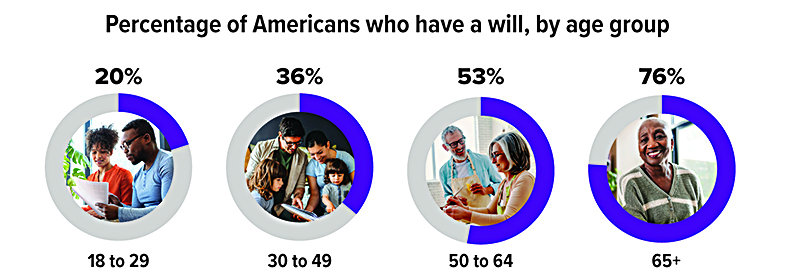

Do You Have a Will?

A 2021 Gallup poll found that only 46% of U.S. adults have a will — similar to the results of other Gallup polls over the last 30 years. It’s not surprising that older people are more likely to have a will, as are people with higher incomes.

Regardless of age or income, having a will is an essential step to pass your assets to your heirs with clarity and confidence. A will enables you to distribute your property, name an executor for your estate, and appoint a guardian for minor children. Various software programs may help you create a will, but it is generally better to consult an attorney who is familiar with the laws of your state.

Source: Gallup, 2021

Food Inflation: What's Behind It and How to Cope

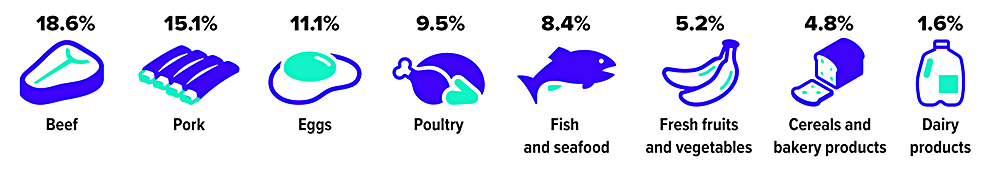

As measured by the Consumer Price Index for food at home, grocery prices increased 3.4% in 2020, a faster rate than the 20-year historical average of 2.4%.1 More recently, food inflation accelerated by 6.5% during the 12 months ending in December 2021, while prices for the category that includes meat, poultry, fish, and eggs spiked 12.5%.2

Food prices have long been prone to volatility, in part because the crops grown to feed people and livestock are vulnerable to pests and extreme weather. But in 2021, U.S. food prices were hit hard by many of the same global supply-chain woes that drove up broader inflation.

The pandemic spurred shifts in consumer demand, slowed factory production in the United States and overseas, and caused disruptions in domestic commerce and international trade that worsened as economic activity picked up steam. A shortage of metal containers and backups at busy ports and railways caused long shipping delays and drove up costs. Severe labor shortages, and the resulting wage hikes, have made it more difficult and costly to manufacture and transport many types of unfinished and finished goods.3

As long as businesses must pay more for the raw ingredients, packaging materials, labor, transportation, and fuel needed to produce, process, and distribute food products to grocery stores, some portion of these additional costs will be passed on to consumers. And any lasting strain on household budgets could prompt consumers to rethink their meal choices and shopping behavior.

Seven Ways to Market the Supermarket

The U.S. Department of Agriculture expects food inflation to moderate in 2022, but no one knows for certain how long prices might stay elevated.4 In the meantime, it may take more effort and some planning to control your family’s grocery bills.

Source: U.S. Bureau of Labor Statistics, 2022

- Set a budget for spending on groceries and do your best not to exceed it. In 2021, a typical family of four with a modest grocery budget spent about $1,150 per month on meals and snacks prepared at home. Your spending limit could be higher or lower depending on your household income, family size, where you live, and food preferences.5

- To avoid wasting food, be aware that food date labels such as “sell by,” “use by,” and “best before” are not based on safety, but rather on the manufacturer’s guess of when the food will reach peak quality. With fresh foods like meat and dairy products, you can usually add five to seven days to the “sell by” date. The look and smell can help you determine whether food is still fresh, and freezing can extend the shelf life of many foods.

- Grocery stores often rotate advertised specials for beef, chicken, and pork, so you may want to plan meals around sale-priced cuts and buy extra to freeze for later. With meat prices soaring, it may be a good time to experiment with “meatless” meals that substitute plant-based proteins such as beans, lentils, chickpeas, or tofu.

- Stock up on affordable and nonperishable food such as rice, pasta, dried beans, canned goods, and frozen fruits and vegetables when they are on sale.

- Select fresh produce in season and forgo more expensive pre-cut and pre-washed options.

- Keep in mind that a store’s private-label brands may offer similar quality at a significant discount from national brands.

- Consider joining store loyalty programs that offer weekly promotions and personalized deals.

1, 4–5) U.S. Department of Agriculture, 2021

2) U.S. Bureau of Labor Statistics, 2022

3) Bloomberg Businessweek, September 15, 2021

What's Your Retirement Dream Elevator Pitch?

Imagine stepping into an elevator and realizing that you’re about to spend the 30-second ride with someone who could make your retirement dreams come true — if only you could explain them before the doors open again. How would you summarize your financial situation, outlook, aspirations, and plans if you had 30 seconds to make an “elevator pitch” about achieving one of your most important goals?

Answering that question — and formulating your own unique retirement dream elevator pitch — could help bring your vision of the future into sharper focus.

What Are Your Goals?

Start with an overview of what you hope to accomplish. That typically includes describing what you want, when you want it, and why. For example, you might say, “My goal involves retiring in 10 years and moving to a different state so I can be closer to family.” Or, “In the next 15 years, I need to accumulate enough money to retire from my regular job and open a part-time business that will help sustain my current lifestyle.”

If your plans include sharing life with a loved one, make sure you’re both on the same page. Rather than assume you have similar ideas about retirement, discuss what you want a future together to look like.

How Much Will It Cost?

To put a price tag on your retirement dream, consider working with a financial professional to calculate how much money you’ll need. Making multiple calculations using different variables — such as changing your anticipated retirement date and potential investment growth rate — will help you develop a better understanding of the challenges and opportunities you may encounter.

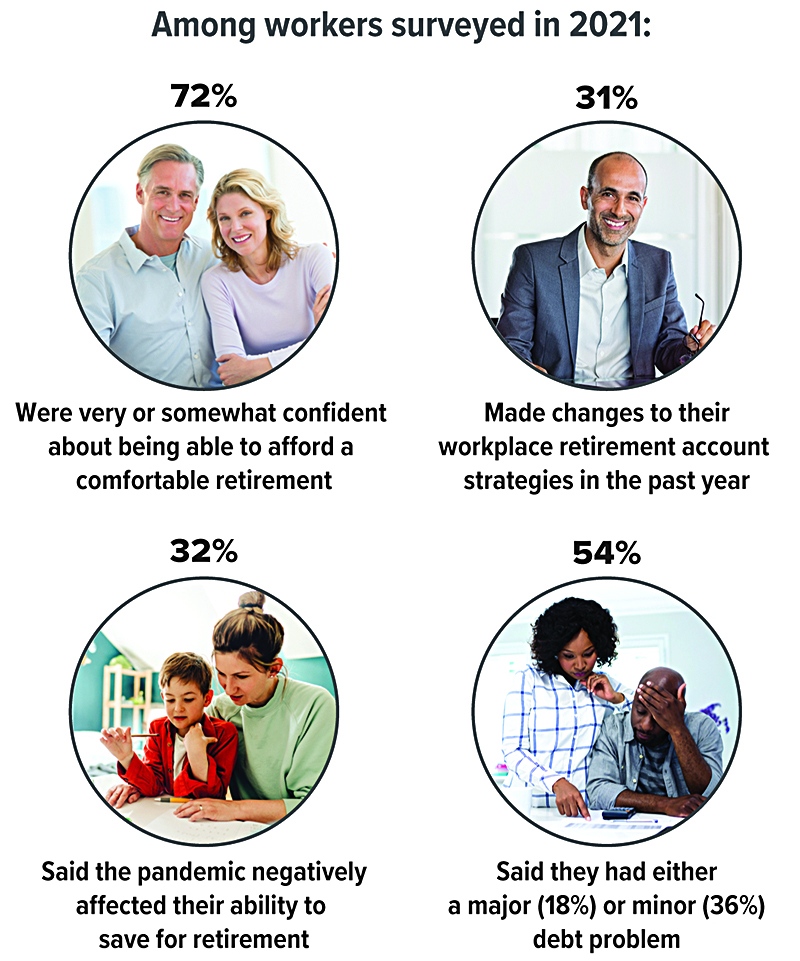

It’s important to remember that plans don’t always work out the way we intend. For example, 72% of workers surveyed in 2021 said they expect to continue working for pay during retirement, but only 30% of retirees said they actually did so. And nearly half (46%) of current retirees left the workforce earlier than expected.1 Understanding the financial implications of an unanticipated change in plans before it happens could make it easier to adjust accordingly.

How Will You Do It?

If your calculations indicate you may be facing a retirement savings shortfall, take a fresh look at your spending habits to help find ways to save more money. Make a list of your fixed expenses and then keep track of your discretionary purchases every day for a month. It might be startling to realize how much you routinely spend on non-essential items, but you’ll quickly discover exactly where to start applying more financial discipline.

Finally, you’ll need to manage the funds you earmark for retirement by choosing the types of accounts to use and allocating your money within each account. If you have access to an employer-sponsored retirement account with matching contributions from your employer, you might want to start there and then invest in additional tax-deferred and taxable investments.

Regardless of the types of accounts you choose, your specific investment decisions should reflect your personal tolerance for risk and time frame, while addressing the priorities outlined in your retirement dream elevator pitch. If your retirement outlook changes at any point, take a fresh look at your investment strategy to make sure you’re still potentially on course.

All investing involves risk, including the possible loss of principal. There is no guarantee that any investment strategy will be successful. Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. There is no assurance that working with a financial professional will improve investment results.

1) Employee Benefit Research Institute, 2021

Source: Employee Benefit Research Institute, 2021

Avoiding Probate

Probate is the process of proving the validity of a will and supervising the administration of an estate usually in the probate court. State law governs the proceedings in the probate court, so the process can vary from state to state. Supervising the administration of an estate can result in additional expense, unwanted publicity, and delays in the distribution of estate assets for a year or longer, which is why planning to avoid the probate process may be beneficial.

There are several ways in which assets may transfer on death directly from the decedent/owner to others without probate. The following are some of the more common ways.

Create a living trust. A revocable living trust is a separate legal entity that can be set up to hold assets. You can transfer most assets to a living trust while you’re alive and have complete access to and control of those assets during your lifetime. You can also direct who is to receive assets held in trust upon your death. The use of trusts involves a complex web of tax rules and regulations, and usually involves upfront costs and ongoing administrative fees. You should consider the counsel of an experienced estate planning professional before implementing a trust strategy.

Name a beneficiary. Many types of contracts allow you, as the account owner, to designate a beneficiary or beneficiaries to receive the assets directly upon your death, avoiding probate. Examples include life insurance, annuities, and retirement accounts such as IRAs and 401(k)s.

Make accounts payable on death. Certain other types of accounts, such as bank accounts and brokerage accounts, also allow you to designate a beneficiary to inherit the account at your death without going through probate.

Own real estate jointly or create a life estate. Owning property jointly, as joint tenants with rights of survivorship, is another way to transfer property at death while avoiding probate. When one joint owner dies, property ownership automatically transfers to the surviving joint owner. You can also create a life estate in the property. In this case, you transfer ownership of the property to others, often called remainder beneficiaries, while you retain a life estate in the property. This means you have the right to use and control the property during your lifetime. Upon your death, complete ownership of the property passes to the remainder beneficiaries.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Prepared by Broadridge Advisor Solutions Copyright 2022.