EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

Honey, They Shrunk the Groceries

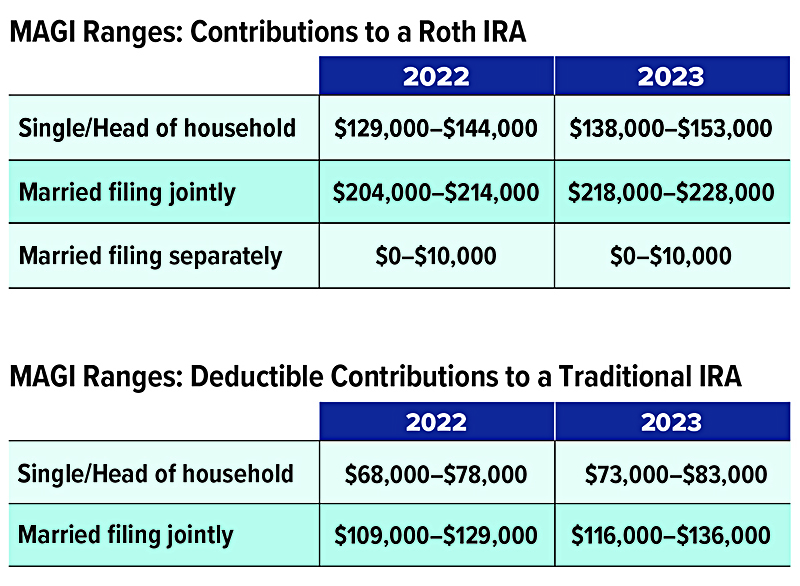

Have you noticed that packages are smaller at the grocery store? If so, you’re not alone. A majority of U.S. adults have noticed shrinkflation — products shrinking in size while prices stay the same or increase. And about two out of three are very or somewhat concerned about the trend.

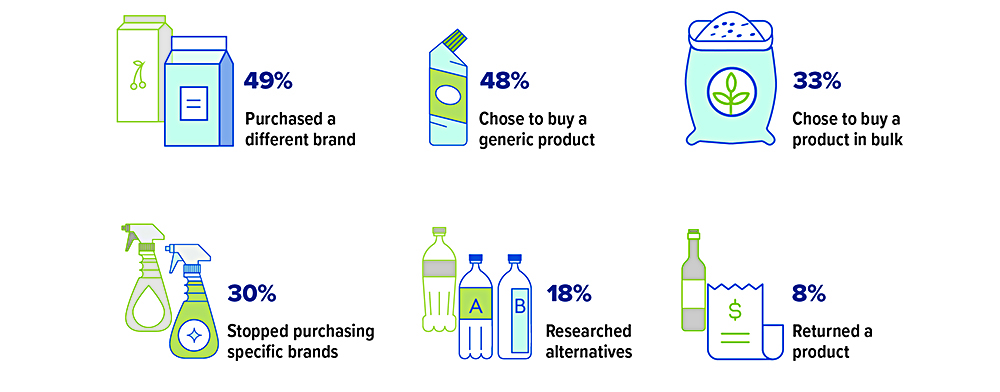

Consumers were most likely to say they noticed shrinkflation with snack items, followed by pantry items and frozen food. Shoppers also noticed it with meat, bread, beverages, dairy, produce, and other items. Here’s what consumers did when they noticed shrinkflation.

Source: Morning Consult, August 29, 2022 (multiple responses allowed)

Key Retirement and Tax Numbers for 2023

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2023.

Estate, Gift, and Generation-Skipping Transfer Tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2023 is $17,000, up from $16,000 in 2022.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2023 is $12,920,000, up from $12,060,000 in 2022.

Standard Deduction

A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2023, the standard deduction is:

- $13,850 (up from $12,950 in 2022) for single filers or married individuals filing separate returns

- $27,700 (up from $25,900 in 2022) for married joint filers

- $20,800 (up from $19,400 in 2022) for heads of household

The additional standard deduction amount for the blind and those age 65 or older in 2023 is:

- $1,850 (up from $1,750 in 2022) for single filers and heads of household

- $1,500 (up from $1,400 in 2022) for all other filing statuses

Special rules apply for those who can be claimed as a dependent by another taxpayer.

IRAs

The combined annual limit on contributions to traditional and Roth IRAs is $6,500 in 2023 (up from $6,000 in 2022), with individuals age 50 or older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see chart). For individuals who are active participants in an employer-sponsored retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see chart). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

Employer-Sponsored Retirement Plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $22,500 in compensation in 2023 (up from $20,500 in 2022); employees age 50 or older can defer up to an additional $7,500 in 2023 (up from $6,500 in 2022).

- Employees participating in a SIMPLE retirement plan can defer up to $15,500 in 2023 (up from $14,000 in 2022), and employees age 50 or older can defer up to an additional $3,500 in 2023 (up from $3,000 in 2022).

Kiddie Tax: Child’s Unearned Income

Under the kiddie tax, a child’s unearned income above $2,500 in 2023 (up from $2,300 in 2022) is taxed using the parents’ tax rates.

Note: The 2023 phaseout range is $218,000 – $ 228,000 (up from $204,000-$214,000 in 2022) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0-$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

Should You Consider Tax-Loss Harvesting?

Stock market losses can be rough on your portfolio’s bottom line, but they may also offer the potential to reduce your tax liability and possibly buy shares at a discount. Whether this strategy — called tax-loss harvesting — is appropriate for you depends on a variety of factors, including your current portfolio performance, your long-term goals, and your current and future taxable income.

Gains and Losses

When an investment loses money, it’s often best to look beyond current performance and hold it for the long term. Sometimes, though, you may want to sell a losing investment, which could help balance gains from selling an investment that has appreciated or reduce your taxable income even if you do not have gains.

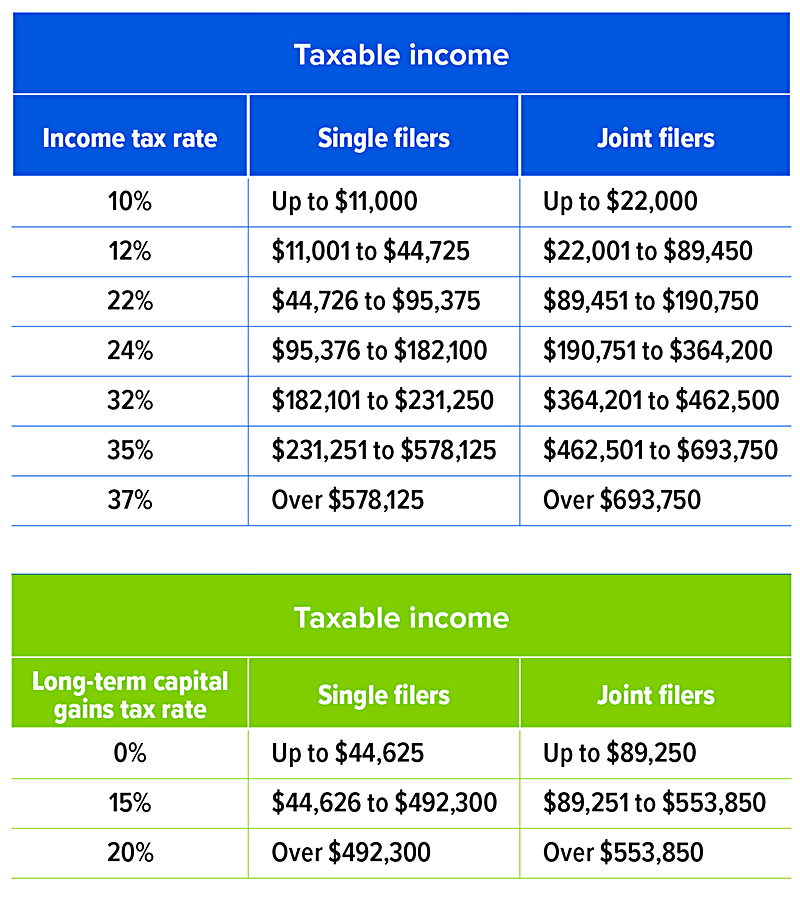

Capital gains and losses are classified as long term if the investment was held for more than one year, and short term if it was held for one year or less. Long-term gains are taxed at a rate of 0%, 15%, or 20% depending on your income. Short-term gains are taxed at your ordinary income tax rate, which may be much higher than your capital gains rate.

For tax purposes, capital losses are applied first to like capital gains and then to the other type of gains; for example, long-term losses are applied first to long-term gains and then to short-term gains. Up to $3,000 of any remaining losses can then be applied to your ordinary income for the current year ($1,500 if you are married filing separately). Finally, any remaining losses can be carried over to be applied to capital gains or ordinary income in future years. For most taxpayers, the biggest benefit comes when applying losses to short-term gains or ordinary income.

Selling, Buying, and Washing

Some investors sell losing investments with the idea of harvesting the tax loss and then buying the same investment while its price remains low. In order to discourage this, the IRS has a wash-sale rule, which prohibits buying “substantially identical stock or securities” within 30 days prior to or after a sale. This also applies to securities purchased by your spouse or a company you own.

It is impossible to time the market, but under the right circumstances, harvesting a tax loss and then buying the same security at least 30 days later (i.e., after the wash-sale period) could potentially result in a lower tax liability when you sell that security later at a gain.

This is most likely if you repurchase the security at a similar or lower price, and you are in a higher tax bracket at the time you take the loss than at the time you take the gain— for example, if you take the loss while working and sell when you are retired.

Any year in which your taxable income falls within the 0% capital gains rate is an opportune time to take gains, and any losses in that year would be applied to short-term gains or ordinary income. Keep in mind that capital gains and losses apply only when investments are sold in a taxable account.

Tax-loss harvesting is a complex strategy, and it would be wise to consult your financial professional before taking action. Although there is no guarantee that working with a financial professional will improve investment results, a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

Random Acts of Financial Kindness

Acts of kindness, even small ones, can have lasting benefits. You may not always see the impact of your investment of time or money, but your acts of kindness will ripple through the lives of people you know…or don’t know. Here are some ideas for practicing financial kindness.

Pay It Forward…or Backward

- Hand out gift cards in small denominations. Add in an extra one with a note asking that it be paid forward to someone else.

- Ask the manager of your local grocery store if you can buy pizza to thank employees for their hard work.

- Give a generous tip along with an encouraging note.

- Pay for the lunch of someone behind you in line.

- Buy extra groceries to donate to the food pantry the next time you shop.

- Recognize someone else’s kind act with a note of thanks, public recognition, or a small gift.

Share Your Time and Talents

- Hire an intern or volunteer to mentor someone.

- Share what you’ve learned about finances with someone who could benefit from your expertise.

- Write a job recommendation.

- Offer your professional services for free.

Help Others Prosper

- Contribute to a scholarship fund in your community to help a student finish school.

- Donate books on finance to your local school or library.

- Support a financial literacy program.

- Help someone save for the future.

- Set up monthly donations to a favorite charity in someone’s honor.

- Start a fundraiser for a good cause.

Don’t Forget to Be Kind to Yourself

- Attend a financial seminar or webinar to learn how you might improve your financial health.

- Accept help from others and allow them to experience the joy that comes from being kind.

- Save for a rainy day.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through DAI Securities, LLC, Member FINRA/SIPC. Financial Planning, Wealth Management and Tax Services offered through EagleStone Tax & Wealth. DAI Securities and EagleStone are not affiliated entities.

Financial Planning, Investment & Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax & Accounting services provided through EagleStone Tax & Accounting Services.

This communication is strictly intended for individuals residing in the state(s) of CO, DC, FL, KS, KY, MD, MA, NY, NC and VA. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.