EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

Rising Interest Rates

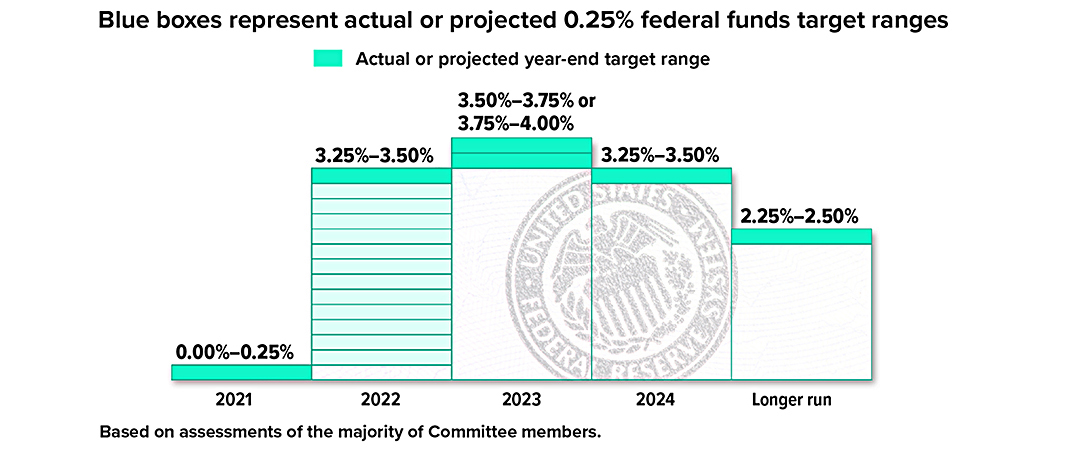

After dropping the benchmark federal funds rate to a range of 0%–0.25% early in the pandemic, the Federal Open Market Committee (FOMC) of the Federal Reserve has begun raising the rate aggressively in response to high inflation. Raising the funds rate places upward pressure on a wide range of interest rates, including the prime rate, small-business loans, home-equity lines of credit, auto loans, credit-card rates, and adjustable-rate mortgages (with indirect pressure on fixed-rate mortgages).

This chart illustrates the federal funds target range at the end of 2021 and future year-end projections released after the FOMC June 2022 meeting, when the Committee raised the range to 1.50%–1.75%.

Source: Federal Reserve, June 2022. These are only projections, based on current conditions, subject to change, and may not come to pass.

Source: Federal Reserve, June 2022. These are only projections, based on current conditions, subject to change, and may not come to pass.

Dividends for Income and Total Returns

John D. Rockefeller, one of the wealthiest Americans in history, loved receiving stock dividends. “Do you know the only thing that gives me pleasure?” he once asked. “It’s to see my dividends coming in.”1

There may be many things other than money that give you pleasure, but you can still appreciate the stabilizing role that dividends might play in your portfolio.

Steady and Dependable

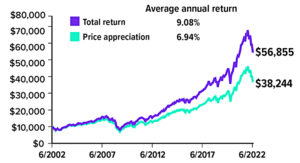

Dividends can be a dependable source of income for retirees and others who want an income stream without selling their underlying investments. If you do not need your dividends for current income, reinvesting these relatively small payments can become a powerful growth engine (see chart). Because dividends are by definition a positive return, they can boost returns in an up market and help balance declining stock prices in a down market.

Whereas stock prices are often volatile and may be influenced by factors that do not reflect a company’s fiscal strength (or weakness), dividend payments tend to be steadier and more directly reflect a company’s financial position. Larger, well-established companies are more likely to pay dividends, but many midsize and smaller companies do as well. Stock funds usually pay dividends based on the dividends of the stocks held by the fund. Some funds focus specifically on dividend stocks.

Quarterly Payments

Dividends are typically paid quarterly but quoted by the annual dollar amount paid on each share, so your annual income from an individual stock can be estimated by multiplying the dividend payment by the number of shares you own. Of course, the income will change if the dividend increases or decreases, or you obtain additional shares.

Dividends are also expressed as yield — the annual dividend income per share divided by the current market price. By this measure, the yield increases as the share price decreases, and vice versa, assuming the dividend payment remains the same. Current dividend yields can be helpful in deciding whether to invest in a stock or stock fund, and historical yields can provide insight into what you might expect from dividends over the long term.

At the end of June 2022, the average yield of dividend-paying stocks in the S&P 500 (about 79% of companies) was 2.18%, but the yield of the S&P High Dividend Index, which focuses on 80 stocks that pay higher dividends, was 4.11%.2

The Power of Reinvestment

Growth in value of a hypothetical $10,000 Investment In the S&P 500 Index for the 20-yesr period ending in June 2022, comparing price appreciation and total return, which includes reinvesting dividends.

Source: Refinitiv, 2022, for the period 6/30/2002 to 6/30/2022. The S&P 500 index is an unmanaged group of securities considered representative of U.S. stocks. Expenses, fees, charges, and taxes are not considered and would reduce the performance shown if included. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Rates of return will vary over time, particularly for long-term investments. Actual results vary.

Some Caveats

The flip side of dividend power is that dividend-paying stocks may not have as much growth potential as non-dividend payers that plow their profits back into the company. And there are times when dividend stocks may drag down, not boost, portfolio performance. Dividend stocks can be particularly sensitive to interest-rate changes. When rates rise, as in the current environment, higher yields of lower-risk, fixed-income investments may be more appealing to investors, placing downward pressure on dividend stocks. As long as a company maintains its dividend payments, however, lower stock prices could be an opportunity to buy shares with higher dividend yields.

Investing in dividends is a long-term commitment. Dividends are typically not guaranteed and could be changed or eliminated. The amount of a company’s dividend can fluctuate with earnings, which are influenced by economic, market, and political events. The return and principal value of all investments fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Investments offering the potential for higher rates of return also involve higher risk.

Stock funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) BrainyQuote.com, 2022; 2) S&P Dow Jones Indices, 2022

Finding Forgotten Funds

As a child, you may have dreamed about finding buried treasure, but you probably realized at an early age that it was unlikely you would discover a chest full of pirate booty. However, the possibility that you have unclaimed funds or other assets waiting for you is not a fantasy.

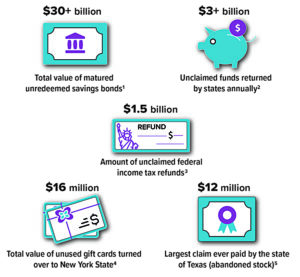

Billions of dollars in unclaimed property are reported each year, and 10% of people have some form of property waiting to be returned by state unclaimed property programs.1 So how do you find what is owed to you, even if it’s not a fortune? One of the challenges of finding lost property is knowing where to look.

State Programs

Every state has an unclaimed property program that requires companies and financial institutions to turn inactive account assets over to the state if they have lost contact with the rightful owner for a period of time. In most states, this dormancy period is three to five years, but may be shorter or longer depending on the type of property and on state law. It then becomes the state’s responsibility to locate the owner.

For state programs, unclaimed property might include financial accounts, stocks, uncashed dividends and payroll checks, utility security deposits, insurance payments and policies, trust distributions, mineral royalty payments, gift cards, and the contents of safe-deposit boxes. State-held property generally can be claimed in perpetuity by original owners and heirs.

Most states participate in a free national database sponsored by the National Association of Unclaimed Property Administrators called MissingMoney.com. You might also check specific databases for every state where you have lived. For more information and links to individual state programs, see the National Association of Unclaimed Property Administrators at unclaimed.org.

Even if your search isn’t fruitful the first time you look, check back often because states regularly update their databases.

Federal Programs

Unclaimed property held by federal agencies might include tax refunds, pension funds, funds from failed banks and credit unions, funds owed investors from U.S. Securities and Exchange Commission enforcement cases, refunds from mortgages insured by the Federal Housing Administration, and matured unredeemed savings bonds. There is no single searchable database for federal agencies, but you can find more information and links to sites you can search at usa.gov/unclaimed-money.

Submitting a Claim

To claim property, follow the instructions given, which will vary by the type of asset and where the property is held. You’ll need to verify ownership, typically by providing information about yourself (such as your Social Security number and proof of address), and submit a claim form either online or by mail. What if the listed property owner is deceased? A claim may be made by a survivor and will be payable according to state or federal law.

Avoiding Scams

Finding and receiving any unclaimed property to which you are entitled should not cost you money. Some states allow legitimate third-party “finders” to offer to help rightful owners locate property for a fee, but you do not need to pay them in order to receive the property. Be on the lookout for scammers who pretend to have unclaimed property in order to trick you into revealing personal or financial information. Before you sign any contracts or give out any information, contact your state’s unclaimed property office.

1) National Association of State Treasurers, 2022

Sources: 1) U.S Department of the Treasury, 2022 (as of December 2021); 2) National Association of Unclaimed Property Administrators, 2022; 3) Internal Revenue Service, 2022 (data for 2018 tax year); 4) Office of the New York State Comptroller, 2022 (data for 2021); Texas Comptroller of Public Accounts, 2022

What the Red-Hot Job Market Means for Workers

The COVID-19 pandemic kicked off a severe labor shortage — and quite possibly the most worker-friendly job market in many years. Unpredictable demand shifts exposed pre-existing mismatches between the knowledge and skills of available workers and the tasks for which they are needed. The sheer number of available jobs has also been running far above the number of unemployed job seekers. For example, employers reported 11.4 million job openings in April, while there were only 6.0 million unemployed persons. 1

This smorgasbord of open positions provides job seekers with more choices and more leverage. U.S. workers have been quitting their jobs at record rates, in many cases to join new employers offering higher pay, lucrative benefits, better working conditions, or the option to work remotely.2

Higher Wages

More intense competition for workers drove the average hourly wage up 5.5% for the year ending in April 2022, but inflation rose 8.3% over the same period, according to the Consumer Price Index (CPI). 3 Unfortunately, real wages, which are adjusted for inflation, dropped as prices spiked. Workers don’t really benefit from wage gains unless they outpace inflation, because it cuts into their buying power.

Even so, labor shortages have been more acute in some industries, especially for lower-paying and in-person jobs, which led to bigger wage increases for some types of workers. For the year ending in April 2022, wages grew 11.0% in the hospitality and leisure industry and 7.4% in transportation and warehousing.4

Longer-Term Changes

The labor force has been aging and shrinking, and retirees’ share of the U.S. population has been growing. Economists have been anticipating a wave of baby boomer retirements, some of which were accelerated by the pandemic. Between February 2020 and November 2021, up to 2.6 million more people retired than were expected to based on previous trends.5

Bigger paychecks could inspire some early retirees and stay-at-home parents to seek jobs, but labor force participation may never return to pre-pandemic levels. This means employers might need to change their hiring practices, reduce experience and education requirements, or provide training programs, opening the door to better-paying jobs for more workers. It’s also possible that automation technologies will help fill the gap.

1-4) U.S. Bureau of Labor Statistics, 2022

5) The Wall Street Journal, March 15, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Prepared by Broadridge Advisor Solutions Copyright 2022.