EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

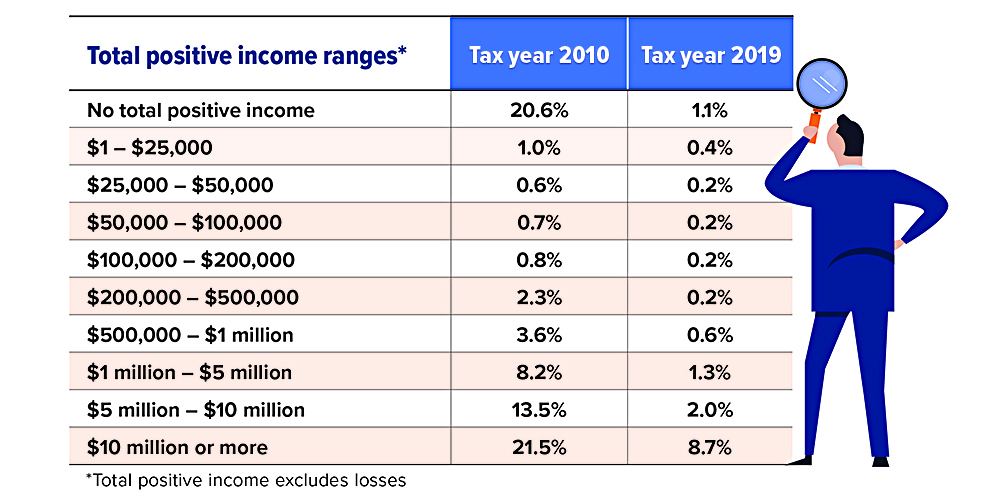

IRS Audit Rates Over Time

IRS audit rates for individual income tax returns have fallen since 2010, but this pattern could reverse as the agency ramps up enforcement. The Inflation Reduction Act of 2022 provided the IRS with an influx of about $80 billion to modernize outdated technology and rebuild a depleted workforce.

Source: Internal Revenue Service, 2022

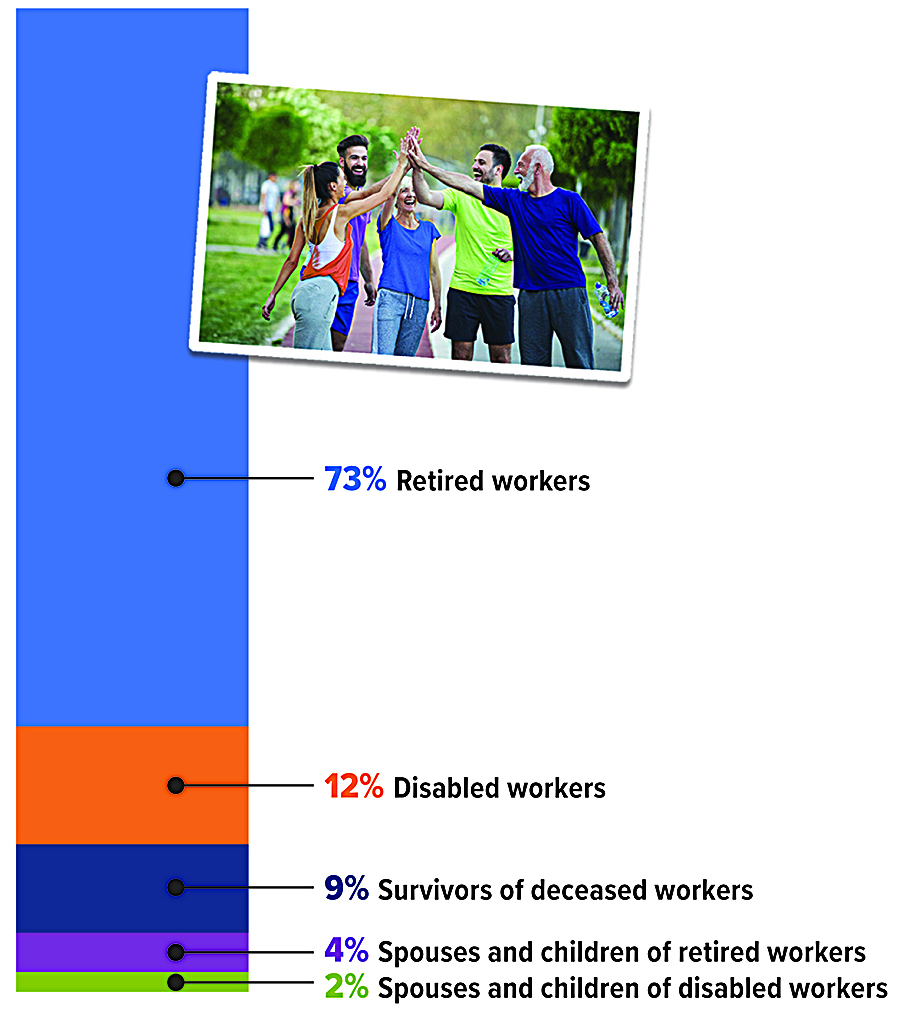

Social Security Offers Benefits from Birth Through Old Age

The bulk of Social Security benefits go to retirees, but Social Security is much more than a retirement program. Most Americans are protected by the Old-Age, Survivors, and Disability Insurance (OASDI) program — the official name of Social Security — throughout their lives.

At the Beginning of Your Career

Your first experience with Social Security might be noticing that Federal Insurance Contributions Act (FICA) taxes have been taken out of your paycheck. Most jobs are covered by Social Security, and your employer is required to withhold payroll taxes to help fund Social Security and Medicare.

Although most people don’t like to pay taxes, when you work and pay FICA taxes, you earn Social Security credits. These enable you (and your eligible family members) to qualify for Social Security retirement, disability, and survivor benefits. Most people need 40 credits (equivalent to 10 years of work) to be eligible for Social Security retirement benefits, but fewer credits may be needed for disability or survivor benefits.

If You Become Disabled

Disability can strike anyone at any time. Research shows that one in four of today’s 20-year-olds will become disabled before reaching full retirement age.¹

Social Security disability benefits can replace part of your income if you have a severe physical or mental impairment that prevents you from working. Your disability generally must be expected to last at least a year or result in death.

When You Marry… or Divorce

Married couples may be eligible for Social Security benefits based on their own earnings or on their spouse’s.

When you receive or are eligible for retirement or disability benefits, your spouse who is age 62 or older may also be able to receive benefits based on your earnings if you’ve been married at least a year. A younger spouse may be able to receive benefits if he or she is caring for a child under age 16 or disabled before age 22 who is receiving benefits based on your earnings.

If you were to die, your spouse may be eligible for survivor benefits based on your earnings. Regardless of age, your spouse who has not remarried may receive benefits if caring for your child who is under age 16 or disabled before age 22 and entitled to receive benefits based on your earnings. At age 60 or older (50 or older if disabled), your spouse may be able to receive a survivor benefit even if not caring for a child.

If you divorce and your marriage lasted at least 10 years, your former unmarried spouse may be entitled to retirement, disability, or survivor benefits based on your earnings.

When You Welcome a Child

Your child may be eligible for Social Security if you are receiving retirement or disability benefits, and may receive survivor benefits in the event of your death. In fact, according to the Social Security Administration, 98% of children could get benefits if a working parent dies.² Your child must be unmarried and under age 18 (19 if a full-time elementary or secondary school student) or age 18 or older with a disability that began before age 22.

At the End of Your Career

Social Security is a vital source of retirement income. The benefit you receive will be based on your lifetime earnings and the age at which you begin receiving benefits. You can get an estimate of your future Social Security benefits by signing up for a my Social Security account at socialsecurity.gov to view your personal Social Security statement. Visit this website, too, to get more information about specific benefit eligibility requirements, only some of which are covered here.

1-2) Social Security Administration, 2022

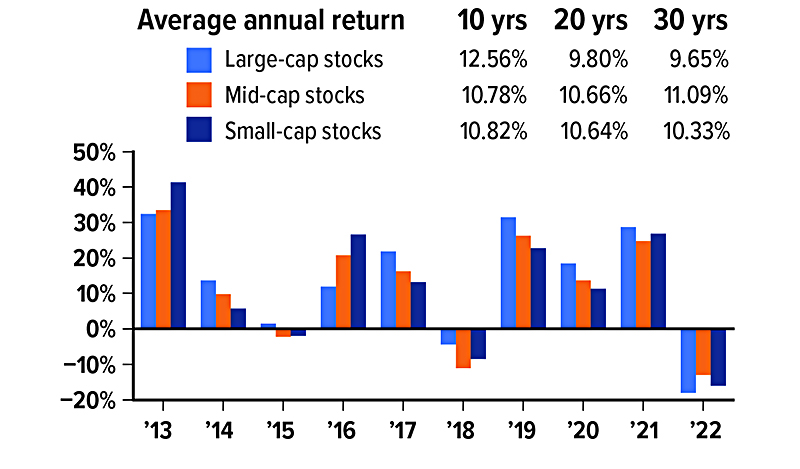

Diversifying with Market Caps

The U.S. stock market struggled in 2022, with the S&P 500 index ending the year down more 19.4%.1 The S&P 500, which includes stocks of large U.S. companies, is generally considered representative of the U.S. stock market as a whole, and it is a good benchmark for broad market performance. But there are thousands of smaller companies, and many of those held onto their stock value better during the market conditions of 2022.

The S&P MidCap 400, which includes midsize companies, ended the year down 14.5%, while the S&P SmallCap 600, which includes smaller companies, was down 17.4%.2 Although these were losses, it was the first year since 2016 that midsize and small companies outperformed large companies (in this case, by having smaller losses). While large companies have registered the highest average annual returns over the last decade, midsize and small companies have been stronger over longer periods (see chart).

Extending Your Reach

As these trends demonstrate, companies of different sizes tend to perform differently in response to market conditions. This suggests that holding stocks in companies of varied sizes could help diversify the stock portion of your portfolio and allow you to pursue a broader range of growth opportunities. Diversification is a method to help manage risk; it does not guarantee a profit or protect against investment loss.

The most convenient and comprehensive way to diversify by size is through mutual funds or exchange-traded funds that track indexes based on market capitalization, calculated by multiplying the number of outstanding shares by the price per share. There is no standard classification system, but Standard & Poor’s indexes offer a helpful comparison and are used as benchmarks for many funds.3

S&P: $14.6 billion or more

S&P MidCap 400:$3.7 billion to $14.6 billion

S&P SmallCap 600: $850 million to $3.7 billion

Russell indexes are also commonly used to construct funds based on market capitalization. The Russell 1000 includes large and midsize companies, while the Russell 2000 is a comprehensive small-cap index. Actively managed funds focusing on market capitalization typically include stocks chosen by the fund manager rather than following an index.

Stability, Growth, and Volatility

Stocks of larger companies, or large caps, are generally considered more stable than the stocks of smaller companies, because their size can help them weather rough economic times — as demonstrated by their strong performance during the pandemic. Large caps may provide solid long-term returns, but they typically have lower growth potential, because they have already experienced substantial growth. Many large U.S. companies have heavy overseas exposure, which makes them more sensitive to global economic forces, one reason they struggled in 2022.

Mid caps may have greater growth potential than large caps, and midsize companies might react more nimbly to changes in the business environment. Mid caps are associated with higher risk and volatility than large caps, but are considered more stable than small caps.

Small-cap stocks might offer the highest growth potential of the three classifications, because they have the furthest to grow and are more likely to react quickly to market opportunities. However, they are typically the most risky and volatile class of stocks.

The investment return and principal value of stocks, mutual funds, and ETFs fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. You should read the prospectus carefully before investing.

1-3) S&P Dow Jones Indices, 2023

Performance in Three Sizes

Even with poor performace in 2022, large-cap stocks have provided the highest returns over the last decade. However, mid caps were the leader over the last 20- and 30-year periods, with small caps not far behind.

Keep an Eye Out for IRS-Related Scams

The IRS warns that although scams are especially prevalent during tax season, they also take place throughout the year.1 As a result, it’s important to always be on the lookout for suspicious activity so that you don’t end up becoming the victim of a scam.

One of the more common IRS scams involves phishing emails. These scams involve unsolicited emails that pose as the IRS to convince you to provide personal information. Scam artists then use this information to commit identity or financial theft. Another dangerous type of phishing, referred to as “spear phishing,” is targeted towards specific individuals or groups within a company or organization. Spear phishing emails are designed to get you to click on a link or download an attachment that will install malware in order to disrupt critical operations within your company or organization.

Another popular IRS scam involves fraudulent communications that appear to be from the IRS or a law enforcement organization. These scams are designed to trick you into divulging your personal information by using scare tactics such as threatening you with arrest or license revocation. Be wary of any email, phone, social media, and text communications from individuals claiming they are from the IRS or law enforcement saying that you owe money to the IRS.

A relatively new IRS scam involves text messages that ask you to click on a link in order to claim a tax rebate or some other type of tax refund. Scammers who send these messages are trying to get you to give up your personal information and/or install malware on your phone. Watch out for texts that appear to be from the IRS that mention “tax rebate” or “refund payment.”

The IRS will not initiate contact with you by email, text message, or social media to request personal information. The IRS usually contacts you by regular mail delivered by the U.S. Postal Service. Here are some steps that may help you avoid scams.

- Never share your personal or financial information via email, text message, or over the phone.

- Don’t click on suspicious or unfamiliar links or attachments in emails, text messages, or instant messaging services.

- Keep your devices and security software up to date, maintain strong passwords, and use multi-factor authentication.

1) Internal Revenue Service, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through DAI Securities, LLC, Member FINRA/SIPC. Financial Planning, Wealth Management and Tax Services offered through EagleStone Tax & Wealth. DAI Securities and EagleStone are not affiliated entities.

Financial Planning, Investment & Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax & Accounting services provided through EagleStone Tax & Accounting Services.

This communication is strictly intended for individuals residing in the state(s) of CO, DC, FL, KS, KY, MD, MA, NY, NC and VA. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.