EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

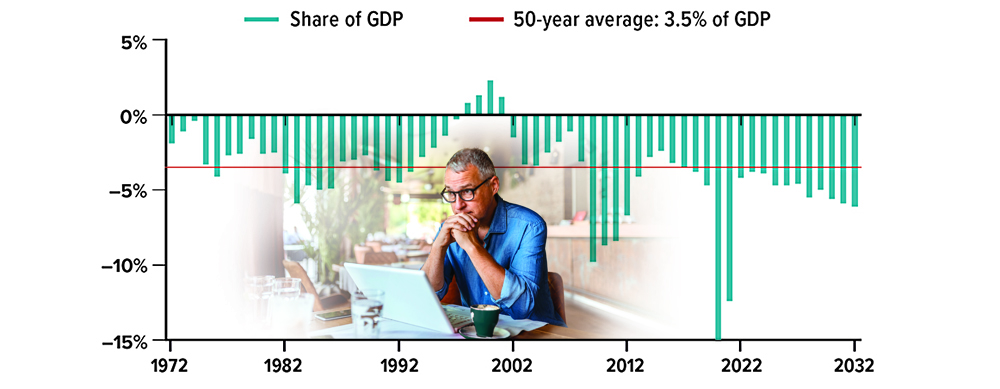

U.S. Deficit Lower for Now

After record federal budget deficits of $3.1 trillion in 2020 and $2.8 trillion in 2021, the 2022 deficit is projected to drop to $1.0 trillion, due to increased tax revenue from a stronger economy and the end of government pandemic-relief spending. These deficits are equivalent to 15.0%, 12.4%, and 4.2% of gross domestic product (GDP), respectively. For comparison, the deficit averaged 3.5% of GDP over the last 50 years.

The deficit is expected to drop further in 2023 before rising steadily due to increasing health-care costs for an aging population and higher interest rates on mounting government debt. In 2032, the deficit is projected to be almost $2.3 trillion, equivalent to 6.1% of GDP.

Source: Congressional Budget Office, May 2022. The federal government’s fiscal year runs from October 1 to September 30, so FY 2022 began on October 1, 2021, and ended on September 30, 2022. Projections for 2022 and beyond are based on current conditions, are subject to change, and may not come to pass.

Retirement Savings in a Volatile Market

If you worry about your retirement investments during market downturns, you’re not alone. Unfortunately, emotions are often the enemy of sound investing. Here are some points to help you stay clear-headed during periods of market volatility.

Markets Rebound

Historically, even the worst bear market has bounced back and eventually gone on to reach new highs. In fact, since 1970, bear markets have lasted an average of 14 months.

A Chance to Buy Low

If you’re investing a set amount of money on a regular basis, such as in a retirement plan account, you’re buying fewer shares when prices are high and more shares when prices are low — one of the basic tenets of investing wisely.

Systematic investing involves making continuous investments on a regular basis, regardless of fluctuating share prices. Although this strategy does not ensure a profit or prevent a loss, you must be financially able to continue making purchases through extended periods of high and low price levels.

Retiree Strategies

The risk of experiencing poor investment returns just before or in the early years of retirement is a significant factor that can affect a nest egg’s long-term sustainability. Fortunately, some strategies can help mitigate this risk.

For example, consider a tiered investment strategy, in which you divide your portfolio into tiers representing your short-, medium-, and long-term needs for income and growth.

The short-term tier(s) could contain the amount you need for about two to five years, invested in assets designed to preserve value. The medium-term tier(s) could hold investments that strive to provide income for perhaps three to 10 years, balanced with some growth potential. The longer-term tier(s) could hold higher-risk, higher-growth potential assets that you wouldn’t need for at least 10 years. Generally, this tier is intended to feed the shorter-term tiers and fuel the strategy over the course of your retirement.

Another possible strategy is using a portion of your retirement savings to purchase an immediate annuity, which offers a predictable retirement income stream you could pair with Social Security and any other steady income sources to cover your fixed expenses.

An immediate annuity is an insurance-based contract in which you pay the issuer a single lump sum in exchange for the issuer’s guarantee of regular income payments for a fixed period or the rest of your life. With some exceptions, you typically receive fixed payments with little or no variation in the amount or timing. When purchasing an immediate annuity, you relinquish control over the amount you invest.

A Financial Professional Can Help

If volatile markets prompt you to question your retirement investing strategy, your financial professional can be an objective third party to help ease your worries and evaluate possible portfolio shifts.

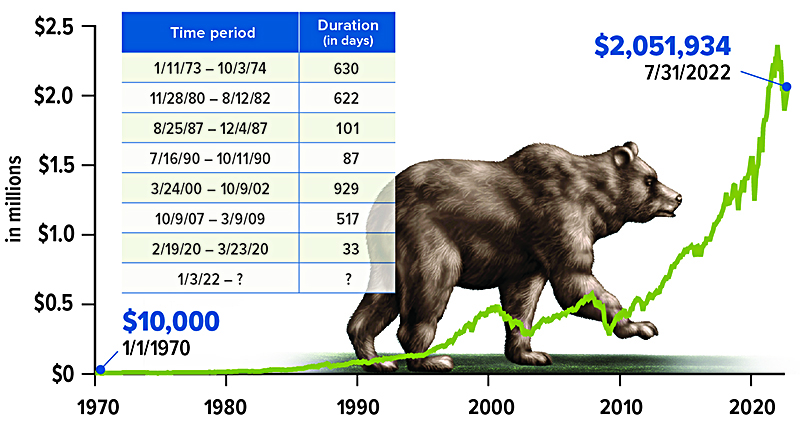

Bear Markets Eventually End

A bear market is generally defined as a loss of at least 20% from a recent high. From 1970 to 2021, there were seven bear markets, the longest lasting less than three years. A new bear market began in January 2022. Despite these down periods, a hypothetical $10,000 investment in the S&P 500 in 1970 would have grown to more than $2 million by 2022.

Source: S&P Dow Jones Indices and Refinitiv, 2022, for the period 1/1/1970 to 7/31/2022. The S&P 500 is an unmanaged index that is considered to be representative of the U.S. stock market. The performance of an unmanaged index is not indicative of any specific investment. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Actual results will vary.

All investments are subject to market fluctuation, risk, and loss of principal. Shares, when sold, may be worth more or less than their original cost. Investments seeking to achieve higher returns also involve a higher degree of risk. There is no assurance that working with a financial professional will improve investment results.

Generally, annuity contracts have fees and expenses, limitations, exclusions, holding periods, termination provisions, and terms for keeping the annuity in force. Most annuities have surrender charges that are assessed if the contract owner surrenders the annuity. Withdrawals of annuity earnings are taxed as ordinary income. Withdrawals prior to age 59½ may be subject to a 10% penalty. Any annuity guarantees are contingent on the financial strength and claimspaying ability of the issuing insurance company.

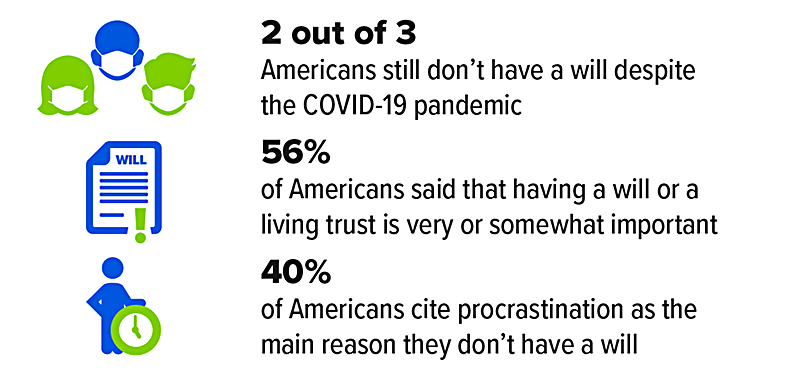

Famous People Who Died Without Proper Planning

The importance of proper estate planning cannot be overstated, regardless of the size of your estate or the stage of life you’re in. Nevertheless, it’s surprising how many American adults haven’t put a plan in place.

You might think that those who are rich and famous would be way ahead of the curve when it comes to planning their estates properly. Yet plenty of celebrities and people of note have died with inadequate or nonexistent estate plans.

Michael Jackson

The king of pop died in June 2009 with an estate worth an estimated $600 million. Jackson had prepared an estate plan that included a trust. However, he failed to fund the trust with assets prior to his death — a common misstep when including a trust as part of an estate plan. While a properly created and funded trust generally avoids probate, an unfunded trust almost always requires probate. In this case, Jackson’s trust beneficiaries had to make numerous filings with the probate court in order to have the judge transfer assets to the trust. This process added significant costs and delays, and made what should have been a private matter open to the public.

Trusts incur upfront costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax professionals before implementing such strategies.

James Gandolfini

When the famous Sopranos actor died in 2013, his estate was worth an estimated $70 million. He had a will, which provided for various members of his family. However, his estate plan did not include proper tax planning. As a result, the Gandolfini estate ended up paying federal and state estate taxes at a rate of 55%. This situation illustrates that a carefully crafted estate plan addresses more than just the distribution of assets. Taxes and other expenses could be reduced, if not eliminated altogether, with proper planning.

Prince

Prince Rogers Nelson, better known as Prince, died in 2016. He was 57 years old, still making incredible music, and entertaining millions of fans throughout the world. The first filing in the Probate Court for Carver County, Minnesota, was by a woman claiming to be his sister, asking the court to appoint a special administrator because no will or other testamentary documents were filed. Since Prince died without a will, the distribution of his over $150 million estate was determined by state law. In this case, a Minnesota judge was tasked with culling through hundreds of court filings from prospective heirs, creditors, and other “interested parties.” The proceeding was open and available to the public for scrutiny.

Barry White

Barry White, the deep-voiced soulful singer, died in 2003 without a will or estate plan. He died while legally married, although he’d been separated from his second wife for many years and was living with a long-time girlfriend. He had nine children. Because he had not divorced his wife, she inherited everything, leaving nothing for his girlfriend or his children. Needless to say, a legal battle ensued.

Heath Ledger

Formulating and executing an estate plan is important. It’s equally important to review your documents periodically to be sure they’re up-to-date. Not doing so could result in problems like those that befell the estate of actor Heath Ledger. Although Ledger had prepared a will years before his death, several changes in his life transpired after the will was written, not the least of which was his relationship with actress Michelle Williams and the birth of their daughter Matilda Rose. The will left nothing to Michelle or Matilda Rose. Fortunately, Ledger’s family later gave all the money to his daughter, but not without some family disharmony.

Florence Griffith Joyner

An updated estate plan works only if the people responsible for carrying out your wishes know where to find these important documents. When Olympic medalist Florence Griffith Joyner died in 1998 at the young age of 38, her family couldn’t locate her will. This led to a bitter dispute between her husband, Al Joyner, and Flo Jo’s mother, who claimed her daughter had promised that she could live in the Joyner home for the rest of her life.

Source: 2022 Wills and Estate Planning Study, Caring.com

Small Businesses Are Short-Staffed and Overwhelmed

COVID-19 kicked off a severe labor shortage — and the most challenging hiring conditions for businesses in many years. In August 2022, 49% of small businesses reported having job openings they could not fill.1 Many owners have had to turn away orders (and revenue), disappoint customers, or work 80-hour weeks to help fill the labor gap, none of which is likely to be sustainable.

Workers sidelined by the pandemic may seek work again at some point, but longer-term factors such as declining birth rates, less immigration, and a wave of baby boomer retirements mean the pool of available workers is shrinking and aging. As a result, labor market conditions could remain tight for some time.

What can small-business owners do if they are struggling to meet staffing needs?

Look closely at compensation. It can be hard for a small business to compete with larger companies when it comes to pay and benefit packages. However, offering competitive wages may be necessary to attract job applicants for open positions and keep reliable employees from seeking better opportunities. In fact, an August 2022 survey found that 46% of small businesses had recently raised wages, and 26% were planning to do so in the next three months.2

Be willing to bend. It’s ideal if you can find employees with skills and experience that match your immediate needs, but those applicants may be few and far between. You might consider lowering the minimum qualifications for hard-to-fill positions, offering on-the-job training for less-experienced workers who seem capable and motivated to improve their skills, or cross-training current employees to fill different roles. It may be easier to find and retain good employees if you accommodate the scheduling needs of students, parents with young children, and older workers who are semi-retired.

Explore stop-gap solutions. To cover seasonal surges or hiring gaps, ask your most productive employees if they are willing to work overtime at higher wages. Otherwise, you might rely on a staffing service to provide temporary or on-call workers. An app-based service, designed to help fill open shifts with “on-demand” workers, may be useful in certain areas and industries (retail and hospitality, for example). Staffing services may insure, screen, and check the backgrounds of provided workers, but they also charge more per hour to cover their costs.

Although it may take time, hand-picking your own permanent employees — and doing what you can to keep them — generally enhances stability and customer service. It’s also likely to be more cost-effective in the long run.

1-2) National Federation of Independent Business, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Prepared by Broadridge Advisor Solutions Copyright 2022.