EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

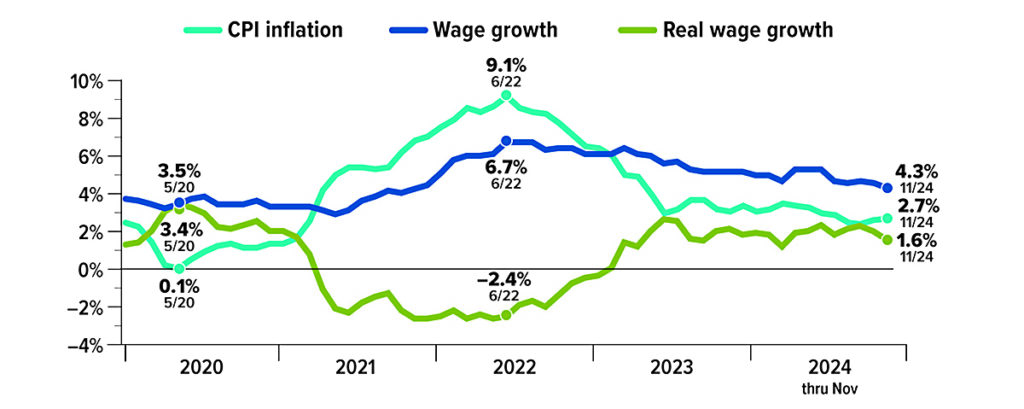

Steady Growth in Real Wages

Wages rose strongly with inflation beginning in mid-2021, but the pace of price increases was faster than wage increases, leading to a loss of buying power despite higher income. Real wages — adjusted for inflation — actually declined during this period. For example, at the height of inflation in June 2022, wages increased at an annual rate of 6.7%, but real wages declined by 2.4%.

Inflation has dropped dramatically since then, while wage growth has cooled more slowly, leading to solid gains in real wages. If this trend continues, it could help keep the economy strong as workers catch up from the hardship of high inflation and benefit from increased income in relation to the cost of living.

Sources: Federal Reserve Bank of Atlanta, 2024; U.S. Bureau of Labor Statistics, 2024. Wage growth is calculated by comparing the median percentage change in wages reported by individuals 12 months apart; real wage growth is calculated by subtracting CPI-U inflation from wage growth.

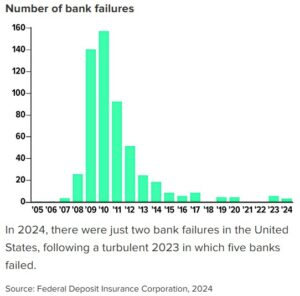

Distressed Loans Pressure Some Banks: Is Your Money Safe?

In March 2023, two of the largest bank failures in history alarmed savers who worried their own bank accounts could be at risk and investors who feared a wider financial crisis. To help restore confidence in the U.S. financial system, the federal government pledged to make all depositors whole and to support other banks that might face liquidity issues stemming from the rapid rise in interest rates.1

Still, these events brought renewed attention to how banks operate and the risks they take to earn money on customer deposits, as well as the government’s role in regulating and supervising bank activities.

Interest rate risks remain

Between March 2022 and July 2023, the Federal Reserve raised the benchmark federal funds rate rapidly (from near 0% to a range of 5.25% to 5.5%) in a quest to bring down inflation.2 Banks earn money by investing customer deposits, often in relatively safe long-term Treasuries and other government-backed bonds. U.S. Treasury securities are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. But as interest rates rose, bonds lost value on the secondary market. And in early 2023, this became a problem for banks that had to sell bond holdings before they matured to meet customer withdrawals.

Though the Fed has begun lowering the federal funds rate, borrowing costs remain elevated, leaving concerns that a similar fate could befall regional banks with distressed real estate loans in their portfolios. Already, many commercial lenders have set aside large reserves to help cover future losses from nonperforming assets (primarily office and retail buildings with high vacancy rates).3

Focus on the FDIC

The Federal Deposit Insurance Corporation (FDIC) is an independent agency backed by the full faith and credit of the U.S. government. FDIC insurance is intended to reassure depositors and offer protection in case an insured bank becomes insolvent, is liquidated, or experiences other financial difficulties. Most banks in the United States are insured by the FDIC, which protects deposits up to $250,000 (per person, insured bank, and account category). A joint account with two named owners qualifies for up to $500,000 of coverage.

When a member bank fails, the FDIC issues payments to depositors (typically up to the limits provided by law) and takes over the administration of the bank’s assets and liabilities. Generally, the FDIC will try to arrange for a healthy bank to take over the deposits of a failed bank. If no bank assumes that role, the FDIC taps a fund that is financed by premiums paid by insured banks.

Are your savings protected?

If you have multiple accounts at one bank, you might check to see who is listed as the owner(s) of each account, what category it falls into, and whether it overlaps with other categories that might affect the amount that’s covered. Ownership categories consist of individual accounts, joint accounts, retirement accounts, trust accounts, and business accounts, among others. You can’t increase your coverage by owning different product types (a checking account, savings account, or CDs, for example) within the same ownership category. A tool on the FDIC’s website, FDIC.gov, can help you estimate the total FDIC coverage on your deposit accounts. If your assets aren’t fully insured, you might consider shifting them to increase your coverage.

If you are married, for example, you could expand your total coverage up to $1 million at one bank by opening two separate individual accounts in addition to a joint account. If you have personal or business account balances that regularly exceed $250,000, you might consider dividing your holdings between multiple financial institutions — or possibly rethink your cash-management strategy altogether.

All investing involves risk, including the possible loss of principal.

1) Federal Reserve and Federal Deposit Insurance Corporation, 2023

2) Federal Reserve, 2023–2024

3) The Wall Street Journal, April 19, 2024

Key Retirement and Tax Numbers for 2025

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2025.

Estate, gift, and generation-skipping transfer tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2025 is $19,000, up from $18,000 in 2024.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2025 is $13,990,000, up from $13,610,000 in 2024.

Standard deduction

A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2025, the standard deduction is:

- $15,000 (up from $14,600 in 2024) for single filers or married individuals filing separate returns

- $30,000 (up from $29,200 in 2024) for married joint filers

- $22,500 (up from $21,900 in 2024) for heads of households

The additional standard deduction amount for the blind and those age 65 or older in 2025 is:

- $2,000 (up from $1,950 in 2024) for single filers and heads of households

- $1,600 (up from $1,550 in 2024) for all other filing statuses

Special rules apply for an individual who can be claimed as a dependent by another taxpayer.

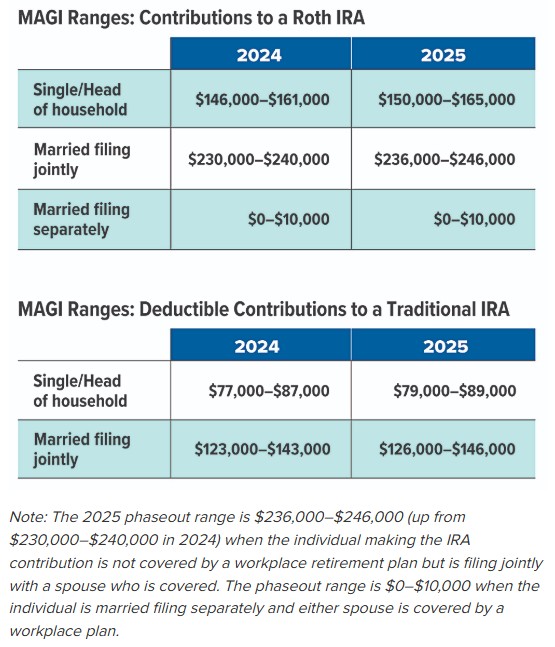

IRAs

The combined annual limit on contributions to traditional and Roth IRAs is $7,000 in 2025 (the same as in 2024), with individuals age 50 or older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see table). For individuals who are active participants in an employer-sponsored retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see table). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

Employer-sponsored retirement plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $23,500 in compensation in 2025 (up from $23,000 in 2024); employees age 50 or older can defer up to an additional $7,500 in 2025 (the same as in 2024), increased to $11,250 in 2025 for ages 60 to 63.

- Employees participating in a SIMPLE retirement plan can defer up to $16,500 in 2025 (up from $16,000 in 2024), and employees age 50 or older can defer up to an additional $3,500 in 2025 (the same as in 2024), increased to $5,250 in 2025 for ages 60 to 63.

Kiddie tax: child’s unearned income

Under the kiddie tax, a child’s unearned income above $2,700 in 2025 (up from $2,600 in 2024) is taxed using the parents’ tax rates.

Get Ready for Tax Time

According to one survey, 42% of Americans would rather go to the dentist than file their taxes.1 Tax season might not be your favorite time of the year, but a little preparation can help make the tax filing process as smooth and painless as possible.

Review last year’s tax return. Not everything will stay the same, but checking last year’s return can reveal information you might need this year. If you use an accountant or professional tax preparer, you may receive a checklist or questionnaire to help you get organized.

Think about recent life events. During 2024, did you tie (or untie) the knot, grow your family, buy or sell a home, start a job, send a child to college, retire, receive an inheritance, or have high health-care costs? These are just some of the common events that might affect your tax return, including the filing status you choose, the amount of income or expenses you have, or tax deductions and credits you might be entitled to.

Gather supporting documents. You’ll automatically receive some tax documents and statements electronically or by mail in January or February. You may need to locate others yourself.

Depending on your situation and whether you itemize deductions or take the standard deduction, supporting documents may include:

- W-2 forms showing wages from your employers

- 1099 forms that report other types of income you received, including interest from banks and brokers, dividends and distributions, retirement plan or health savings account (HSA) distributions, Social Security benefits, and self-employment income

- 1098 forms for mortgage interest, property taxes, or education-related payments

- Receipts or statements for child-care or medical costs

- Receipts for donations to charity

Collect supporting documents in one place, and make a list of information you’re missing so that you can check it off the list once you have it.

Consider making IRA or HSA contributions. If you’re eligible, you can contribute to a traditional IRA (deductible or not), Roth IRA, or an HSA for 2024 up until the tax filing deadline, as long as you haven’t already reached the contribution limit for the year.

1) Chamber of Commerce, 2024

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.