Anxious About Your Finances?

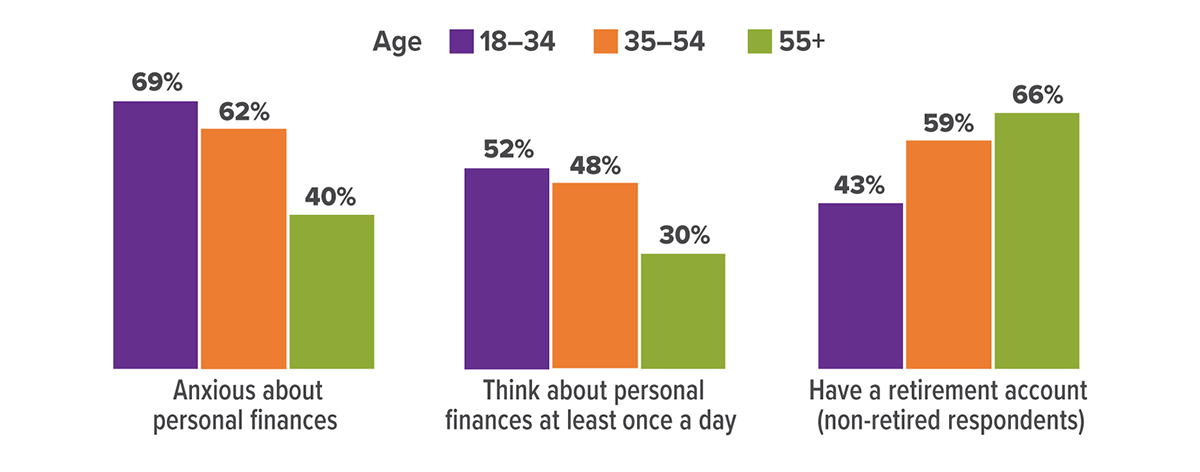

A study of financial capability found that older Americans were significantly less anxious about personal finances than younger people. However, about one-third of non-retired people 55 and older had no retirement account.

A comparison of the percentages regarding financial anxiety and retirement accounts suggests that having sufficient resources to contribute to a retirement account is an important aspect of feeling less financial stress for older people. However, many younger people feel stress regardless of whether they have retirement savings. This is especially true of those ages 35 to 54 who may have large mortgages, children in college, and other financial stressors.

Source: FINRA Investor Education Foundation, 2022 (2021 data)

SECURE 2.0 Act Expands Early Withdrawal Exceptions

Tax-advantaged retirement accounts such as 401(k) plans and IRAs are intended to promote long-term retirement savings and thus offer preferential tax treatment in return for a commitment to keep savings in the account until at least age 59½. Withdrawals before that age may be subject to a 10% federal income tax penalty on top of ordinary income tax. However, there is a long list of exceptions to this penalty, including several new ones added by the SECURE 2.0 Act of 2022.

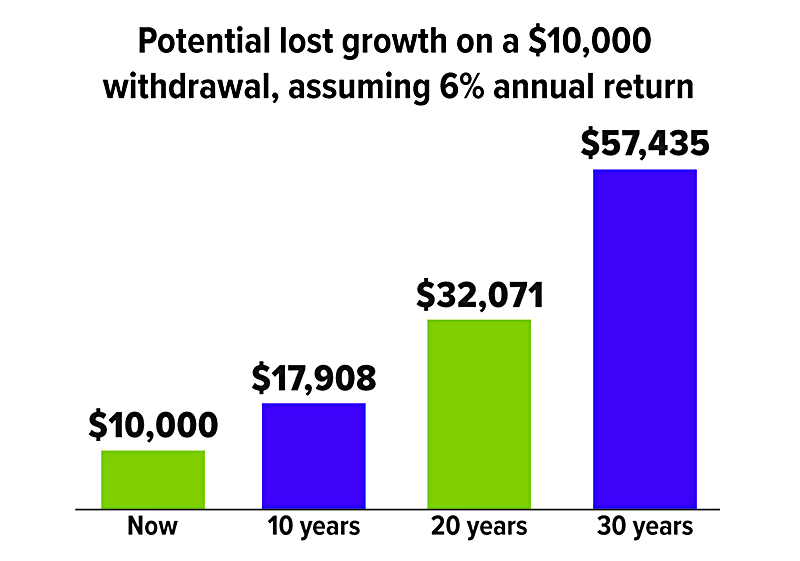

Before considering these exceptions, keep in mind that the greatest penalty for early withdrawal from retirement savings could be the loss of future earnings on those savings (see chart). Even so, there are times when tapping retirement savings might be necessary.

Some employer plans allow loans that may be a better solution than an early withdrawal. If a loan or other resources are not available, these exceptions could help. They apply to both employer-sponsored plans and IRAs unless otherwise indicated.

New Exceptions

The SECURE 2.0 Act added the following exceptions to the 10% early withdrawal penalty. Withdrawals covered by these exceptions can be repaid within three years. If the repayment is made after the year of the distribution, an amended return would have to be filed to obtain a refund of any taxes paid.

- Disaster relief — up to $22,000 for expenses related to a federally declared disaster; distributions can be included in gross income equally over three years (effective for disasters on or after January 26, 2021)

- Terminal illness — defined as a condition that will cause death within seven years as certified by a physician (effective 2023)

- Emergency expenses — one distribution of up to $1,000 per calendar year for personal or family emergency expenses; no further emergency distributions allowed during three-year repayment period unless funds are repaid or new contributions are at least equal to the withdrawal (effective 2024)

- Domestic abuse — the lesser of $10,000 (indexed for inflation) or 50% of the account value for an account holder who certifies that he or she has been the victim of domestic abuse during the preceding one-year period (effective 2024)

Exceptions Already in Place

These exceptions to the 10% early withdrawal penalty were in effect prior to the SECURE 2.0 Act. They cannot be repaid unless indicated.

- Death or permanent disability of the account owner

- A series of substantially equal periodic payments for the life of the account holder or the joint lives of the account holder and designated beneficiary

- Unreimbursed medical expenses that exceed 7.5% of adjusted gross income

- Up to $5,000 for expenses related to the birth or adoption of a child; can be repaid within three years

- Distributions taken by an account holder on active military reserve duty; can be repaid up to two years after end of active duty

- Distributions due to an IRS levy on the account

- (IRA only) Up to $10,000 lifetime for a first-time homebuyer to buy, build, or improve a home

- (IRA only) Health insurance premiums if unemployed

- (IRA only) Qualified higher education expenses

Special Exceptions for Employer Accounts

The 10% penalty does not apply for distributions from an employer plan to an employee who leaves a job after age 55, or age 50 for qualified public safety employees. SECURE 2.0 extended the exception to public safety officers with at least 25 years of service with the employer sponsoring the plan, regardless of age, as well as to state and local corrections officers and private-sector firefighters.

Retirement account withdrawals can have complex tax consequences. Consult your tax professional before taking specific action.

Lost Opportunity

An early retirement plan withdrawal could end up costing more than you might imagine, even without the 10% penalty. Income taxes will reduce the present value of the withdrawal, and you will lose the potential long-term growth on the amount withdrawn.

This hypothetical example is used for illustrative purposes only and does not represent the performance of any specific investment. Fees and expenses are not considered and would reduce the performance shown if they were included. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

SECURE 2.0: Big Impacts for Small Businesses

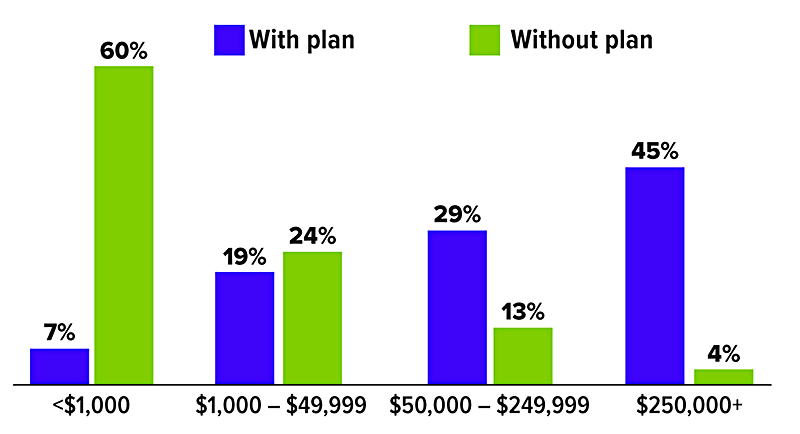

An AARP study released in July 2022 found that nearly half of all private sector employees ages 18 to 64 had no access to a retirement plan at work. It also found that small businesses are more likely to lack a work-based plan, putting their workers at a significant disadvantage when it comes to retirement preparations (see chart).

Last December, Congress passed a $1.7 trillion omnibus package that included the SECURE 2.0 Act of 2022, a sweeping set of provisions designed to improve the nation’s retirement-planning health. Here is a brief look at some of the tax perks, rule changes, and incentives included in the legislation to help small businesses and their employees.1

Tax Perks for Employers in 2023

Perhaps most appealing to small business owners, the Act enhances the tax credits associated with adopting new retirement plans, beginning in 2023.

For employers with 50 employees or less, the pension plan start-up tax credit increases from 50% of qualified start-up costs to 100%. Employers with 51 to 100 employees will still be eligible for the 50% credit. In either case, the credit maximum is $5,000 per year (based on the number of employees) for the first three years the plan is in effect.

In addition, the Act offers a tax credit for employer contributions to employee accounts for the first five tax years of the plan’s existence. The amount of the credit is a maximum of $1,000 per participant, and for each year, a specific percentage applies. In years one and two, employers receive 100% of the credit; in year three, 75%; in year four, 50%; and in year five, 25%. The amount of the credit is reduced for employers with 51 to 100 employees. No credit is allowed for employers with more than 100 workers.

Rule Changes and Relevant Years

In 2024, employers will be able to adopt a starter 401(k) or similar 403(b) plan, an auto-enrollment plan for employee contributions only. The plan may accept up to $6,000 per participant annually ($7,000 for those 50 and older), indexed for inflation. Designed to be lower cost and easier to administer than traditional plans, these programs impose minimum and maximum contribution rates and other rules.

SIMPLE plans may benefit from two new contribution rules. First, employers may make nonelective contributions to employee accounts up to 10% of compensation or $5,000. Second, the annual contribution limits (standard and catch-up) for employers with no more than 25 employees will increase by 10% more than the limit that would otherwise apply. An employer with 26 to 100 employees would be permitted to allow the higher contribution limits if the employer makes either a matching contribution on the first 4% of compensation or a 3% nonelective contribution to all participants, whether or not they contribute. These changes also take effect in 2024.

Beginning in 2025, 401(k) and 403(b) plans will generally be required to automatically enroll eligible employees and automatically increase their contribution rates every year, unless they opt out. Employees will be enrolled at a minimum contribution rate of 3% of income, and rates will increase each year by 1% until they reach at least 10% (but not more than 15%). Not all plans will be subject to this new provision; exceptions include those in existence prior to December 29, 2022, and those sponsored by organizations less than three years old or employing 10 or fewer workers, among others.

Participant Incentives on the Horizon

SECURE 2.0 drafters were creative in finding ways to encourage workers to take advantage of their plans. For example, effective immediately, employers may choose to offer small-value financial incentives, such as gift cards, for joining a plan, or beginning in 2024, they may provide a matching contribution on employee student loan payments. Also starting in 2024, workers will be able to withdraw up to $1,000 a year in an emergency without having to pay a 10% early distribution penalty, which may ease the fear of locking up savings until retirement (restrictions apply).

1) SECURE stands for Setting Every Community Up for Retirement Enhancement and originated with the SECURE Act of 2019.

Source: Employee Benefit Research Institute, 2023. “With plan” includes workers with a defined contribution plan, IRA, or defined (DB) plan. Total assets include savings and investments other than the value of their home and DB plan. Numbers may not add up to 100% due to rounding.

As Your Parents Age, Help Them Protect Their Finances

It’s heartbreaking to hear stories of people losing money (even their life savings) as a result of fraud or financial exploitation, especially if they are older and financially vulnerable. In fact, it’s quite common. People age 70 and older reported losses of $567 million in 2022.1 You know your parents could be at risk, and you want to protect them, but how?

One place to start is by looking for warning signs that your parents have been victimized, or are at risk of being influenced, manipulated, or coerced by a stranger or someone they know.

- Unusual bank account activity, including large or unexplained withdrawals, and nonsufficient fund notices

- Missing checks, credit cards, or financial statements

- Unpaid bills

- Lost money or valuables that can’t be located after a thorough search

- Relationships with people who seem to have undue influence

- Unexplained changes to legal documents

- Declining memory and decision-making skills

Regularly checking in with your parents may help you spot issues that need to be addressed. If your parents have fallen victim to a financial scam or are being pressured for money from someone they know, they may be embarrassed or reluctant to tell you, even if you ask. Do your best to remain objective and nonjudgmental, and patiently listen to their views while expressing your own concern for their well-being.

Laying some groundwork to help prevent future incidents is also important. For example, talk to your parents about how they might handle common scams. Let them know it’s a good idea to get a second opinion from you before acting on any request for information or money, even if it seems to come from their financial institution, a well-known company, law enforcement, a government agency such as the IRS or Social Security Administration, or even a grandchild in trouble.

Encourage them to set up appointments with their elder law attorney or financial professional to talk about concerns and legal and financial safeguards. They might also want to add layers of protection to their financial accounts, such as naming a trusted contact or setting up account alerts.

People are often reluctant to report financial fraud or exploitation, either out of embarrassment or fear of being wrong. But if you suspect your parents have been victimized, you can get help from many sources, including the National Elder Fraud Hotline, sponsored by the U.S. Department of Justice. You can call (833) 372-8311 to be connected with case managers who will assist you and direct you to additional resources.

1) Federal Trade Commission, 2022

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matter addressed herein.

Securities offered through Emerson Equity LLC. Member FINRA/SIPC. Advisory Services offered through EagleStone Tax & Wealth Advisors. EagleStone Tax & Wealth Advisors is not affiliated with Emerson Equity LLC. Financial Planning, Investment and Wealth Management services provided through EagleStone Wealth Advisors, Inc. Tax and Accounting services provided through EagleStone Tax & Accounting Services.

For more information on Emerson Equity, visit FINRA’s BrokerCheck website or download a copy of Emerson Equity’s Customer Relationship Summary.