EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

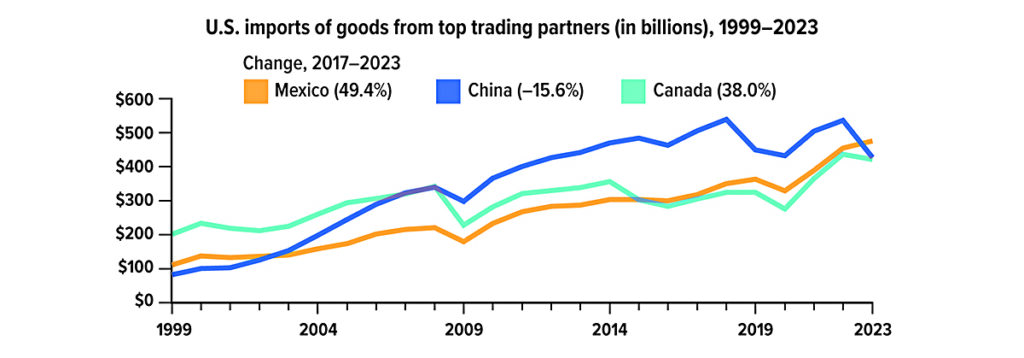

Friend or Foe? Trade Shifts Reflect Geopolitical Risks

In 2023, the United States bought more goods from Mexico than China for the first time since 2002. In 2017, the Trump administration placed steep tariffs on many Chinese products. These levies, which were kept by the Biden administration, make the cost of goods from China less competitive against U.S. products and those imported from nations with free trade agreements. The pandemic, the war in Ukraine, and attacks in the Red Sea have all disrupted supply chains and provided further impetus to reconfigure trade strategies.

Sources: U.S. Census Bureau, 2024; McKinsey Global Institute, 2024

Mixing It Up: Asset Allocation and Diversification

Asset allocation and diversification are so fundamental to portfolio structure that it’s easy to lose sight of these strategic tools as you track the performance of specific securities or the dollar value of your investments. It might be worth considering how these strategies relate to each other and to the risk and potential performance of your portfolio.

Keep in mind that asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Establishing balance

Asset allocation refers to the mix of asset types in a portfolio — generally stocks, bonds, and cash alternatives. These asset classes have different growth and risk profiles and tend to perform differently under various market conditions. Stocks typically have higher long-term growth potential but are associated with greater volatility, while bonds tend to have moderate growth potential with less volatility. Cash alternatives usually have low growth potential but are the most stable of the three asset classes; however, if cash investments do not keep pace with inflation, they could lose purchasing power over time.

There is no right or wrong asset allocation. The appropriate allocation for you depends on your age, risk tolerance, time horizon, and specific goals. Younger investors might be comfortable with a more aggressive allocation heavily weighted toward stocks, because they have a longer time to recover from potential losses and may be willing to accept significant short- to medium-term drops in portfolio value in exchange for long-term growth potential. Older investors who are more concerned with preserving principal and those with near-term investment objectives, such as college funding, might prefer a more conservative allocation with greater emphasis on bonds and cash alternatives.

Adding variety

Diversification refers to holding a wide variety of securities within an asset class to help spread the risk within that class. For example, the stock portion of a portfolio could be diversified based on company size or capitalization (large cap, mid cap, and small cap). You could add international stocks, which tend to perform differently than domestic stocks. A well-diversified portfolio should include stocks across a broad range of industries and market sectors.

A portfolio’s bond allocation might be diversified with bonds of different types and maturities. Corporate bonds typically pay higher interest rates than government bonds with similar maturities, but they are associated with a higher degree of risk. U.S. Treasury bonds are guaranteed by the federal government as to the timely payment of principal and interest. Foreign bonds could also increase diversification. Longer-term bonds tend to be more sensitive to interest rates; they typically offer higher yields than bonds with shorter maturities, but this has not been true since the unusual interest-rate increases that began in 2022.

Staying on target

Once you have established an appropriate asset allocation and diversification strategy, it’s important to periodically examine your portfolio to see how it compares to your targeted structure. Depending on the level of change, you may want to rebalance the portfolio to bring it back in line with your strategic objectives. Rebalancing involves selling some investments in order to buy others. Keep in mind that selling investments in a taxable account could result in a tax liability.

The principal value of stocks and bonds fluctuate with changes in market conditions. Shares of stock, when sold, and individual bonds redeemed prior to maturity may be worth more or less than their original cost. Concentrating in a particular industry or sector could expose your portfolio to significant levels of volatility and risk. Investing internationally involves additional risks, such as differences in financial reporting, currency exchange risk, and economic and political risk unique to the specific country or region. This may result in greater share price volatility. The principal value of cash alternatives may be subject to market fluctuations, liquidity issues, and credit risk; it is possible to lose money with this type of investment.

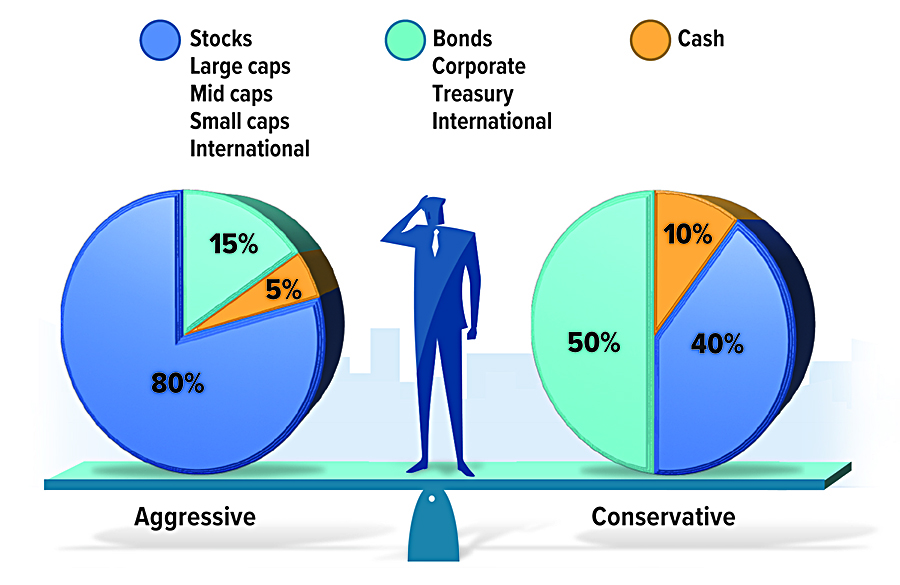

Sample Portfolios

This chart shows how aggressive and conservative portfolios could be diversified by dividing asset classes among different types of securities. The percentage of each type of security might vary widely depending on the investor’s situation and preferences, and many investors may not hold all types of securities.

These hypothetical portfolios are shown for illustrative purposes only. They are examples, not recommendations.

Insurance Gaps May Pose Risks for High-Net-Worth Households

Serious accidents don’t happen very often, but when they do, the impact can be devastating. And unfortunately, you could be held legally responsible if a member of your household causes a car wreck or if someone is injured on your property, even if you go to great lengths to help make your home and the surrounding area safe for visitors.

If you have teenagers who drive, employ household workers, own a pool or trampoline, entertain often, coach youth sports, or are a public figure, the odds are even higher that you could become the target of a lawsuit. Of course, the wealthier you are, the more you stand to lose if a liability claim is filed against you. It’s important to reassess your liability coverage periodically and make sure it’s sufficient based on your family’s financial situation, lifestyle, and the related risks.

Is your umbrella big enough?

Standard homeowners and auto insurance policies generally cover personal liability, but you may not have enough coverage to protect your income and assets in the event of a high-dollar judgment. That’s where an umbrella policy comes into the picture, providing an extra layer of financial protection against lawsuits claiming that you or a member of your household is liable for bodily injury or damage to the property of others (up to policy limits).

To purchase an umbrella policy, you must first have a certain amount of liability coverage in place on your homeowners/renters and auto insurance (typically $300,000 and $250,000, respectively), which serve as a deductible for the umbrella policy. An umbrella policy will commonly provide liability coverage worth $1 million to $10 million.

One general guideline is to have liability coverage in place that matches your net worth. This includes assets such as savings and investment accounts, cars, valuable art and collectibles, plus the equity in your home and/or any other real estate that you own. You may want to add the value of your projected stream of future income. (Qualified retirement plan assets may have some protection from civil liability under federal and/or state law, depending on the plan and jurisdiction.)

What’s covered and what isn’t?

An umbrella policy may help pay legal expenses and compensation for time off from work to defend yourself in court. It might also cover some nonbusiness-related personal injury claims that are typically excluded from standard homeowners policies, such as libel, slander, invasion of privacy, and defamation of character.

A personal umbrella policy won’t cover your own injuries or damage to your property; nor will it cover liability associated with your business — for that, you may need a commercial umbrella policy. You generally won’t be covered if you hurt someone on purpose, commit a crime, or breach a contract. Read your policy carefully for other possible exclusions, such as injury claims involving some breeds of dogs.

Do these situations apply to you?

Household help. If you have a nanny, housekeeper, or other employees who work at your home, workers compensation insurance is typically required by law. A type of coverage known as employment practice liability insurance, which covers claims such as harassment, wrongful termination, and discrimination, may also be available.

Special events. If you host parties where alcohol is served, always take steps to moderate guests’ drinking and don’t let anyone drive home intoxicated. Consider purchasing a special event policy designed to help limit your exposure if you host a costly event, such as a wedding, at your home or another venue.

Proper names. If you establish a trust or limited liability company (LLC) for the ownership of certain assets, make sure the named owner is accurately reflected in insurance policies meant to protect those assets. To ensure coverage for an automobile, for example, the name on the policy should match the registration. Property purchased through an LLC should generally be insured by the LLC, with the individual as an additional named insured.

After the Loss of a Loved One, Watch Out for Scams

Scam artists often prey on those who are most vulnerable. Unfortunately, this includes individuals who have recently lost a loved one and are easily taken advantage of during their time of grief. Scammers will look for details from obituaries, funeral homes, hospitals, stolen death certificates, and social media websites to obtain personal information about a deceased individual and use it to commit fraud.

A common scam after the loss of a loved one, often referred to as “ghosting,” is when an identity thief uses personal information obtained from an obituary to assume the identity of a deceased individual. That information is then used to access or open financial accounts, take out loans, and file fraudulent tax returns to collect refunds. Typically, a ghosting scam will occur shortly after someone’s death — before it has even been reported to banks, credit reporting agencies, or government organizations such as the Social Security Administration (SSA) or Internal Revenue Service (IRS).

Another scam involves scam artists using information from an obituary to pass themselves off as a friend or associate of the deceased — sometimes referred to as a “bereavement” or “imposter” scam. These individuals will falsely claim a personal or financial relationship with the deceased in order to scam money from grieving loved ones. Scam artists will also pose as government officials or debt collectors falsely seeking payment for a deceased individual’s unpaid bill.

If you recently experienced the loss of a loved one, consider the following tips to help reduce the risk of scams:

- Report the death to the SSA and IRS as soon as possible.

- Notify banks and other financial institutions that the account holder is deceased.

- Contact your state’s department of motor vehicles and ask them to cancel the deceased’s driver’s license.

- Ask the major credit reporting bureaus (Equifax, Experian, and TransUnion) to put a “deceased alert” on the deceased person’s credit reports and monitor them for unusual activity.

- Avoid putting too much personal information in an obituary, such as a birth date, place of birth, address, or mother’s maiden name.

- Be wary of individuals who try to coerce or pressure you over alleged debts owed by the deceased.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.