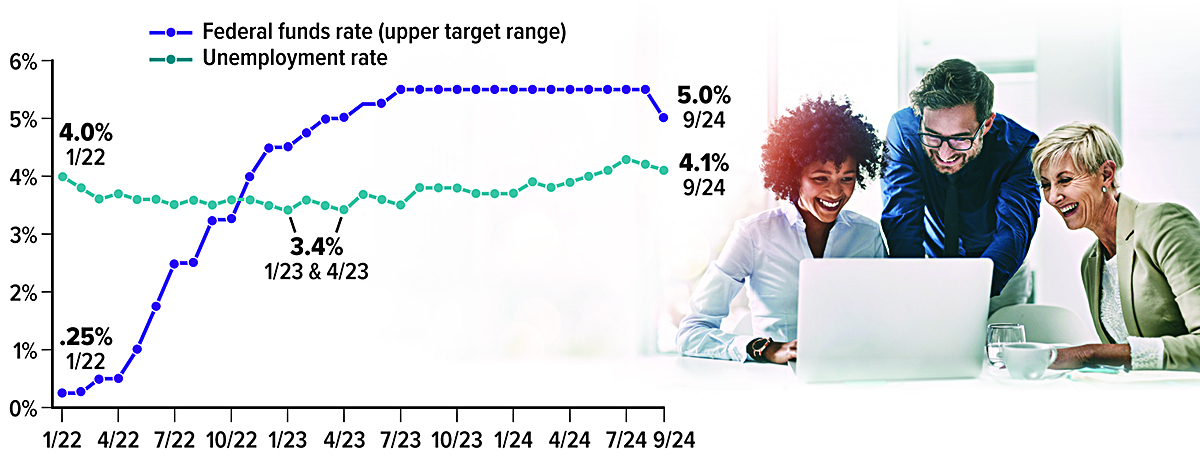

Employment Stayed Strong Despite High Rates

When the Federal Reserve raises interest rates to fight inflation, the unemployment rate typically rises as the economy slows in response to the higher cost of borrowing. Remarkably, unemployment remained under 4% for 27 months during and after the Fed’s unprecedented rate increases that began in early 2022 — the longest period at this level since the late 1960s. It has risen slightly but remained just above 4% through September 2024. With inflation apparently under control, the Fed has begun to decrease rates, which could help keep employment strong.

Sources: Federal Reserve, 2024; U.S. Bureau of Labor Statistics, 2024

Year-End 2024 Tax Tips

Here are some things to consider as you weigh potential tax moves before the end of the year.

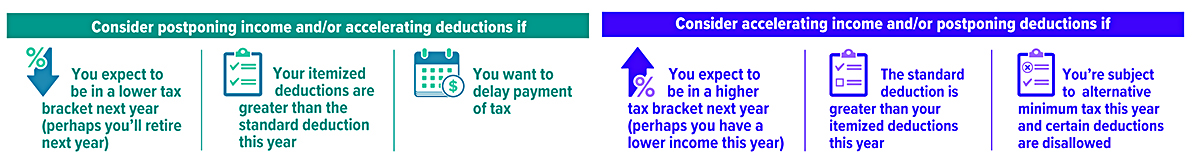

Set aside time to plan

Effective planning requires that you have a good understanding of your current tax situation, as well as a reasonable estimate of how your circumstances might change next year. There’s a real opportunity for tax savings if you’ll be paying taxes at a lower rate in one year than in the other. However, the window for most tax-saving moves closes on December 31, so don’t procrastinate.

Defer income to next year

Consider opportunities to defer income to 2025, particularly if you think you may be in a lower tax bracket then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments for services in order to postpone payment of tax on the income until next year.

Accelerate deductions

Look for opportunities to accelerate deductions into the current tax year. If you itemize deductions, making payments for deductible expenses such as qualifying interest, state taxes, and medical expenses before the end of the year (instead of paying them in early 2025) could make a difference on your 2024 return.

Make deductible charitable contributions

If you itemize deductions on your federal income tax return, you can generally deduct charitable contributions, but the deduction is limited to 50% (currently increased to 60% for cash contributions to public charities), 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of organization to which you contribute. (Excess amounts can be carried over for up to five years.)

Increase withholding on social security

If it looks as though you’re going to owe federal income tax for the year, consider increasing your withholding on Form W-4 for the remainder of the year to cover the shortfall. The biggest advantage in doing so is that withholding is considered as having been paid evenly throughout the year instead of when the dollars are actually taken from your paycheck.

More to Consider

Here are some other things to consider as part of your year-end tax review.

Save more for retirement

Deductible contributions to a traditional IRA and pretax contributions to an employer-sponsored retirement plan such as a 401(k) can help reduce your 2024 taxable income. If you haven’t already contributed up to the maximum amount allowed, consider doing so. For 2024, you can contribute up to $23,000 to a 401(k) plan ($30,500 if you’re age 50 or older) and up to $7,000 to traditional and Roth IRAs combined ($8,000 if you’re age 50 or older). The window to make 2024 contributions to an employer plan generally closes at the end of the year, while you have until April 15, 2025, to make 2024 IRA contributions. (Roth contributions are not deductible, but qualified Roth distributions are not taxable.)

Take any required distributions

If you are age 73 or older, you generally must take required minimum distributions (RMDs) from your traditional IRAs and employer-sponsored retirement plans (an exception may apply if you’re still working for the employer sponsoring the plan). Take any distributions by the date required — the end of the year for most individuals. The penalty for failing to do so is substantial: 25% of any amount that you failed to distribute as required (10% if corrected in a timely manner). Beneficiaries are generally required to take annual distributions from inherited retirement accounts (and under certain circumstances, a distribution of the entire account 10 years after certain events, such as the death of the IRA owner or the beneficiary); there are special rules for spouses.

Weigh year-end investment moves

Though you shouldn’t let tax considerations drive your investment decisions, it’s worth considering the tax implications of any year-end investment moves. For example, if you have realized net capital gains from selling securities at a profit, you might avoid being taxed on some or all of those gains by selling losing positions. Any losses above the amount of your gains can be used to offset up to $3,000 of ordinary income ($1,500 if your filing status is married filing separately) or carried forward to reduce your taxes in future years.

A Critical Combo: Life Insurance with Long-Term Care Benefits

An important part of any retirement strategy involves accounting for potential long-term care (LTC) expenses, which can be surprisingly high. The median cost of a private room in a nursing home was $9,733 in 2023, while a full-time home health aide was $6,292 per month.1

If you plan to pay for care out of pocket, consider how long your retirement savings would last if you or your spouse end up needing care in a nursing home for several years. How would writing those checks every month affect the healthy spouse’s quality of life?

On the other hand, you may not like the idea of paying costly premiums for traditional long-term care insurance that you might never need. If so, you may be interested in one of these alternatives that combine permanent life insurance with long-term care coverage.

An efficient hybrid

Although LTC insurance is typically a “use-it-or-lose-it” proposition, a hybrid (or linked-benefit) policy can help pay for care if it’s needed or provide a larger death benefit for your beneficiaries if it’s not. Hybrid policies are generally more expensive than standalone LTC policies, and the maximum LTC benefit may be smaller. Currently, the max LTC benefit amount is typically equal to about five times the premium.2

A hybrid policy may be purchased with a single premium, or installments paid over a few years (usually no more than 10). And you won’t have to worry about future rate increases or the issuer canceling the policy, which can happen with a traditional LTC policy.

Tack on a rider

Another option is to buy a life policy with an attached long-term care rider — which typically can’t be added later. Any LTC payments are usually limited to the death benefit, which means they are generally not as robust as with a standalone LTC policy or a linked-benefit policy. However, the death benefit is larger (for the same premium).

If you consider either of these strategies, you should have a need for life insurance and evaluate the policy on its merits as life insurance.

Collecting benefits

Long-term care benefits kick in when the insured person needs help with two or more activities of daily living (such as eating, bathing, and transferring) or is severely cognitively impaired, though there is typically a 90-day waiting, or elimination, period. Care may be provided in your home or at a facility.

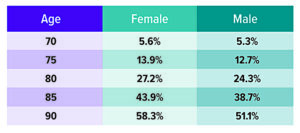

Probability of needing care, by attained age

(for someone who is currently age 65)

With linked-benefit policies and LTC riders, benefits may be paid through reimbursement of the actual cost of care or an indemnity model that pays a certain cash benefit regardless of the actual cost of care. If your policy uses an indemnity model, it might allow you to pay a family caregiver. When you use the LTC benefit, the death benefit is reduced, but some policies may still offer a small death benefit even if you use up the LTC coverage.

With linked-benefit policies and LTC riders, benefits may be paid through reimbursement of the actual cost of care or an indemnity model that pays a certain cash benefit regardless of the actual cost of care. If your policy uses an indemnity model, it might allow you to pay a family caregiver. When you use the LTC benefit, the death benefit is reduced, but some policies may still offer a small death benefit even if you use up the LTC coverage.

Plus, permanent life policies and most hybrid life-LTC policies have a cash-value component that you could tap into for emergencies or retirement income if you are lucky enough to need little or no care. (Loans and withdrawals will reduce the policy’s cash value and death benefit.)

The danger in waiting to explore combination life-LTC policies — beyond the fact that premiums rise with age — is that you could develop a health condition that would disqualify you from coverage.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Policies commonly have mortality and expense charges. If a policy is surrendered prematurely, there may be surrender charges and income tax implications. Optional benefit riders are available for an additional cost and are subject to the contractual terms, conditions, and limitations outlined in the policy; they may not, however, benefit all individuals. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.

1) Genworth Cost of Care Survey, December 2023

2) American Association for Long-Term Care Insurance, 2024 (estimate is for benefits at age 90 for policies with inflation growth option)

Playing Fair: New Consumer Protections for Airline Passengers

There’s no doubt about it, airline travel can be stressful. Thanks to a new federal law and rules issued by the U.S. Department of Transportation, airline passengers could have extra consumer protections, some in time for the holiday travel season.

Hassle-free refunds. In the past, airline passengers were forced to figure out how to obtain a refund by researching an airline’s website or waiting for hours on the phone with an airline’s customer service department. As of October 28, airline passengers will be entitled to an automatic refund for:

- Canceled or significantly changed flights (e.g., arrivals delayed by three or more hours for domestic flights and six or more hours for international flights), regardless of the reason

- Significantly delayed baggage return

- Extra services (e.g., Wi-Fi, seat selection, or inflight entertainment) that were paid for but not provided

Airlines must issue refunds of the full amount of the ticket purchased within seven business days of refunds becoming due for credit card purchases and 20 days for other payment methods. Passengers who accept a ticket for a significantly delayed flight or are rebooked on a different flight to their destination will not receive refunds. The refunds must be in the form of cash or whatever original payment method was used to make the purchase (e.g., credit card or airline miles). Finally, airlines are not allowed to substitute other forms of compensation (e.g., vouchers or travel credits) unless a passenger affirmatively chooses to accept an alternate form of compensation.

Protection against surprise fees. Many airlines advertise cheap “teaser” fares that don’t take into account additional fees — all of which can significantly increase the cost of a ticket. Airlines are required to disclose various ancillary fees upfront, such as charges for checked bags, carry-on bags, and changing or cancelling a reservation. They must also provide a detailed explanation of each fee before a ticket can be purchased. The compliance period for this rule was scheduled to begin in 2025 but was temporarily blocked by a U.S. appeals court this past July.

Free family seating. Under a proposed rule, airlines will be prohibited from charging families an extra fee to guarantee a child will sit next to a parent or adult travel companion, assuming adjacent seating is available when the tickets are booked.

Visit the Department of Transportation’s website at transportation.gov/airconsumer for more information.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.