EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

Health Insurance Premiums Jumped in 2023

In 2023, the average total annual premium for employer-sponsored health insurance coverage was $8,435 for single coverage and $23,968 for family coverage, with average worker contributions of $1,401 and $6,575, respectively. Total premiums for both types of coverage increased a little more than 6.5% over 2022, the highest annual increase since 2011. The increase in worker contributions was 5.6% for single coverage and 7.7% for family coverage, the highest since 2017 and 2019, respectively.

On average, the pace of premium increases has slowed over the last 10 years. The big jumps in 2023 may reflect the cumulative effect of high general inflation in 2021 and 2022, because premiums are typically set before the beginning of the year.

Sources: Kaiser Family Foundation, 2023; U.S. Bureau of Labor Statistics, 2024

Social Security 101

Social Security is complex, and the details are often misunderstood even by those who are already receiving benefits. It’s important to understand some of the basic rules and options and how they might affect your financial future.

Full retirement age (FRA)

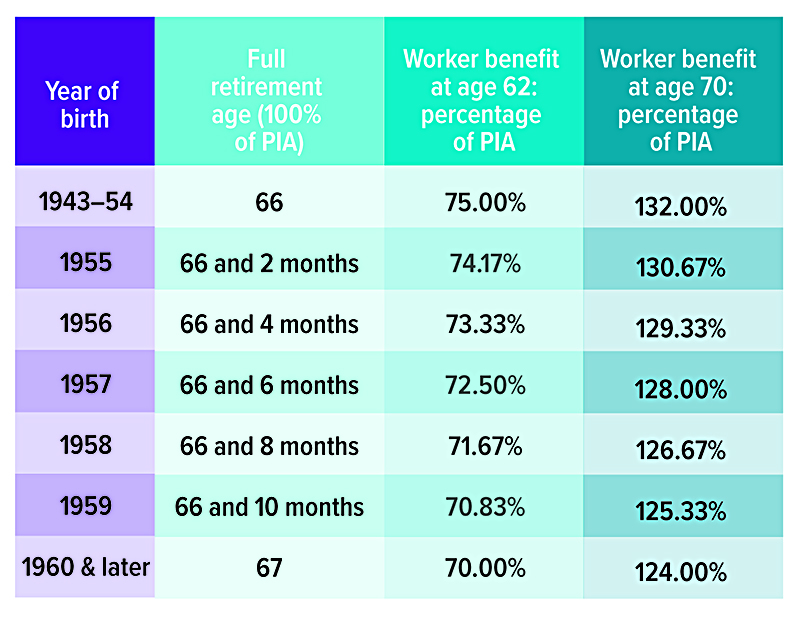

Once you reach full retirement age, you can claim your full Social Security retirement benefit, also called your primary insurance amount or PIA. FRA ranges from 66 to 67, depending on your birth year (see chart).

Claiming early

The earliest you can claim your Social Security retirement benefit is age 62. However, your benefit will be permanently reduced if claimed before your FRA. At age 62, the reduction would be 25% to 30%, depending on your birth year. Your benefit may be further reduced temporarily if you work while receiving benefits before FRA and your income exceeds certain levels. However, when you reach FRA, an adjustment is made, and over time you will regain any benefits lost due to excess earnings.

Claiming later

If you do not claim your benefit at FRA, you will earn delayed retirement credits for each month you wait to claim, up to age 70. This will increase your benefit by two-thirds of 1% for each month, or 8% for each year you delay. There is no increase after age 70.

Spousal benefits

If you’re married, you may be eligible to receive a spousal benefit based on your spouse’s work record, whether you worked or not. The maximum spousal benefit, if claimed at your full retirement age, is 50% of your spouse’s PIA (regardless of whether he or she claimed early) and doesn’t include delayed retirement credits. If you claim a spousal benefit before reaching your FRA, your benefit will be permanently reduced.

Dependent benefits

Your dependent child may be eligible for benefits after you begin receiving Social Security if he or she is unmarried and meets one of the following criteria: (a) under age 18, (b) age 18 to 19 and a full-time student in grade 12 or lower, (c) age 18 or older with a disability that started before age 22. The maximum family benefit is equal to about 150% to 180% of your PIA, depending on your situation.

Survivor benefits

If your spouse dies, and you have reached your FRA, you can claim a full survivor benefit — 100% of your deceased spouse’s PIA and any delayed retirement credits. Note that FRA is slightly different for survivor benefits: 66 for those born from 1945 to 1956, gradually rising to 67 for those born in 1962 or later.

You can claim a reduced survivor benefit as early as age 60 (age 50 if you are disabled, or at any age if you are caring for the deceased’s child who is under age 16 or disabled, and receiving benefits). If you are eligible for a survivor benefit and a retirement benefit based on your own work record, you could claim a survivor benefit first and switch to your own retirement benefit at your FRA or later, if it would be higher.

Dependent children are eligible for survivor benefits, using the same criteria as dependent benefits. Dependent parents age 62 and older may be eligible for survivor benefits if they received at least half of their support from the deceased worker at the time of death.

Claiming Early or Later

Divorced spouses

If you were married for at least 10 years and are unmarried, you can receive a spousal or survivor benefit based on your ex’s work record. If your ex is eligible for but has not applied for Social Security benefits, you can still receive a spousal benefit if you have been divorced for at least two years.

These are just some of the fundamental facts to know about Social Security. For more information, including an estimate of your future benefits, see ssa.gov.

Is Tip Fatigue Wearing You Out?

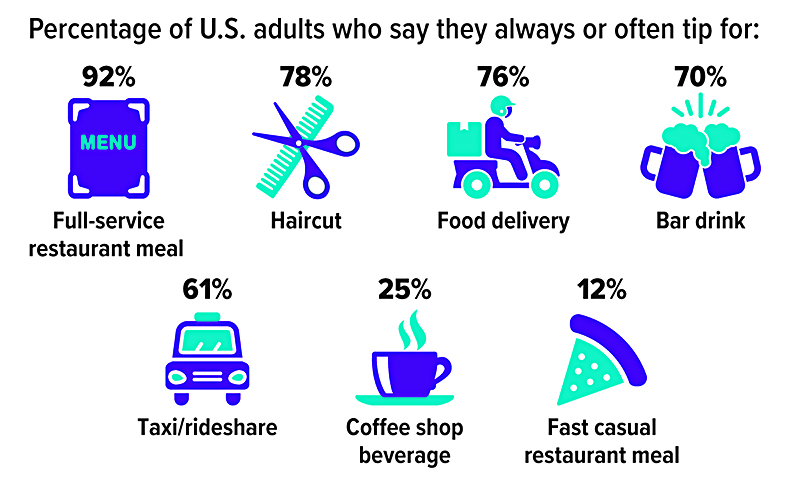

Traditionally, tipping has been a way to reward workers for providing good service. But the norms around tipping are changing, and if you’ve recently felt more pressure to tip, you’re not alone. A survey by the Pew Research Center found that 72% of adults said that tipping was expected in more places today than it was five years ago, a phenomenon known as “tip creep” or “tipflation.” 1

Why tipping culture is changing

Tipping affects everyone (even tipped workers have to tip others!) and confusion and complaints about tipping abound. If you’re among those feeling uneasy about tipping, blame the pandemic. That’s when tipping culture started to change. Consumers, anxious to reward front-line workers and support struggling businesses, left more and bigger tips. Businesses adopted digital ordering and payment solutions that made tipping more convenient and could be programmed with preset tip suggestions that were often higher than customers were used to.

And then inflation took its toll. Businesses that lost employees during the pandemic increasingly realized that tips could help fill wage gaps and attract employees reluctant to return to service positions. But consumers, already having to make their money go further, began to grow weary of seemingly constant tip requests, especially in situations or places where they had not previously been asked to tip.

Tipping guidelines

Tipping often feels good, but the pressure to tip can be guilt-provoking and confusing. When a worker turns a screen around and you’re prompted to choose a preset tip, it can feel wrong to choose the lowest option. While you might always tip your server at a sit-down restaurant, in situations where you’ve had little to no direct interaction with any employee, should you even tip at all?

Ultimately, tipping is always voluntary and it’s up to you to decide who, where, and how much to tip. While there are no set rules, here are some guidelines you can use to inform your decisions.2

- Full-service restaurant or food delivery: 20% of total bill

- Quick service restaurant: 10%

- Online food orders/takeout: $1 to $5 per order

- Bar or coffee shop: $1 to $2

- Hotel bellstaff: $1 to $5 per bag

- Hotel housekeeping: $1 to $5 per night

- Valet/parking attendant: $1 to $5 when car is delivered

- Rideshare/taxi driver: 15% to 20% of the fare

To Tip or Not to Tip?

Source: Pew Research Center, 2023

Finding a balance

Planning ahead can help you avoid some of the frustration around tipping and still tip fairly and appropriately.

Do an informal audit. How much have you spent on tips during the last month or two? Does that align with your budget?

Set tipping limits you’re comfortable with. You can always make adjustments at the register.

Reserve higher tips for special situations. This might be rewarding a worker at your favorite coffee shop, or showing your appreciation when someone provides extra-special service.

Don’t feel bound by on-screen tip recommendations. Use the “custom” tip option when available to leave the amount you want.

Carry small bills. These can be used in traditional tip jars, or when traveling, to reward workers who don’t have access to digital tips.

Talk to the manager or business owner if you have questions or complaints. It’s not always clear where your tips are going (for example at fast-casual restaurants or when ordering online), so feel free to ask. And reserve your complaints about tipping expectations for management, rather than workers.

Respect policies. While many businesses encourage tipping, some do not allow their employees to accept tips for legal reasons. Instead, consider leaving positive feedback.

1) Pew Research Center, 2023

2) Toast, 2023; American Hotel & Lodging Association, 2023; U.S. News & World Report, 2023

Do You Need to Adjust Your Tax Withholding?

Once you’ve filed last year’s tax return and can see where your finances are headed this year, it may be a good time to adjust your income tax withholding to help make sure you’re having the right amount withheld from your paycheck.

Tax withholding is a balancing act. If you have too much tax withheld, you will receive a refund when you file your income tax return. If you prefer to receive more in your paycheck instead, you will need to reduce your withholding. However, if you have too little tax withheld, you will owe tax when you file your tax return and might owe a penalty.

Two tools — IRS Form W-4 and the Tax Withholding Estimator on irs.gov — can be used to help figure out the right amount of federal income tax to have withheld from your paycheck. Using these can be beneficial when tax laws change, your filing status changes, you start a new job, or you have other major life changes. You might make a special effort to review your withholding if any of the following situations apply:

- Filing as a two-income family

- Holding more than one job at the same time

- Working for only part of the year

- Claiming credits, such as the child tax credit

- Itemizing deductions

- Having a high income and a complex return

How to adjust your withholding

Your employer will withhold tax from your paycheck based on the information you provide on Form W-4 and the IRS withholding tables. In some cases, you will need to give your employer a new Form W-4 within 10 days of a change in personal circumstances (for example, if the number of allowances you are allowed to claim is reduced or your filing status changes from married to single). In other cases, you can submit a new Form W-4 whenever you wish. See IRS Publication 505 for more information.

If you have a large amount of nonwage income, such as interest, dividends, or capital gains, you might want to increase the tax withheld or claim fewer allowances. In this situation, also consider making estimated tax payments using IRS Form 1040-ES.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.