EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

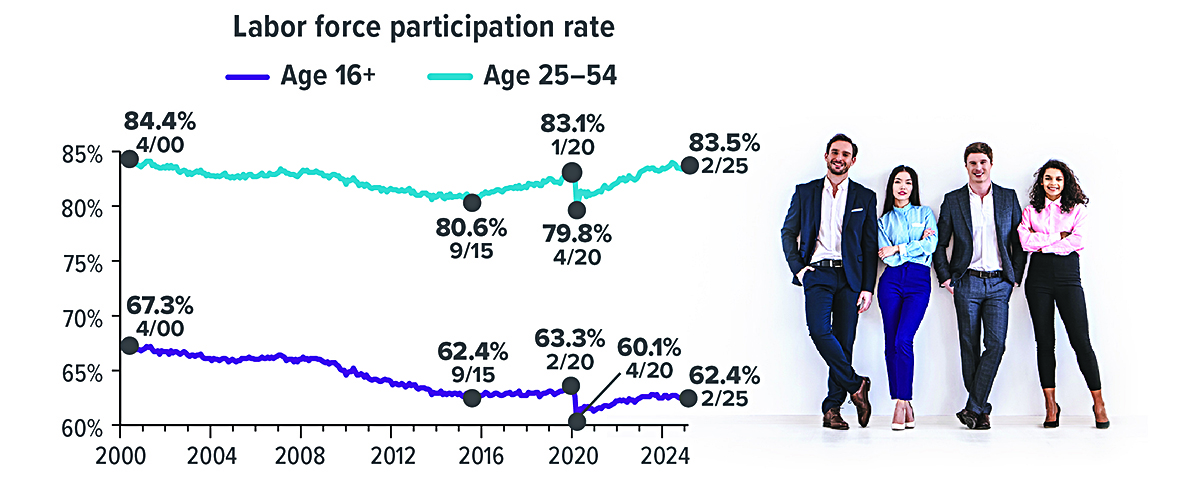

Prime Workforce Stays Strong

The labor force participation rate — the percentage of Americans age 16 and older who are working or actively looking for work — peaked in early 2000, when it began to drop due to an aging population and more young people in college. Participation was rising before the pandemic but has only partially recovered, due in large part to accelerated retirement among older workers.

The rate for the prime working ages of 25 to 54 surpassed the pre-pandemic level in 2023 and was still above it as of early 2025. A solid prime workforce, combined with technology and other productivity measures, could help the U.S. economy stay strong with a smaller percentage of the total population in the workforce.

Sources: U.S. Bureau of Labor Statistics, 2025; U.S. Chamber of Commerce, December 13, 2024

Versatile 529 Plans Can Help with More than Just College

529 plans were originally created in 1996 as a tax-advantaged way to save for college. Over the past several years, Congress has expanded the ways 529 plan funds can be used, making them a more flexible and versatile savings vehicle.

College, plus other education expenses

A 529 savings plan can be instrumental in building a college fund — its original purpose. Funds contributed to a 529 savings plan accumulate tax-deferred and earnings are tax-free if the funds are used to pay qualified education expenses, which now include:

- College expenses: the full cost of tuition, fees, books, and equipment (including computers) and, for students attending at least half time, housing and food costs at any college in the U.S. or abroad accredited by the U.S. Department of Education

- Apprenticeships programs: the full cost of fees, books, and equipment for programs registered with the U.S. Department of Labor

- K-12 tuition expenses: up to $10,000 per year

If 529 funds are used to pay a non-qualified education expense, the earnings portion of any withdrawal is subject to ordinary income tax and a 10% penalty.

Estate planning tool

529 plans offer grandparents an opportunity to save for a grandchild’s education in a way that accomplishes estate planning goals, while still allowing grandparents access to those funds if needed.

Specifically, due to an accelerated gifting feature unique to 529 plans, grandparents (or other relatives) can contribute a lump sum to a 529 plan of up to five times the annual gift tax exclusion and avoid gift tax by making an election on their tax return to spread the gift equally over five years. In 2025, the gift tax exclusion is $19,000, so grandparents could gift up to $190,000 to a 529 plan for their grandchild ($19,000 x 5 years x 2 grandparents) and avoid gift tax. These funds are not considered part of the grandparents’ estate for federal estate tax purposes (unless one or both grandparents die in the five-year period, in which case special allocation rules apply). And if a grandparent is also the account owner of the 529 plan (529 plan rules allow only one account owner), then the grandparent will retain control of the 529 plan funds (even though the funds are not considered part of the estate) and can access them for health-care needs, an emergency, or any other reason (but the earnings portion of any non-qualified withdrawal will be subject to ordinary income tax and a 10% penalty).

Student loan repayment

Nearly 43 million borrowers have student loans, and the average loan balance is approximately $38,000.1 To help families who might have leftover 529 funds after college, Congress expanded the approved use of 529 plan funds in 2019 to include the repayment of qualified education loans up to $10,000 for the 529 beneficiary or a sibling of the beneficiary. This includes federal and private loans.

Retirement builder: Roth IRA rollover

As of 2024, 529 account owners can roll over up to $35,000 from a 529 plan to a Roth IRA for the same beneficiary. Any rollover is subject to annual Roth IRA contribution limits, so $35,000 can’t be rolled over all at once. For example, in 2025, the Roth IRA contribution limit is $7,000 (for people under age 50) or 100% of annual earned income, whichever is less, so that is the maximum amount that can be rolled over in 2025.

There are a couple of other caveats. For the rollover to be tax- and penalty-free, the 529 plan must have been open for at least 15 years. And contributions to a 529 account made within five years of the rollover date can’t be rolled over — only contributions outside the five-year window can be rolled over.

Participation in a 529 plan generally involves fees and expenses, and there is the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. The tax implications of a 529 plan can vary significantly from state to state. Most states offering their own 529 plans may provide advantages and benefits exclusively for their residents and taxpayers, which may include financial aid, scholarship funds, and protection from creditors. Before investing in a 529 plan, consider the investment objectives, risks, charges, and expenses, which are available in the issuer’s official statement and should be read carefully. The official disclosure statements and applicable prospectuses contain this and other information about the investment options, underlying investments, and investment company and can be obtained from your financial professional.

1) educationdata.org, 2024

Life Insurance in Retirement

What role can life insurance play in your retirement plan? Most of us think of life insurance as protection against financial loss should we die prematurely. But when we reach retirement and the kids are all self-sufficient, do we still need life insurance? The answer is maybe. Here are some situations where life insurance may make sense for retirees or those close to retirement.

Provide a source of retirement income

While life insurance is designed to protect against unexpected economic loss, cash value life insurance also may provide a source of income during retirement. Earnings on the cash value accumulate tax-deferred, and in some instances, cash-value distributions can be received income tax-free. However, loans used to access cash values from a life insurance policy will reduce the policy’s cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured.

Help pay for long-term care

Some cash value life insurance policies provide multiple sources of protection. Along with the death benefit and potential cash value, these policies may also provide a long-term care benefit. Often, these policies allow for a portion or all of the death benefit to be “accelerated” if used for the payment of qualifying medical and long-term care expenses.

Provide for a dependent family member

Sometimes, even in retirement, there are family members who depend on you for financial and/or custodial support. Should you die unexpectedly, life insurance may help provide funds needed to support dependent family members with disabilities.

Replace income for a surviving spouse

While Social Security provides retirement income for many of us, at the death of a spouse, his or her benefits end, reducing the total benefits available to the surviving spouse. Life insurance can be used to replace the loss of income for the surviving spouse.

Pay off debt

While past generations often retired with little or no debt, it is not uncommon for today’s retirees to leave the workforce while still carrying a mortgage, car loan, and credit card debt. Life insurance can provide the cash to pay off these debts, which is especially beneficial for a surviving spouse.

Help cover final expenses

Unfortunately, the expense of dying is often overlooked or underestimated. Uninsured medical bills, funeral costs, debts, and estate administration costs can add up. Typically, these expenses are paid in a lump sum, which can reduce savings for surviving spouses and dependent family members. Proceeds from life insurance can be used to help pay for these final expenses, which may help preserve savings for other needs.

Leave a legacy

For many approaching retirement, as well as for those already there, a primary concern is having enough money to live comfortably. While conserving savings and keeping track of spending in retirement are important, all too often retirees will forgo spending on themselves in order to fulfill a desire to leave a legacy. Having life insurance can help you feel freer to spend more in retirement because you know you’ll be leaving something behind for your loved ones.

Life insurance provides protection for your family’s financial future should you die during your working years. However, life insurance may provide other benefits that can be useful during your retirement. Whether life insurance should be part of your retirement plan is best determined based on your individual circumstances and goals. You may want to talk with an insurance or financial professional before making this decision.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely there may be surrender charges and income tax implications. Any guarantees associated with payment of death benefits, income options, or rates of return are based on the financial strength and claims-paying ability of the insurer.

Are Extended Warranties Worth It?

When you purchase a vehicle, a major appliance, a laptop, or other big-ticket item, chances are you’ll be asked to buy an extended warranty or service contract. Extended warranties are offered by retailers for an additional cost and cover product repairs for a specific period of time under certain conditions.

Selling extended warranties may be quite profitable for retailers because they keep a percentage of what they charge for these contracts. But are they a good deal for you? Here are some questions to consider before you pull out your wallet.

Is your purchase covered by a manufacturer’s warranty? Many products come with a manufacturer’s warranty that covers replacement or repairs within a certain time period (one year, for example). Manufacturers may also offer low-cost repair or replacement of items known to have manufacturing defects, although there are no guarantees unless state or federal laws apply. You may want to forgo purchasing an extended warranty if it will result in duplicate coverage.

Does your credit card offer extended warranty protection? This benefit is included with some credit cards and generally doubles the manufacturer’s warranty period for products purchased using the card up to a certain time and dollar limit. Some products (including motorized vehicles) are excluded, and terms and conditions vary. Check your card’s benefit guide for more details.

Are you buying a product that’s typically reliable? Before you spring for an extended warranty on a product that’s unlikely to need major repairs, research online product reviews to gauge reliability and the potential for problems to occur.

Have you read the fine print? Extended warranties typically contain many exclusions and limitations, so don’t assume all repairs will be covered — it’s possible your claim will be denied if it doesn’t meet strict criteria. In addition, some extended warranties may require you to pay additional charges when the product needs to be serviced (e.g., deductibles, fees, and shipping costs).

Will repairs be costly? Weigh the cost of the extended warranty against what it might cost to pay for the repairs yourself. Not all repairs are expensive, and if you could cover them out of pocket, buying an extended warranty might not be worth it.

An alternative to buying an extended warranty is to set aside money in an emergency account to cover future repair costs, big or small. That may be a more cost-efficient and flexible way to help protect your purchase in the event a repair is not covered under a manufacturer’s or credit card warranty.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.