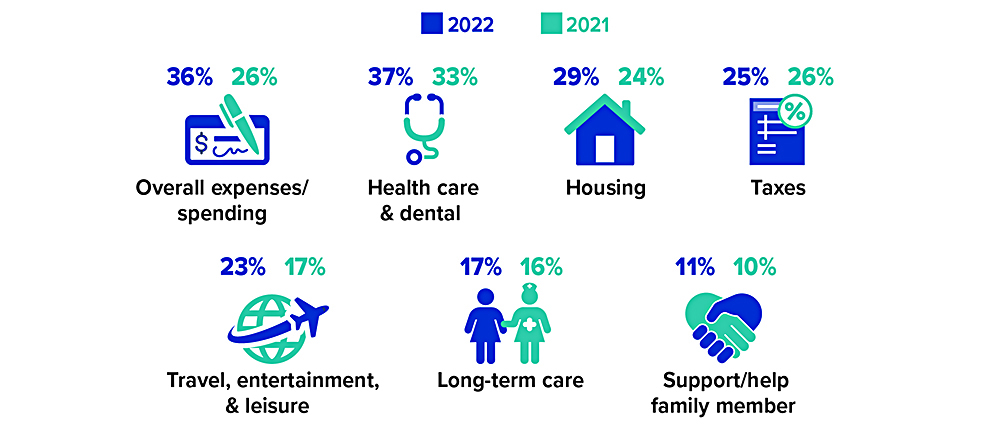

Spending Higher Than Expected for More Retirees in 2022

Considering high inflation, it’s not surprising that the percentage of retirees who said their spending was higher than expected increased in 2022 over 2021. These surveys were conducted in January of each year, so with inflation continuing to run high, it’s likely that even more retirees may be experiencing unexpected spending.

Source: Employee Benefit Research Institute, 2022

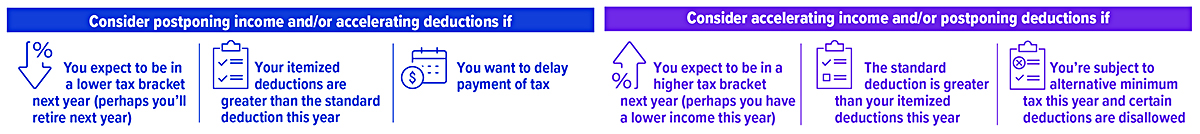

Year-End 2022 Tax Tips

Here are some things to consider as you weigh potential tax moves before the end of the year.

Set Aside Time to Plan

Effective planning requires that you have a good understanding of your current tax situation, as well as a reasonable estimate of how your circumstances might change next year. There’s a real opportunity for tax savings if you’ll be paying taxes at a lower rate in one year than in the other. However, the window for most tax-saving moves closes on December 31, so don’t procrastinate.

Defer Income to Next Year

Consider opportunities to defer income to 2023, particularly if you think you may be in a lower tax bracket then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments for services in order to postpone payment of tax on the income until next year.

Accelerate Deductions

Look for opportunities to accelerate deductions into the current tax year. If you itemize deductions, making payments for deductible expenses such as medical expenses, qualifying interest, and state taxes before the end of the year (instead of paying them in early 2023) could make a difference on your 2022 return.

Make Deductible Charitable Contributions

If you itemize deductions on your federal income tax return, you can generally deduct charitable contributions, but the deduction is limited to 50% (currently increased to 60% for cash contributions to public charities), 30%, or 20% of your adjusted gross income (AGI), depending on the type of property you give and the type of organization to which you contribute. (Excess amounts can be carried over for up to five years.)

Increase Withholding

If it looks as though you’re going to owe federal income tax for the year, consider increasing your withholding on Form W-4 for the remainder of the year to cover the shortfall. The biggest advantage in doing so is that withholding is considered as having been paid evenly throughout the year instead of when the dollars are actually taken from your paycheck.

More to Consider

Here are some other things to consider as part of your year-end tax review.

Save More for Retirement

Deductible contributions to a traditional IRA and pre-tax contributions to an employer-sponsored retirement plan such as a 401(k) can help reduce your 2022 taxable income. If you haven’t already contributed up to the maximum amount allowed, consider doing so. For 2022, you can contribute up to $20,500 to a 401(k) plan ($27,000 if you’re age 50 or older) and up to $6,000 to traditional and Roth IRAs combined ($7,000 if you’re age 50 or older). The window to make 2022 contributions to an employer plan generally closes at the end of the year, while you have until April 18, 2023, to make 2022 IRA contributions. (Roth contributions are not deductible, but qualified Roth distributions are not taxable.)

Take Any Required Distributions

If you are age 72 or older, you generally must take required minimum distributions (RMDs) from your traditional IRAs and employer-sponsored retirement plans (an exception may apply if you’re still working for the employer sponsoring the plan). Take any distributions by the date required — the end of the year for most individuals. The penalty for failing to do so is substantial: 50% of any amount that you failed to distribute as required. Annual distributions from inherited retirement accounts are generally required by beneficiaries (as well as under the 10-year rule); there are special rules for spouses.

Weigh Year-End Investment Moves

Though you shouldn’t let tax considerations drive your investment decisions, it’s worth considering the tax implications of any year-end investment moves. For example, if you have realized net capital gains from selling securities at a profit, you might avoid being taxed on some or all of those gains by selling losing positions. Any losses above the amount of your gains can be used to offset up to $3,000 of ordinary income ($1,500 if your filing status is married filing separately) or carried forward to reduce your taxes in future years.

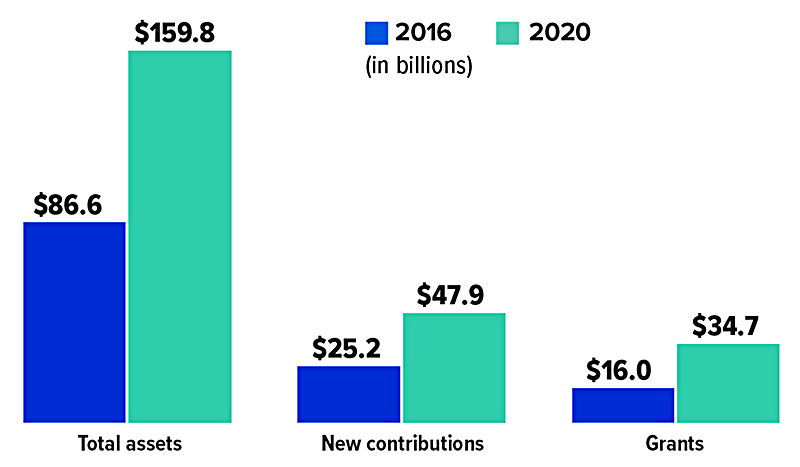

Donor-Advised Funds Combine Charitable Impact with Tax Benefits

A donor-advised fund (DAF) is a charitable account offered by sponsors such as financial institutions, community foundations, universities, and fraternal or religious organizations. Donors who itemize deductions on their federal income tax returns can write off DAF contributions in the year they are made, then gift funds later to the charities they want to support. DAF contributions are irrevocable, which means the donor gives the sponsor legal control while retaining advisory privileges with respect to the distribution of funds and the investment of assets.

Donors can take their time vetting unfamiliar charities and exploring philanthropic opportunities. They can wait to take advantage of matching fund campaigns, have money ready to aid victims when disaster strikes, or build up funds over multiple years to make one large grant for a special purpose. Grants can generally be made to any qualified tax-exempt charitable organization in good standing.

Under current law, there are no rules about how quickly money in DAFs should be granted. However, legislation has been introduced — the Accelerating Charitable Efforts (ACE) Act — that would impose a 15-year limit on the donor’s advisory privileges, among other changes. You may want to watch for future developments if you are interested in using donor-advised funds to execute a charitable giving strategy. (Any legislation passed in 2022 likely would not take effect until 2023.)

Tax-Efficient Timing

Gifts to public charities, including donor-advised funds, are tax deductible up to 60% of adjusted gross income (AGI) for cash contributions and 30% of AGI for non-cash assets (if held for more than one year). Contribution amounts that exceed these limits may be carried over for up to five tax years.

DAF contributions can be timed to make the most of the tax deduction. In an especially high-income year, for example, a larger contribution might keep a taxpayer from climbing into a higher tax bracket or crossing a threshold that would trigger Medicare surcharges or the net investment income tax.

Now that the standard deduction has been expanded ($12,950 for single filers and $25,900 for joint filers in 2022), many taxpayers don’t benefit from itemizing deductions, including those for charitable donations. But with advance planning, it may be possible to bunch charitable contributions that would normally be donated over several years in a single tax year, ensuring that itemized deductions surpass the standard deduction.

A similar approach may appeal to pre-retirees in their peak earning years. Those who expect to be in a lower tax bracket and/or might claim the standard deduction during retirement might consider making deductible contributions to a donor-advised fund while they are still working.

Gifting Appreciated Assets

Contributions to a donor-advised fund can be made with cash, publicly traded securities, and more complicated assets such as real estate, valuable art and collectibles, or a stake in a privately held business, offering a convenient way to gift appreciated assets. Fund sponsors typically have experience in evaluating and liquidating donated assets (a qualified appraisal may be needed). This way, a donor can make a single contribution to a DAF that eventually benefits multiple charities, including smaller organizations that are not able to accept direct donations of appreciated assets.

Giving appreciated assets to charity can provide lucrative tax savings. A donor may qualify for a tax deduction based on the current fair market value of the contribution while helping reduce capital gain taxes on the profits from the sale of those assets. This strategy may be helpful when family businesses or shares of privately held companies are sold, or any time a larger tax deduction is needed.

DAFs have fees and expenses that donors giving directly to a charity would not face. All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

Growth in Donor-Advised Funds

Source: National Philanthropic Trust, 2021

Is It Time to Buy an Electric Vehicle?

Record-breaking fuel prices may have you thinking about buying an electric vehicle sooner rather than later. All electric vehicles (EVs) or plug-in electric vehicles (PEVs), as they’re also called, run on electric energy stored in a rechargeable battery rather than on fuel. Plug-in hybrid electric vehicles (PHEVs) that can run on either type of power are also popular. The market is evolving quickly: 126 additional hybrid and EV models were introduced between 2020 and 2021, and U.S. sales nearly doubled. 1

Cost and Battery Range

Saving money at the pump and benefiting the environment will generally cost more upfront, in part because of high battery and production costs. Prices are likely to rise in the short term, too, as demand and raw material costs increase. However, maintenance costs may be lower because EVs have fewer moving parts. And the more you drive, the more your energy savings could add up.

Tax credits or incentives may help offset the cost of purchasing a new electric or hybrid vehicle. Starting in 2023, an updated tax credit of up to $7,500 will be available for the purchase of new clean vehicles, including some EVs and PHEVs. There is also a new tax credit of up to $4,000 for some pre-owned EVs purchased from a dealer.

Check on credit availability before you buy, because not all vehicles will qualify, and you may not be eligible to claim the tax credit (income limits apply). Tax credits and other incentives may also be offered at the state or local level. You can find more information about tax credits and incentives at fueleconomy.gov.

A special concern for EV shoppers is battery range. Fortunately, most EVs can easily handle daily driving, with typical driving ranges of 150 to 400 miles on a single charge.2 Vehicles can charge at home via a standard outlet, but you may opt to pay an electrician to install a high-powered charger to greatly increase charging speed (incentives or rebates may help offset the cost). You’ll also want to consider the availability of public charging stations; networks are expanding rapidly, but are still not found everywhere.

Get in Line

Like their gas-powered counterparts, EVs come in many makes and models, including cars, crossovers, sports utility vehicles, and trucks. To find your favorites, read reviews and test drive if possible. Once you’re serious about buying, one way to ensure you’re in line to purchase the model you want is to get on a manufacturer’s waiting list, though there may be a fee. Wait times will likely fall as more manufacturers ramp up production and new models are introduced. So if you decide not to buy an EV now or can’t find one in stock, you should have plenty of opportunity to buy one not too far down the road.

1-2) U.S. Department of Energy, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Prepared by Broadridge Advisor Solutions Copyright 2022.