College students and parents deserve all the help they can get when paying for college or repaying student loans. If you’re in this situation, here are three federal tax benefits that might help put a few more dollars back in your pocket.

American Opportunity Credit

The American Opportunity tax credit is worth up to $2,500 per student per year for qualified tuition and fees (not room and board) for the first four years of college. It is calculated as 100% of the first $2,000 of qualified tuition and fees plus 25% of the next $2,000 of such expenses.

There are two main eligibility restrictions: the student must be enrolled in college at least half-time, and the parents’ modified adjusted gross income (MAGI) must be below a certain level. To claim a $2,500 tax credit in 2023, single filers must have a MAGI of $80,000 or less, and joint filers must have a MAGI of $160,000 or less. A partial credit is available for single filers with a MAGI between $80,000 and $90,000, and joint filers with a MAGI between $160,000 and $180,000. The same limits applied in 2022 (and would be used when completing your 2022 federal tax return).

One key advantage of the American Opportunity credit is that it can be claimed for multiple students on a single tax return in the same year, provided each student qualifies independently. For example, if Mom and Dad have twins in college and meet the credit’s requirements for each child, they can claim a total credit of $5,000 ($2,500 per child).

Lifetime Learning Credit

The Lifetime Learning credit is worth up to $2,000 for qualified tuition and fees for courses taken throughout one’s lifetime to acquire or improve job skills. It’s broader than the American Opportunity credit — students enrolled less than half-time as well as graduate students are eligible. The Lifetime Learning credit is calculated as 20% of the first $10,000 of qualified tuition and fees (room and board expenses aren’t eligible).

Income eligibility limits for the Lifetime Learning credit are the same as the American Opportunity credit. In 2023, a full $2,000 tax credit is available for single filers with a MAGI of $80,000 or less, and joint filers with a MAGI of $160,000 or less. A partial credit is available for single filers with a MAGI between $80,000 and $90,000, and joint filers with a MAGI between $160,000 and $180,000. The same limits applied in 2022.

One disadvantage of the Lifetime Learning credit is that it is limited to a total of $2,000 per tax return per year, regardless of the number of students in a family who may qualify in a given year. So, in the previous example, Mom and Dad would be able to take a total Lifetime Learning credit of $2,000, not $4,000. Two other points to keep in mind: (1) the American Opportunity credit and the Lifetime Learning credit can’t be taken in the same year for the same student; and (2) the expenses used to qualify for either credit can’t be the same expenses used to qualify for tax-free distributions from a 529 plan or a Coverdell education savings account.

Student Loan Interest Deduction

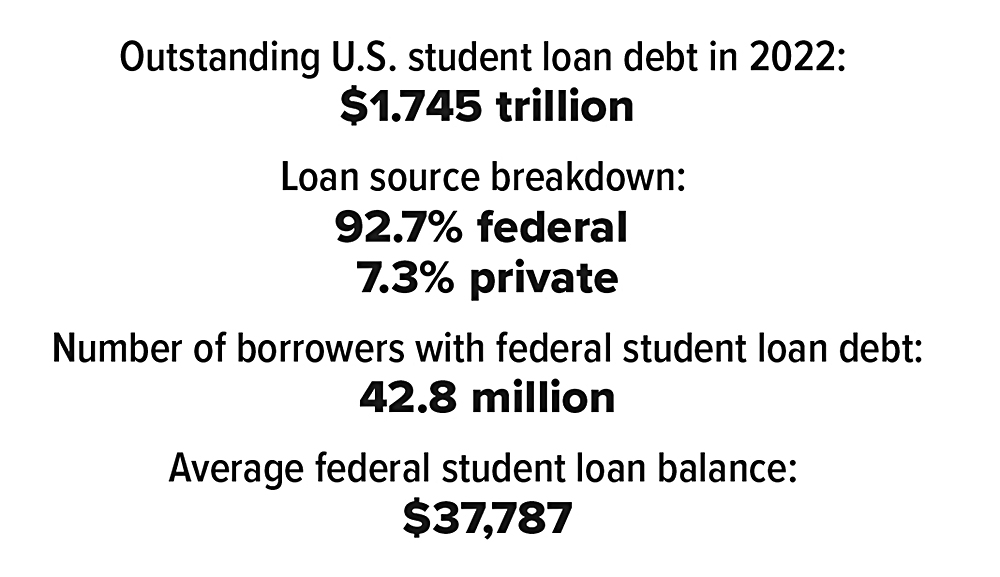

Undergraduate and graduate borrowers can deduct up to $2,500 of interest paid on qualified federal and private student loans during the year if income limits are met. In 2023, a full $2,500 deduction is available for single filers with a MAGI of $75,000 or less, and joint filers with a MAGI of $155,000 or less. A partial deduction is available for single filers with a MAGI between $75,000 and $90,000, and joint filers with a MAGI between $155,000 and $185,000. In 2022, the income limits were slightly lower: a full deduction was available for single filers with a MAGI of $70,000 or less, and joint filers with a MAGI of $140,000 or less; a partial deduction was available for single filers with a MAGI between $70,000 and $85,000, and joint filers with a MAGI between $140,000 and $170,000. The 2022 limits would be used when completing your 2022 federal income tax return.

If you paid at least $600 in student loan interest during the year, your loan servicer should send you a Form 1098-E showing how much you paid. If you don’t receive a 1098-E, you can still claim the deduction. You just need to call your loan servicer or log in to your online account to find the amount of interest you paid.