EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

Why Do Workers Take Less Paid Time Off Than They Can?

In a 2023 survey, nearly nine out of 10 workers said it was extremely or very important to have a job that offers paid time off (PTO) for vacations, doctor appointments, and minor illnesses. Yet almost half said they take less time off than their employers allow. Here are the top reasons they gave for not using all their PTO.

Source: Pew Research Center, 2023 (survey did not include workers with unlimited paid time off)

Beware of These Life Insurance Beneficiary Mistakes

Life insurance has long been recognized as a useful way to provide for your heirs and loved ones when you die. While naming your policy’s beneficiaries should be a relatively simple task, there are a number of situations that can easily lead to unintended and adverse consequences. Here are several life insurance beneficiary traps you may want to discuss with a professional.

Creating a taxable situation

Generally, life insurance death proceeds are not taxed when they’re paid. However, there are exceptions to this rule, and the most common situation involves having three different people as policy owner, insured, and beneficiary. Typically, the policy owner and the insured are one and the same person. But sometimes the owner is not the insured or the beneficiary. For example, mom may be the policy owner on the life of dad for the benefit of their children. In this situation, mom is effectively creating a gift of the insurance proceeds for her children/beneficiaries. As the donor, mom may be subject to gift tax. Consult a financial or tax professional to figure out the best way to structure the policy.

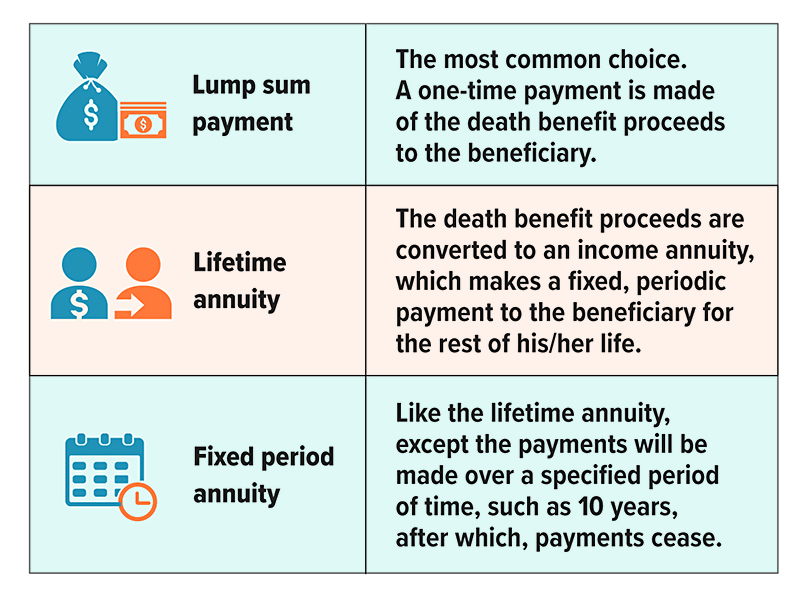

Life Insurance Payout Options

Most life insurance policies offer several options to the policy benefeciary, including:

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

While trusts offer numerous advantages, they incur up-front costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax advisors before implementing such strategies.

Trailblazers: Women Who Made Financial History

March is Women’s History Month. What better time to reflect on the contribution women have made to the field of finance? What follows are the stories of just five of the many women who helped blaze the trail for others in investing, banking, finance, and economics.

Victoria Claflin Woodhull and Tennessee “Tennie” Claflin

Victorian-era sisters Victoria Woodhull and Tennie Claflin were pioneers on many fronts. Not only did they launch the first brokerage house by and for women, they started a progressive newspaper supporting women’s rights and were also suffragists. In 1872, Woodhull was the first woman to run for president.

The sisters’ rise to fame had quite unconventional beginnings. Their father was a “snake oil salesman” who made his young girls serve as psychics and healers in his scams. Woodhull later parlayed this unusual experience into a business relationship with the superstitious tycoon Cornelius Vanderbilt. With the backing of his fortune, the sisters opened Woodhull, Claflin & Co., New York’s first female-owned brokerage firm. Through surreptitious means (a hidden back door and a women-only lounge), the company helped women manage their own money during a time when it was frowned upon to do so.1

Maggie Lena Walker

Maggie Lena Walker was born to enslaved parents in 1864 in Richmond, Virginia. At just 14 years old, she joined the local council of the Independent Order of St. Luke, an African-American benevolent society that aided the sick and elderly, promoted humanitarian causes, and encouraged individual self-sufficiency. Walker eventually assumed leadership of the organization, where she served until her death. Among her achievements were launching The St. Luke Herald newspaper, which encouraged economic independence and, in 1903, becoming the first African-American woman to charter a bank — the St. Luke Penny Savings Bank.

Upon opening, the bank helped hundreds begin saving money, including one person who opened an account with just 31 cents. Walker also encouraged children to save by handing out penny banks and allowing them to open accounts after saving 100 pennies.

The bank later merged with two others to become The Consolidated Bank and Trust Company, the nation’s oldest bank continually operated by African-American management until 2009.2

Muriel Siebert

The first woman to buy a seat on the New York Stock Exchange (NYSE) and the first to be a superintendent of banking for the state of New York, Muriel Siebert was also the first woman to lead a NYSE member firm.

Considered “a scrapper” with “the same brash attitude that characterized Wall Street’s most successful men,” Siebert made it her life’s mission to fight for women to occupy the most vaunted seats at Wall Street’s proverbial tables. She donated millions to help women secure careers in business and finance.

At a 1992 luncheon where she was honored for her life’s work, Siebert said women “…are still not making partner and are not getting into the positions that lead to the executive suites. There’s still an old-boy network. You have to keep fighting.”3

Dr. Janet Yellen

Currently serving as U.S. Secretary of the Treasury — the first woman to do so — Dr. Janet Yellen has been a standout in the field of economics for decades.

Born to a middle-class family in Brooklyn, New York, Dr. Yellen graduated summa cum laude from Brown University in 1967 and earned her Ph.D. in economics from Yale in 1971, the only woman to do so that year. After teaching at several top universities, including Harvard and the London School of Economics, she served as a member of the Federal Reserve Board of Governors.

In 1997, President Bill Clinton appointed her as the first woman chair of the White House Council of Economic Advisors. She later went on to serve the Federal Reserve System in a variety of leadership roles. In October 2013, President Barack Obama nominated her for the position of Federal Reserve Board Chair, the first woman to hold that role.

Dr. Yellen is not only the first woman to lead the U.S. Treasury, the Federal Reserve Board, and the White House Council of Economic Advisors, she also is the first person to have held all three posts.4

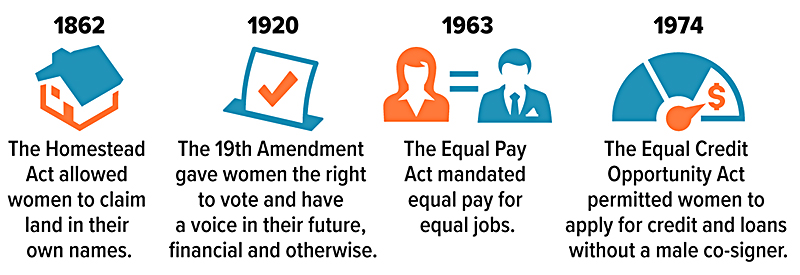

Milestones in Financial HERstory

Source: HerMoney, 2022

1) Museum of the City of New York

2) National Park Service and the National Women’s History Museum

3) The New York Times, August 25, 2013

4) National Women’s History Museum and Investopedia

Braving the Housing Market? An Assumable Mortgage Might Be the Solution

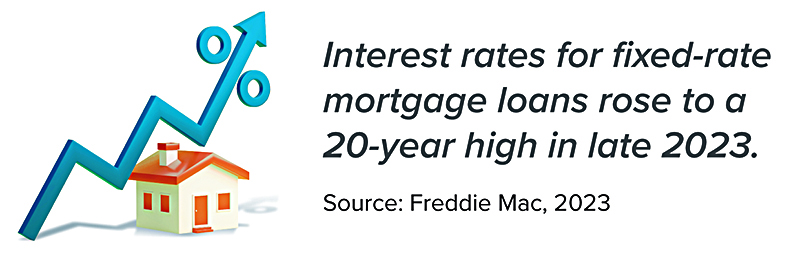

This past year, the housing market has experienced a perfect storm, with high interest rates and inflation resulting in reduced purchasing power for homebuyers. In addition, many current homeowners were reluctant to sell — and give up their lower mortgage rates — leading to lower housing inventory and higher home prices.

If you have been struggling to buy a home in the current market, one possible solution is to look for a home with an assumable mortgage. If you’re thinking of selling your current home, having an assumable mortgage can make it more marketable and appealing to buyers.

When a mortgage is assumable, a buyer can take over the seller’s existing mortgage and continue making payments on the original terms. This includes the interest rate, payment schedule, and remaining loan balance. In the current market, a buyer may be able to assume a mortgage with a more favorable interest rate than what they would be able to get when applying for a new home loan. To assume a mortgage, the homebuyer must meet the original lender’s qualification requirements and pay closing costs.

One major drawback of an assumable mortgage is that the homebuyer must come up with a down payment that will make up any difference between the sale price and the outstanding balance on the original mortgage loan. This means that the homebuyer must either pay cash or take out a second mortgage to cover the remainder of the purchase price. For example, if a home is selling for $500,000, and the seller still owes $300,000 on the mortgage loan, the down payment would be $200,000. If the original loan has a low enough interest rate, an assumable mortgage could be advantageous for a homebuyer with access to enough cash or financing to cover the difference between the sale price and outstanding balance of the assumed loan.

It’s important to note that not all mortgage loans are assumable. As a result, finding a home with an assumable mortgage may be difficult, and if you do find one, competition may be fierce. Generally, assumable mortgages are limited to government-backed loans from the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA). Unique terms, requirements, and fees may apply.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.