EagleStone Wealth Advisors, Inc. is in the process of withdrawing its registration with the SEC and is no longer taking on any new clients. EagleStone Tax & Wealth Advisors has merged with Onyx Bridge Wealth Group, Onyx Bridge Tax Group, and Onyx Bridge Retirement Group, respectively. You will be redirected to their site in the next 5 seconds.

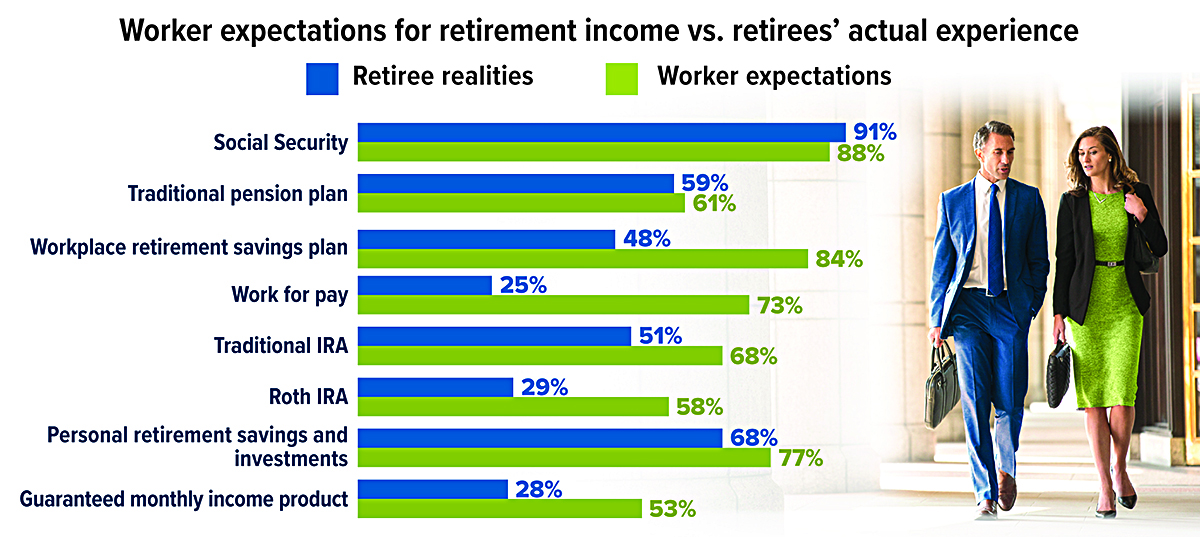

Sources of Retirement Income: Worker Expectations vs. Retiree Realities

About 90% of retirees say they rely on Social Security, approximately the same as the percentage of workers who expect Social Security to help them meet their retirement income needs. Similarly, about 60% of workers expect a traditional pension plan to provide income, which is only slightly higher than the percentage of retirees who say a pension helps pay their bills. In other cases, worker expectations differ dramatically from retiree realities.

Source: Employee Benefit Research Institute, 2024

Treasury Yields Hit 17-Year High

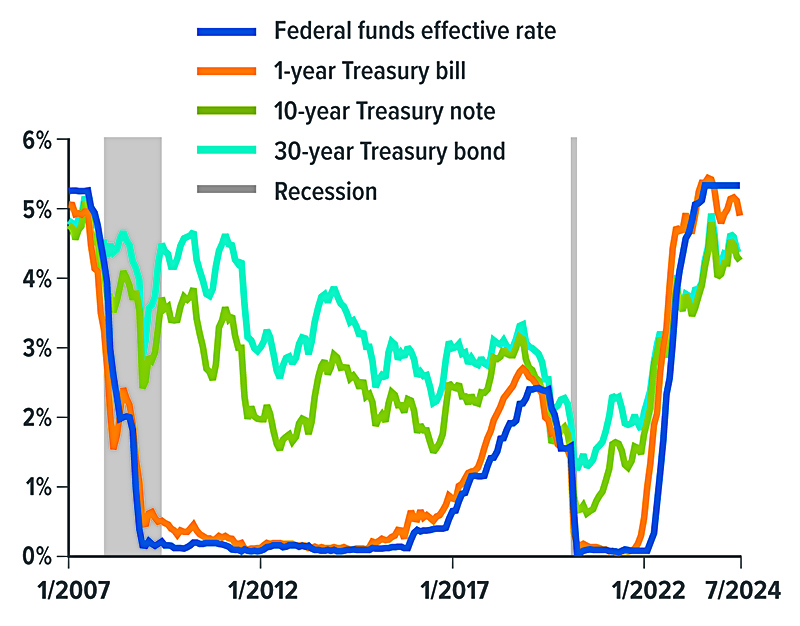

As the Federal Reserve raised interest rates to combat inflation, yields on U.S. Treasury securities climbed to levels not seen since before the Great Recession (see chart). Considering how stubborn inflation has been, the Fed may move slowly in decreasing interest rates. So Treasury yields might remain relatively elevated for some time, even though they have backed off recent highs. In the longer term, Treasuries purchased in the current high-rate environment could offer higher yields than new issues, potentially increasing their value on the secondary market.

You might consider holding Treasuries to maturity to add stability and predictable income to your portfolio, or you could purchase them with an eye toward selling if prices rise — or both. Whatever your goals, there are a variety of Treasury securities available, with maturity dates ranging from four weeks to 30 years. Although longer-term securities typically offer higher yields, the opposite has been true during the last two years, in part because short-term Treasuries respond more directly to changes in the federal funds rate, the Fed’s primary tool for influencing interest rates. As the funds rate declines, Treasury yields by maturity — called the yield curve — might return to a more typical pattern.

Purchasing Treasuries

Treasuries are sold in $100 denominations and can be purchased as new-issue securities through a Treasury auction, either directly from the U.S. Treasury (treasurydirect.gov) or from a bank, broker, or dealer, or on the secondary market through a brokerage firm.

When buying Treasuries (or any bonds), keep in mind that yield is the annual return based on the purchase price and the interest rate paid on the face (par) value, called the coupon rate. When a bond is purchased at face value, the yield is the same as the coupon rate. Treasuries, whether at auction or on the secondary market, are typically sold above or below face value — at a premium or a discount, respectively — to offer a yield in line with the current market. Interest paid on Treasuries is subject to federal income tax but exempt from state and local income taxes.

Treasury bills (T-bills) are short-term securities issued with maturities of four, eight, 13, 17, 26, and 52 weeks. T-bills are sold at a discount from their face value, and the difference between the discount price and the face value at maturity, called the discount rate, is interest paid on the bill.

Treasury notes (T-notes) earn a fixed rate of interest every six months and are issued in maturities of two, three, five, seven, and 10 years. The 10-year Treasury note is often referenced regarding the performance of the bond market and is also used as a benchmark by the mortgage market.

Treasury bonds (T-bonds) are similar to T-notes but have a maturity of 20 or 30 years. Like the T-note, they provide an interest payment every six months.

Treasury inflation-protected securities (TIPS) are inflation-indexed bonds with the principal adjusted by changes in the Consumer Price Index (CPI). If the CPI rises, the principal value of TIPS increases, which can be a helpful hedge against inflation. TIPS are issued in maturities of five, 10, and 30 years. (Unless you own TIPS in a tax-deferred account, you must pay federal income tax on the income plus any increase in principal, even though you won’t receive any accrued principal until the bond matures.)

Treasury floating-rate notes (FRNs) are issued with a two-year maturity and an interest rate that is adjusted weekly, based on the most recent discount rate for 13-week T-bills. However, interest payments are made quarterly.

Following the Fed

Yields on short-term Treasuries, up to the one-year bill, generally follow the federal funds rate. Until the rapid increase in the funds rate that began in 2022, longer-term Treasuries offered higher yields, because investors typically demand a higher premium for tying up their cash for a longer period.

Source: Federal Reserve, 2024

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities fluctuates with market conditions. If not held to maturity, they could be worth more or less than the original amount paid.

Do You Know Your Medicare Coverage Options?

There are two ways to obtain Medicare coverage: (1) Original Medicare (Part A hospital insurance and Part B medical insurance), often combined with a Medigap supplementary policy and a Part D prescription drug plan; and (2) Medicare Advantage (Part C), which replaces Original Medicare and often includes prescription drug coverage as well as features similar to those provided by a Medigap policy.

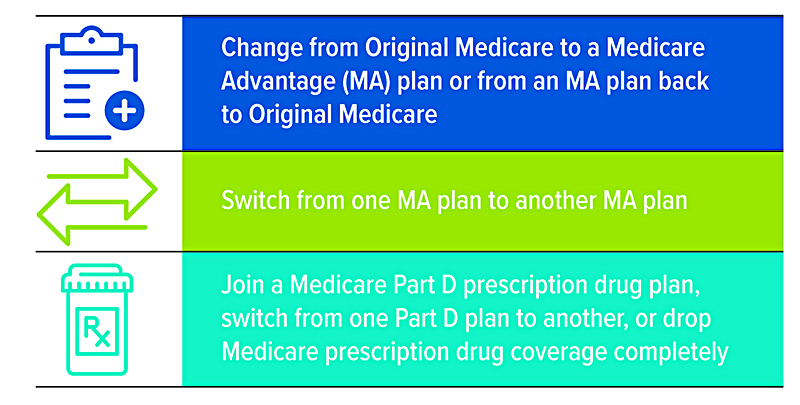

New beneficiaries can choose among these options when they enroll, while current beneficiaries can make changes during the annual Open Enrollment Period from October 15 to December 7 (see chart). Some changes can also be made at other times of the year.

Original Medicare with Medigap and Part D

Original Medicare is administered directly by the federal government and includes standardized premiums, deductibles, copays, and coinsurance payments. While these out-of-pocket costs are relatively moderate for doctor visits, laboratory tests, short hospital stays, and other medical services, there is no out-of-pocket maximum, so a serious illness or extended hospital stay could be financially devastating.

For this reason, beneficiaries often purchase a Medigap policy offered by private insurers, which pays nearly all or a percentage of Medicare out-of-pocket costs, and for some services not covered by Medicare such as emergency medical care outside the United States. In most states, Medigap policies are labeled by letter (for example, Plan A). Benefits for each plan are standardized, but premiums vary by insurance company, location, gender, tobacco use, and marital status.

The best time to buy a Medigap policy is when you first enroll in Medicare Part B. You then have a six-month period during which you can buy any Medigap policy in your state for the same premium the insurance company charges to healthy enrollees, even if you have health problems. If you miss this opportunity, a company can charge you more for coverage or refuse coverage altogether, depending on your health.

Part D prescription drug plans are offered by private insurers under Medicare supervision. Monthly premiums, deductibles, and out-of-pocket costs vary by plan.

Medicare Advantage

Medicare Advantage (MA) is offered by private insurers but mostly funded by Medicare. These “all-in-one” plans are generally more cost-effective than the combined costs of Original Medicare, Medigap, and Part D. All MA plans have out-of-pocket maximums and may offer additional benefits such as dental care and eyeglasses. In return for lower costs, MA plans strongly encourage or require the use of network providers and may deny claims that would be paid by Original Medicare.

Personalized comparisons

The best place to start exploring optional plans is at medicare.gov/plan-compare. After entering your zip code, you will have a choice to find a Medicare Advantage Plan, a Medicare Part D drug plan, or a Medigap policy. If you are already a Medicare beneficiary, you can save time by logging in to your online account, or create a new account. When exploring MA plans, be sure that your preferred providers are included in the plan’s network. Recently, an increasing number of providers have left MA networks due to claim denials and stringent preauthorization requirements.1

Open Enrollment offers the opportunity to change MA plans or return to Original Medicare. Keep in mind, however, that when you change from an MA plan to Original Medicare, you may pay a higher premium for a Medigap policy, or be unable to obtain a policy, depending on your health.

Annual Open Enrollment

Medicare beneficiaries can make the following changes during annual Open Enrollment from October 15 to December 7, with changes effective January 1.

In addition, you can change from MA to Original Medicare or switch MA plans during the Medicare Advantage Open Enrollment Period from January 1 to March 31. You may also be able to make changes during other special enrollment periods.

When exploring Part D drug plans, be sure to accurately enter the name, dosage, and frequency of your prescription drugs. Slight differences, such as a tablet vs. a capsule or generic vs. brand, can make a big difference in the cost of the medication. Note that Medicare Part D out-of-pocket costs will be capped at $2,000 starting in 2025.2

1) KFF Health News, November 29, 2023

2) The Part D cap will be adjusted annually based on the change in Medicare Part D per capita spending (i.e., the amount that Medicare spends on each Part D beneficiary).

FAFSA for 2025-2026 School Year Opens December 1

For the second year in a row, the Free Application for Federal Student Aid, commonly known as the FAFSA, will be delayed. The FAFSA for the 2025–2026 school year will open on December 1 instead of the typical October 1 date. Last year, despite a redesigned FAFSA that was supposed to be easier to complete, families faced a perfect storm — a delayed rollout, technical glitches, and processing delays, which led to confusion and late financial aid packages from colleges. By one estimate, as of March 2024, FAFSA completions for the class of 2024 were down 40% from the prior year, with only about 27% of the class of 2024 successfully completing a FAFSA, compared to 45% for the class of 2023.1

Tips for submitting the FAFSA

The 2025–2026 FAFSA is the same as the redesigned, streamlined version from last year. Here’s what you need to know about completing the form.

- FSA ID. To file the FAFSA online, parents and students each need their own FSA ID, which is a username/password combination that functions as a legal signature. You can create an FSA ID online, and the same ID can be used for all years of college.

- Income and assets. The FAFSA requires two key types of information: income and assets. For income, the 2025–2026 FAFSA will rely on information from your 2023 federal income tax return (it essentially looks back two years). This data will be automatically imported from the IRS. For assets, the FAFSA will use the value of your assets as of the date you submit the form.

- Student Aid Index. The FAFSA calculates a figure called the “Student Aid Index,” which is a yardstick that measures aid eligibility. Colleges use this figure to craft a financial aid package that attempts to meet a student’s financial need (colleges are not obligated to meet 100% of need).

- Eligibility for Direct Loans. All students who file the FAFSA are eligible for an unsubsidized federal Direct Loan, regardless of financial need. But students who demonstrate need on the FAFSA are eligible for a subsidized Direct Loan, which means the government pays the interest that accrues during school and any loan deferment periods. Students with a high level of financial need may also qualify for a federal Pell Grant.

- College aid. Some colleges might require the FAFSA before awarding students certain college-based aid, including merit scholarships and grants, so filing it can still be beneficial, even if a student does not plan on taking out any federal loans.

The FAFSA must be submitted every year for students to be eligible for federal aid. For more information, families can visit the federal student aid website at studentaid.gov.

1) National College Attainment Network, April 8, 2024

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.