHP coverage are generally lower than for traditional preferred provider organization (PPO) coverage. In exchange, you pay a larger annual deductible before the plan begins to cover a percentage of expenses.

Certain types of preventive care, such as annual physicals, health screenings, and selected medications, may be covered without a deductible (in some cases, provided at no cost). HDHPs can also offer telehealth and other remote health-care services without a deductible through 2024. Regardless of the deductible, the costs for medical services may be reduced through the insurer’s negotiated rate.

To protect consumers from catastrophic expenses, most health insurance plans have an annual out-of-pocket maximum above which the insurer pays all medical expenses. HDHP maximums are generally higher than those of traditional plans. But if you reach the annual maximum, your total cost for that year would typically be lower for an HDHP, with the up-front savings on premiums. If you have low medical costs, the lower premiums also will generally make an HDHP more cost-effective. For other scenarios, the cost-effectiveness of an HDHP may vary with your situation. Although an HDHP might save money over the course of a year, some consumers could be hesitant to obtain appropriate care because of the higher out-of-pocket expense at the time of service.

Triple Tax Advantage

You must be enrolled in an HDHP to establish and contribute to an HSA, which allows investments within the account and offers three powerful tax advantages: (1) contributions are deducted from your adjusted gross income, (2) investment earnings compound tax-free inside the HSA, and (3) withdrawals are tax-free if the money is spent on qualified medical expenses (including dental and vision expenses). Some states do not follow federal tax rules on HSAs.

HSA contributions are typically made through payroll deductions, but in most cases, they can also be made directly to the HSA provider. In 2023, contribution limits are $3,850 for an individual and $7,750 for a family ($4,150/$8,300 in 2024), plus an additional $1,000 if the account holder is age 55 or older. Although 2023 payroll contributions must be made by December 31, you can make direct contributions for 2023 up to the April 2024 tax deadline. Some employers contribute to an employee’s HSA, and any employer contributions would be considered in the annual contribution limit.

Saving for the Long Run

Many people use HSAs to pay health-care expenses as they go, but there are advantages to paying from other funds and allowing the HSA to accumulate and pursue tax-deferred growth over time. Assets in an HSA belong to the contributor, so they can be retained in the account or rolled over to a new HSA if you change employers or retire. Unspent HSA balances can be used to help meet health-care needs in future years whether or not you are enrolled in an HDHP; however, you must be enrolled in an HDHP to contribute to an HSA.

Although HSA funds cannot be used to pay regular health insurance premiums, they can be used to pay Medicare premiums and long-term care costs, which could make an HSA an excellent vehicle to help fund retirement expenses. After you enroll in Medicare, you can no longer contribute to an HSA (because Medicare is not an HDHP), but you can continue to use the HSA funds tax-free for qualified expenses. After age 65, you can withdraw HSA funds for any purpose without paying the 20% penalty that typically applies to those under age 65, but you would pay ordinary income taxes, similar to a withdrawal from a traditional IRA.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

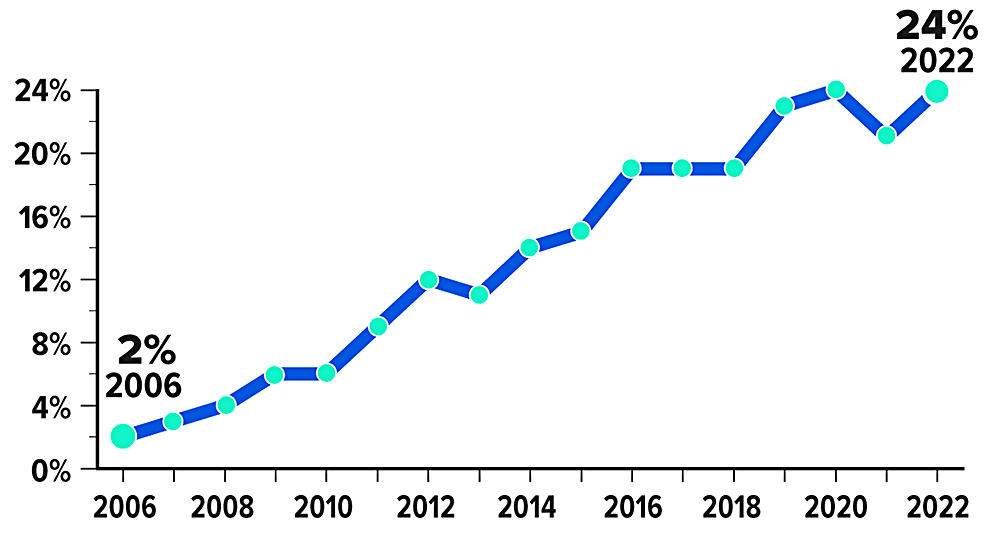

Growing Trend

Percentage of covered workers enrolled in an HSA-eligible high-deductible health plan

Source: Kaiser Family Foundation, 2022

New Medicare Rules Tackle Prescription Drug Prices

The Inflation Reduction Act of 2022 included provisions intended to lower prescription drug costs for Medicare enrollees and slow drug spending by the federal government. According to an estimate by the Congressional Budget Office, the law’s drug pricing reforms could reduce the federal budget deficit by $237 billion over 10 years (2022 to 2031).1

Here’s an overview of the changes to the Medicare program — which covers 64 million seniors and people with disabilities — and timelines for when they take effect.

Drug Price Negotiation

For the first time, the federal government will negotiate lower prices for some of the highest-cost drugs covered under Medicare Part B and Part D. The first 10 drugs selected for the negotiation program were announced in August of 2023. The negotiated “maximum fair prices” for the initial 10 drugs are to be published by September 1, 2024, and go into effect starting January 1, 2026. Up to 15 drugs will be subject to negotiation each year for 2027 and 2028, and up to 20 more drugs for each year after that.2

Inflation Rebates

By one estimate, the list prices of about half of all drugs covered by Medicare between 2019 and 2020 rose faster than inflation.3 To discourage this practice, manufacturers of drugs covered under Medicare Part B and Part D will be required to pay rebates to the federal government if price increases for brand-name drugs without generic or biosimilar competition exceed an inflation-adjusted benchmark (beginning in 2023).

Medicaid, a federal program that provides health coverage for low-income Americans of all ages, already receives similar inflationary rebates.

Redesigned Part D Benefits

The new law also modifies the design of Medicare’s benefits and shifts liabilities so that Part D insurance plans will pay a larger share of the program’s drug costs, while enrollees and the government pay less.

Under the 2023 Medicare Part D standard benefit, enrollees pay a $505 deductible and 25% of all drug costs up to the catastrophic threshold, and then a 5% coinsurance (above $11,206 in total costs or $7,400 in out-of-pocket costs). But there is currently no limit on the total amount that beneficiaries might have to pay out of pocket if high-cost drugs are needed.

Starting in 2024, the 5% coinsurance requirement for Part D prescription drugs in the catastrophic phase is eliminated, which effectively caps enrollees’ out-of-pocket drug costs at about $3,250. A hard cap of $2,000 will apply to out-of-pocket costs for Part D prescription drugs in 2025 and beyond (adjusted for inflation). Annual premium increases will also be limited to no more than 6%.4

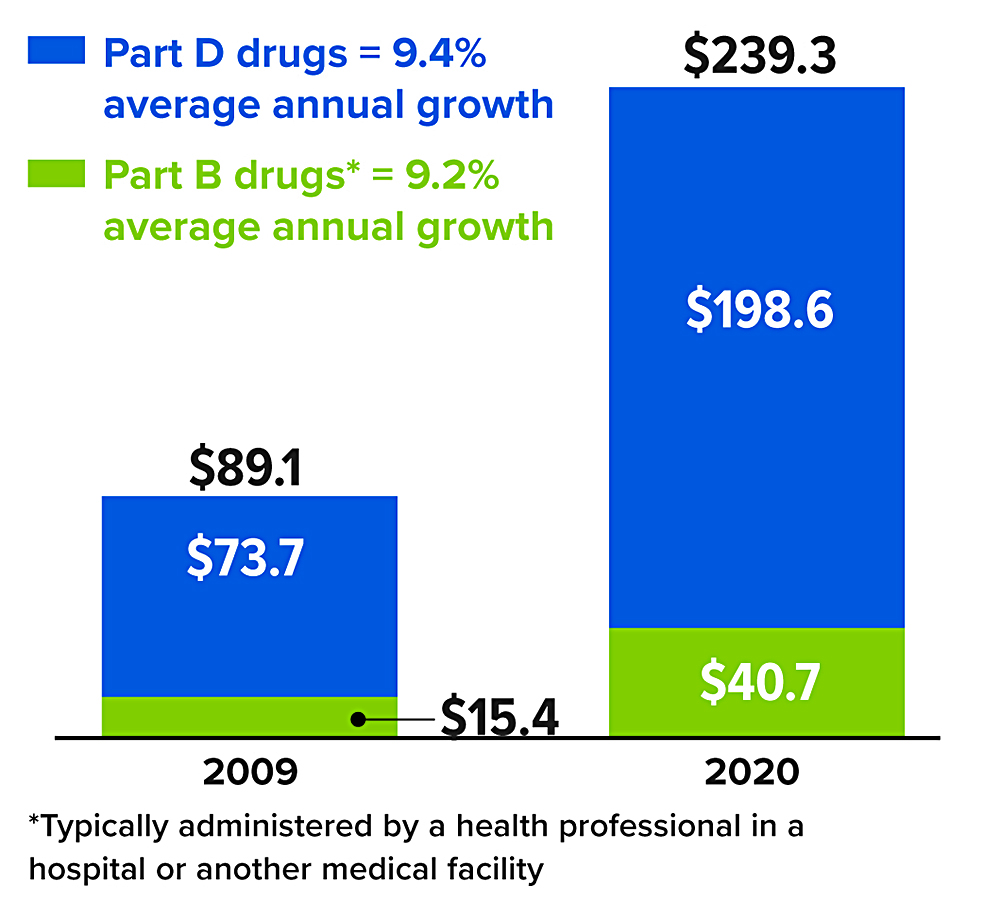

Rising Medicare spending on drugs (in billions) between 2009 and 2020

*Typically administered by a health professional in a hospital or another medical facility

Source: MedPAC Data Book, July 202

How to Kill Your Zombie Subscriptions

In a 2022 survey, consumers were first asked to quickly estimate how much they spend on subscription services each month, then a while later, they were directed to break down and itemize their monthly payments. On average, the consumers’ actual spending was $219 per month, about 2.5 times as much as the $86 they originally guessed.1

Zombie subscriptions are auto-renewing services that people sign up for then forget about or rarely use. Some common examples include mobile phone and internet plans, television, music, and game streaming services, news subscriptions, meal delivery, language courses, and health/fitness memberships (digital and in person).

New types of services are rolling out every day, which is just one reason why subscription costs can creep up on you. But with inflation cutting into your purchasing power, getting rid of a few unnecessary recurring charges could help balance your household budget.

Conduct an audit. Some subscriptions are billed annually, so you may need to scrutinize a full year’s worth of credit card statements. Plus, if you purchased a subscription through an app store on your smartphone, the name of the service won’t be specified. So when you notice a recurring charge that you can’t identify, try looking for a list of subscriptions in your device’s settings.

Use an app. One in 10 consumers said they rely on banking and personal finance apps to track their spending on subscription services. There are several popular services that can be used to scan account statements for recurring costs and remind you to cancel unwanted subscriptions before they renew automatically — if you are comfortable sharing your financial information.

Some companies make it difficult to cancel unwanted subscriptions by requiring a call, hiding the phone number, and/or forcing customers to wait to speak to a representative. If you find this practice frustrating, help may be on the way. The Federal Trade Commission has proposed a new rule that requires companies to make it just as easy to cancel a subscription as it is to sign up.

1) C+R Research, 2022

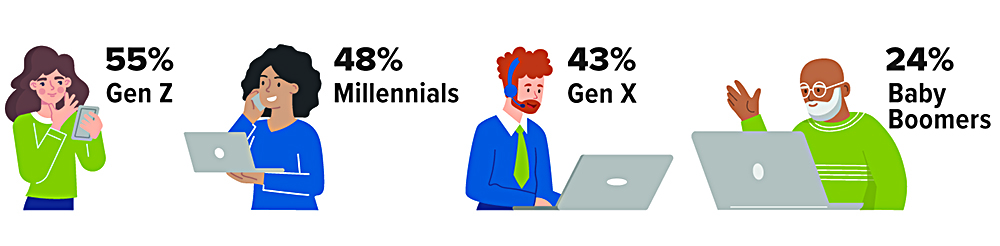

Share of consumers who forgot about subscriptions but still paid for them, by age group

Source: C+R Research, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.